- Ethereum ETFs saw $2.4B in inflows last week, surpassing Bitcoin’s $827M and driving ETH toward $4,000.

- Analysts, including Mike Novogratz, see ETH breaking $4K soon, with projections of $5K–$6K by 2025.

- Bullish sentiment, ETF momentum, and strong price action suggest ETH could outperform BTC in the coming months.

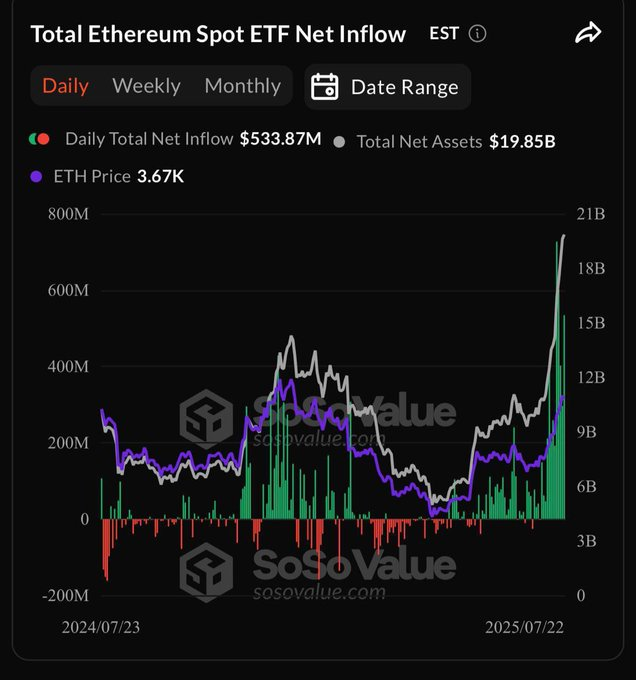

Ethereum has been stealing the spotlight lately, leaving even Bitcoin a bit in the shadows. Spot Ethereum ETFs pulled in a massive $2.4 billion in inflows last week, while Bitcoin ETFs only managed $827 million. That’s a pretty clear sign of where investor excitement is shifting. ETH has outperformed BTC by nearly 4% in value growth and is pushing closer to the $4,000 mark. Resistance is there, but the buying frenzy around Ether ETFs just keeps growing, with inflows hitting record highs day after day.

Record-Breaking Inflows and Analyst Buzz

The Kobeissi Letter recently reported that Ethereum ETFs saw $533.9 million in net inflows on a single day—Tuesday, to be exact. That’s their biggest single-day inflow ever. This wave of demand has analysts whispering (or shouting) that ETH could potentially outperform Bitcoin for the rest of 2025. Galaxy Digital’s CEO, Mike Novogratz, even told CNBC that ETH is likely to “knock on the $4,000 ceiling a few times” and could head into full-on price discovery after that. He made it clear he owns both BTC and ETH, but the way he talks about Ethereum? Sounds like he’s betting on its mainstream moment.

Can ETH Smash $5,000?

A handful of analysts believe Ethereum could reach $5,000, maybe sooner than people expect. Changelly’s August forecast puts ETH at around $4,274 by the end of next month, and if the ETF momentum doesn’t slow down, there’s room for a bigger run. CoinCodex, looking out a bit longer, suggests Ethereum might climb to $6,184 by October 2025—about a 60% gain from where it is now. Considering ETH is already up nearly 50% in just the past month, that target isn’t exactly a wild dream.

Sentiment and Market Conditions

According to CoinCodex indicators, Ethereum’s current sentiment is firmly bullish. The Fear & Greed Index is flashing 71, which leans heavily toward greed, and ETH has posted 21 green days out of the last 30. With volatility holding around 16.3%, traders are sensing this could be the time to strike. If the ETF inflow streak holds and ETH breaks through $4,000, the stage might be set for the next leg up—maybe even toward that $5K milestone everyone’s talking about.