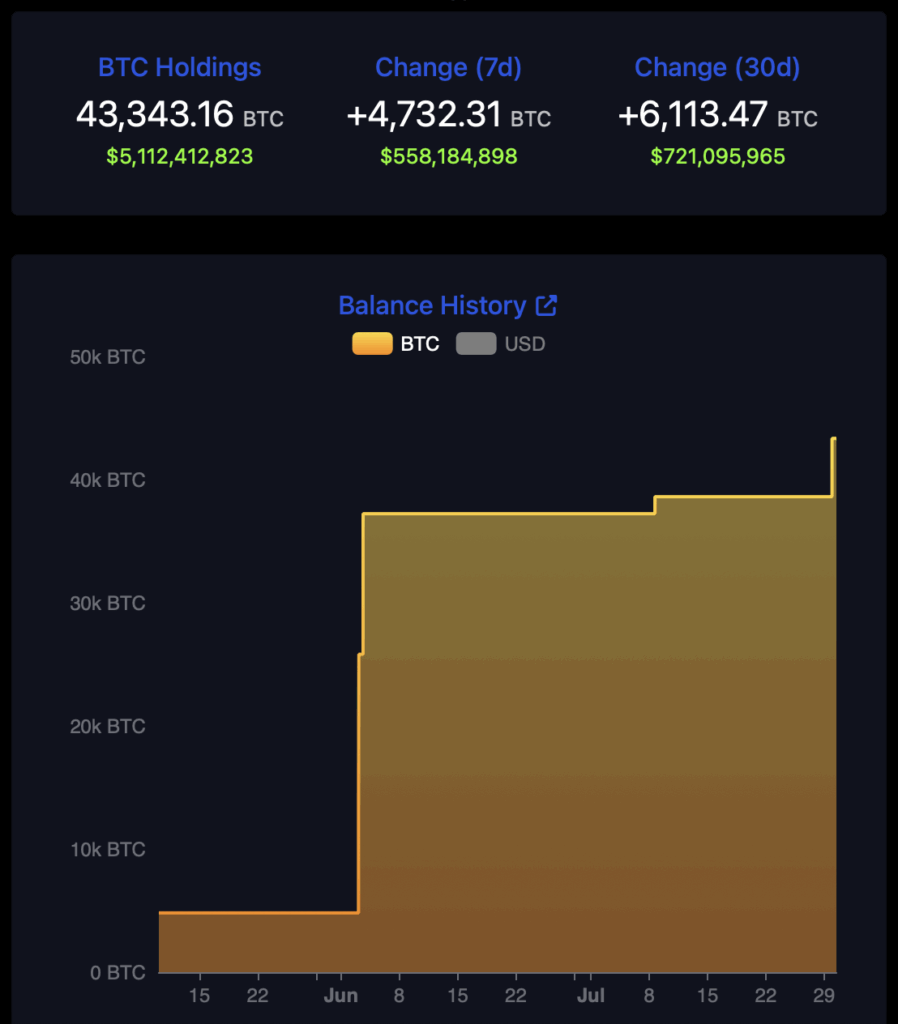

- Twenty One Capital upped its Bitcoin holdings to 43,500 BTC—worth about $5.1B.

- The firm’s backed by Tether, Bitfinex, SoftBank, and Cantor Fitzgerald.

- It’s launching through a SPAC merger and will trade under ticker “XXI”.

In a move that could rattle the corporate crypto landscape, Twenty One Capital just beefed up its Bitcoin stash—by a lot. The new treasury firm said Tuesday it added roughly 5,800 BTC from Tether, pushing its total holdings to 43,500 BTC. That’s… well, around $5.1 billion based on Bitcoin’s current price near $117,500.

That haul makes Twenty One potentially the third-largest corporate Bitcoin holder on the planet. Not bad for a company that hasn’t even started trading yet.

The firm’s a joint effort powered by a curious mix of old money and new: Tether, Bitfinex, Cantor Fitzgerald, and SoftBank are all behind it. It’s aiming to be more than just a treasury—it’s a Bitcoin-first public company. “With the partners, capital, team, and structure we’ve assembled, we feel like we can do anything,” said CEO Jack Mallers. “And we’re just getting started.”

Trading Soon, and Trading Big

Based outta Austin, Texas, Twenty One plans to hit the public market via a SPAC merger with Cantor Equity Partners. Once that goes through, they’ll list under the ticker “XXI.” Until then, Cantor’s placeholder stock—CEP—has been on a wild ride. It closed down 4.5% Tuesday, but still sits up 134% over the past week after word of the merger got out.

When it launches, Twenty One will only trail two corporate whales in Bitcoin: Strategy and MARA Holdings. That’s some heavy company. The idea is simple: hold a ton of BTC, let investors buy in through the stock market, and maybe—just maybe—rebuild the global financial system on top of it.

As Mallers put it, “We’re not here to beat the existing system, we’re here to build a new one.” Big words. Big Bitcoin wallet to back it up.

Wall Street Meets Web3

So who’s behind this whole thing, anyway? It’s an interesting cocktail.

Tether, the issuer of the most-used stablecoin on Earth, obviously brings a massive crypto footprint. Bitfinex adds crypto exchange muscle. On the TradFi side, there’s SoftBank—Japan’s mega investor—and Cantor Fitzgerald, the Wall Street powerhouse once helmed by Howard Lutnick, a name that pops up in both finance and politics.

Put it all together and you’ve got a $3.9 billion Bitcoin machine that’s half hedge fund, half disruptor. It’s one more sign that traditional finance isn’t just flirting with Bitcoin anymore—they’re locking it into their balance sheets and betting on it long term.