- SOL lost $184 support, dipping to $178.81 with over $57M in liquidations.

- Legal troubles and weak technical indicators are pressuring price action.

- Meme coins like PENGU and BONK outperform, hinting at selective market interest.

Solana (SOL) slid under the $180 mark on Friday, extending a rough week after losing its grip on the crucial $184.13 support the day before. This drop came despite bullish chatter earlier in the week, where some traders called for new highs.

Data from CoinGlass paints a messy picture—over $57 million in positions got liquidated in just 24 hours, and nearly 87% of that hit long traders. It’s like a chain reaction; once SOL failed to hold above $184, the selling pressure just snowballed.

Earlier this week, things looked rosy as Solana rallied to its February 14 peak of $205.34. But by midweek, that momentum evaporated, and the token nosedived nearly 12% through Thursday. The total liquidations between Wednesday and early Friday hit around $101 million, adding fuel to the fire.

Technical Signals Look Weak

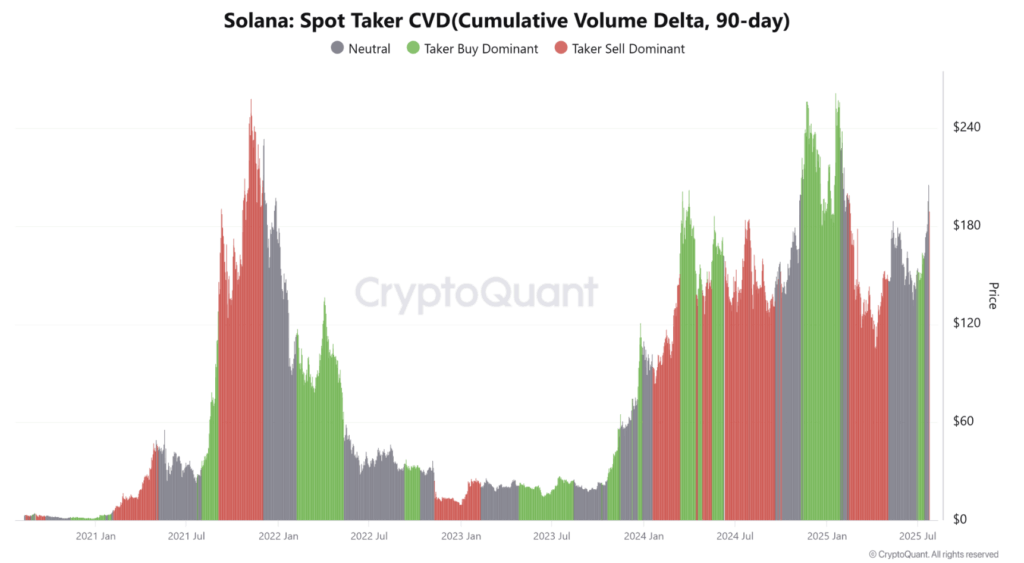

On-chain data shows bears are tightening their grip. The Taker CVD (Cumulative Volume Delta), which tracks market buy vs. sell volumes over three months, flipped negative on Wednesday—bad news for bulls.

The RSI on the daily chart dropped to 56, falling sharply from Tuesday’s overbought levels. It’s basically saying the hype has cooled. Meanwhile, the MACD histogram is shrinking and pulling closer together, signaling fading bullish energy.

If this bearish trend sticks, more downward pressure is likely. For now, $168-$170 is the key zone traders are watching. Lose that, and the next pit stop could be $160.

Legal Clouds Over Solana

Adding to the heat, Solana got dragged into a fresh lawsuit this week. Burwick Law filed a class-action suit in New York, targeting Pump.Fun (a Solana-based memecoin platform) along with Solana Labs, Solana Foundation, Jito Labs, and Jito Foundation.

The allegation? Operating what they describe as an “illegal gambling and money transmission scheme.” Whether these claims hold water or not, this kind of legal spotlight rarely helps market sentiment.

Traders Still Betting on a Bounce

Not everyone’s spooked, though. Bybit trader Christiaan is calling this a “buy-the-dip” moment, predicting Solana could hit $500 before this cycle is over. His roadmap? A push to $300, some pullback, then another run to $400+.

For that to happen, SOL needs to reclaim $184 first. Break that level, and $205.34 is the next test. At the time of writing, SOL hovers around $178.81.

Meme Coins Are Stealing the Show

Oddly enough, Solana’s ecosystem tokens are flying while SOL drags. Pudgy Penguins (PENGU) is up a staggering 400% in a month, while Bonk (BONK) and Fartcoin (FARTCOIN) have climbed 158% and 38%. This divergence shows traders are picking their spots carefully in the Solana universe.

If SOL wants to turn the tide, it needs a strong close above resistance soon. Otherwise, the bears might have more room to play.