- Bitcoin was the first blockchain currency

- El Salvador was the first country to recognize BTC as a legal tender

- BTC price briefly attained its highest value of $69,000 on November 10, 2021

Bitcoin has played a crucial role in the history of crypto, emerging as the leading cryptocurrency. The king crypto has been part of all the market crashes in the crypto sphere, recording notable price fluctuations across speculative bubbles from 2014, 2017, 2021, and 2022.

Bitcoin traded within the higher three-digit range during the first half of 2014. After that, it started dropping to retest the lower-three digit range and eventually retraining to $172.15 in January 2015. The price then pumped to the highest three-digit content in 2017 when it finally breached the $1,000 mark to trade at $1,008.4 in February 2017. This was the same year when the flagship crypto recorded an unprecedented boom, managing to cross the $10,000 mark.

On December 12, 2017, Bitcoin briefly reached $17,249.92, and despite this considerable achievement, the price dipped again in 2018, taking a free fall during most of that year. Towards the end of 2018, the price stabilized and maintained a value well above the $3,000 level.

Between 2019 and 2021, the largest crypto by market cap dipped in value again but eventually reached an all-time high of $69,000 in November 2021. The price hike was attributed to the launching of a Bitcoin exchange-traded fund (ETF) in the U.S. Other price surges in 2021 followed events involving Tesla and Coinbase (in that order).

Tesla’s price pump for the king crypto came as the electric car maker announced in March 2021 that it had acquired $1.5 billion worth of BTC, together with a Coinbase IPO that fueled mass interest. In 2022, Bitcoin lost almost 75% of its value after a brutal year characterized by bankruptcies, liquidations, and legal proceedings that reinvigorated the crypto winter.

Bitcoin Adoption

Regarding adoption, El Salvador was the first country to embrace Bitcoin as a legal tender in 2021. The government had been experimenting with using BTC as a currency since 2019, but the country’s Legislative Assembly finally passed the bill on June 8, 2021. With this approval, Bitcoin became a legitimate legal currency in the El Salvadorian state on September 7, 2021, when the law finally came into effect.

Besides El Salvador, Ukraine legalized crypto in February 2022, but the development was limited. In the same way, the Central African Republic passed a law on April 27, 2022, making it legal to use the CFA Franc, Bitcoin, and other cryptocurrencies.

Bitcoin Price Prediction For 2023

The crypto market was, however, conspicuously different by the end of 2022, as the BTC price was trading at $17,323 on January 10, 2023, with a market cap of $333.22 and a 24-hour trading volume of $16.24 billion. BTC’s price is now 74% below its all-time peak.

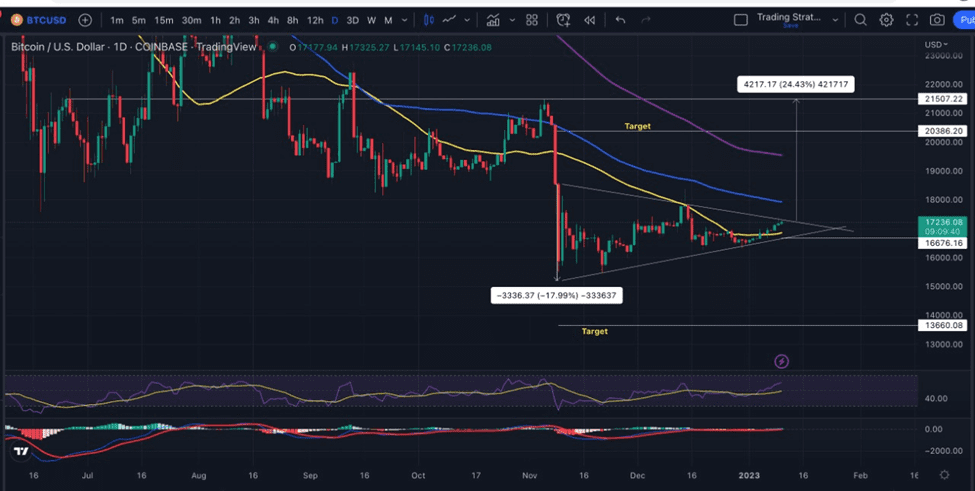

The king crypto is looking for support to push it to the $20K level after consolidating in a symmetrical triangle over the last 30 days. As shown on the daily chart (below), the Bitcoin price has formed a technical formation that distinguishes itself by providing equal bullish or bearish targets.

Bitcoin’s (BTC) price was trading with a bullish bias at $17,236. The flagship cryptocurrency is looking for support to push it to the $20K level after breaching the resistance offered by the 50-day Simple Moving Average (SMA) at $16,860 and flipping it into support.

As such, increasing demand pressure from the current level would open the path for the price to test the next barrier offered by the 100-day SMA near the $18,000 psychological level. Flipping this level into support would set the trajectory for the bullish target of the prevailing chart pattern at $20,386. In overly ambitious cases, bulls can raise the price to the range high of $21,507, signifying a 24.43% increase from the current price.

BTC/USD Daily Chart

Cementing the buyer’s presence in the market is the positive outlook of the relative strength index (RSI) and moving average convergence divergence (MACD) indicators, which are moving upwards to signify that there is still more room for the upside.

On the flip side, if selling pressure increases and BTC price loses the 50-day SMA support, Bitcoin could crack through the lower boundary of the chart pattern at $16,676 to reach the bearish target of the technical formation at $13,660.