- DOGE slid 5% in 24 hours, down to $0.20, but volume spiked to 1.25B DOGE during the drop.

- Technicals still favor a long-term uptrend, with whales buying the dip.

- A breakout above $0.23 could shift momentum fast—$0.265 would be the next stop.

Dogecoin took a pretty sharp hit in the past 24 hours—sliding nearly 5% from around $0.22 to touch $0.20. That’s the biggest intraday drop for DOGE this month. It had been flirting with $0.23 earlier but couldn’t hold the line, running into some heavy resistance and aggressive sellers. Over the last week, it’s down about 10%, and the market cap has dropped to $31 billion. But despite the dip, some chart watchers aren’t too worried just yet.

Volume Spikes as Liquidations Hit

Weird thing is, even though the price dropped, DOGE’s on-chain volume went wild. Activity spiked to over 1.25 billion DOGE—mostly around midnight. Analysts think it was caused by a wave of liquidations and stop-losses getting triggered all at once. That cascade may have set off a chain reaction, with bots and traders all hitting the exits at the same time.

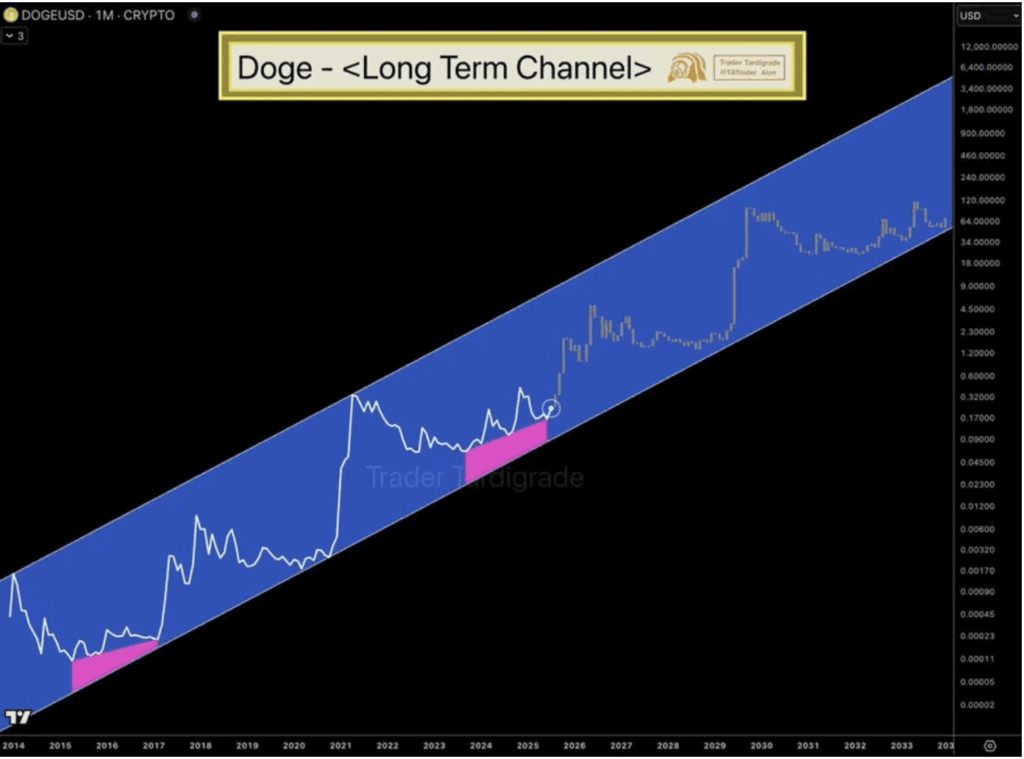

Long-Term Channel Still Holding Up

According to Trader Tardigrade, DOGE is still cruising inside its long-term upward channel—the one that dates all the way back to 2014. That channel has acted like a springboard in the past, especially near its lower edge. Right now, Dogecoin’s hanging out in the lower-mid zone of that channel, which has historically meant “accumulation before lift-off.”

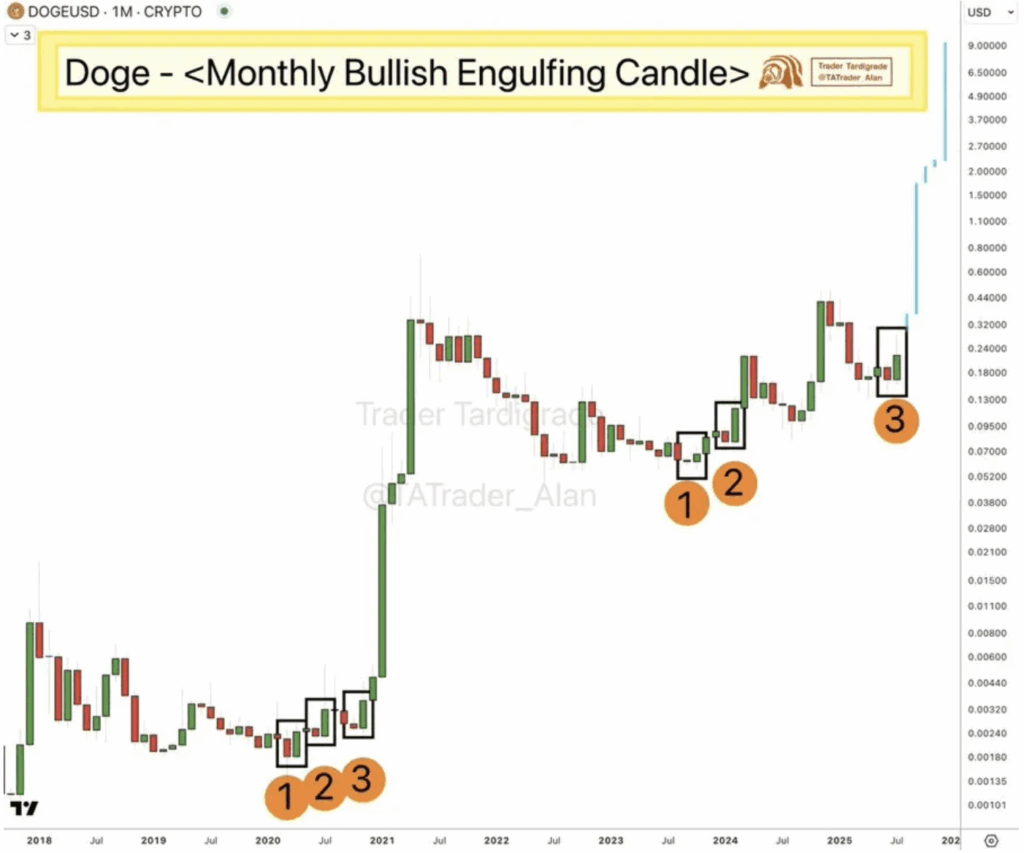

Even more interesting? The last few monthly candles have all been bullish engulfing ones. Tardigrade called this a possible setup for the next breakout, jokingly dubbing it the path “to Valhalla.” So yeah, things aren’t all doom and gloom.

Falling Wedge Could Flip the Short-Term Script

Zooming into the short-term, Ali Martinez spotted something else—a falling wedge pattern on DOGE’s 1-hour chart. That’s typically a bullish setup. If DOGE can break above the $0.229 to $0.230 zone, it could aim for $0.265. But if it falls through $0.215 or worse, $0.210? Might get a bit messier before it gets better.

Meanwhile, big wallets seem unfazed. Some whales bought the dip, scooping up over 310 million DOGE. Bit Origin, a major digital asset firm, even dropped in for 40 million of those coins as part of a larger $500 million diversification move.

A Deeper Accumulation Phase?

The broader crypto market’s been on edge lately, thanks to inflation jitters and stock market wobbles. Still, DOGE’s stuck to its long-term trend, and institutional interest doesn’t seem to be slowing. If anything, this correction might just be another reload before the next leg up.