- Ethereum ETFs are on fire — 12-day inflow streak, with over $7.7B so far.

- New treasuries like The Ether Machine are buying ETH in bulk — up to $1.5B in one go.

- ETH price just hit $3,850, riding a 25% weekly pump.

Ethereum’s having a moment. Again. But this time, it’s different — there’s serious money pouring in. Like, big money. Spot Ethereum ETFs are stacking inflows fast, and now treasury-backed firms are popping up left and right. According to Framework Ventures’ co-founder Vance Spencer, we could be looking at a massive wave of buying pressure — and soon.

“Mid-eleven figures” is how he put it. That’s somewhere between $50 billion and $100 billion flowing into ETH over the next year and a half. And for a $400B asset, that’s not a trickle. That’s a flood.

ETF Inflows Aren’t Slowing Down

Ethereum ETFs in the U.S. just notched their 12th straight day of inflows, pulling in $2.2 billion in the past five trading sessions alone. Monday was no joke either — Fidelity’s FETH led the charge with $127 million, while the total for the day hit nearly $300 million.

Across the board, the inflow total now sits around $7.7B, even with Grayscale’s more expensive ETHE fund dragging things down with outflows. BlackRock’s ETH ETF has crossed $8 billion, though — so the appetite’s clearly growing.

Nate Geraci from NovaDius pointed out that five of the top ten ETF inflow days happened just in the last two weeks. That says a lot.

Treasuries Going All-In on ETH

And it’s not just ETFs. There’s a wave of new treasury-focused Ethereum firms showing up — almost one per day lately. Wild.

One of the biggest? A brand-new investment group called The Ether Reserve is going public on Nasdaq via a SPAC merger. The combined entity, “The Ether Machine,” plans to buy 400,000 ETH. That’s over $1.5 billion worth — making it the largest public Ethereum treasury company to date.

Also on the radar is ETH Strategy, a DeFi project that just bought 6,900 ETH and launched a token backed by staked Ethereum. They’re calling it a “compounding flywheel.” Jargon aside, it’s basically another player scooping up ETH and locking it up.

Meanwhile, other smaller firms like Bitmine Immersion Tech and SharpLink Gaming are quietly increasing their holdings too. No flash, just accumulation.

ETH Price Action: Starting to Boil

Ethereum just tapped $3,850 — the highest it’s been in seven months. It’s cooled off slightly since, trading around $3,730 on Tuesday morning, but the momentum is clearly building.

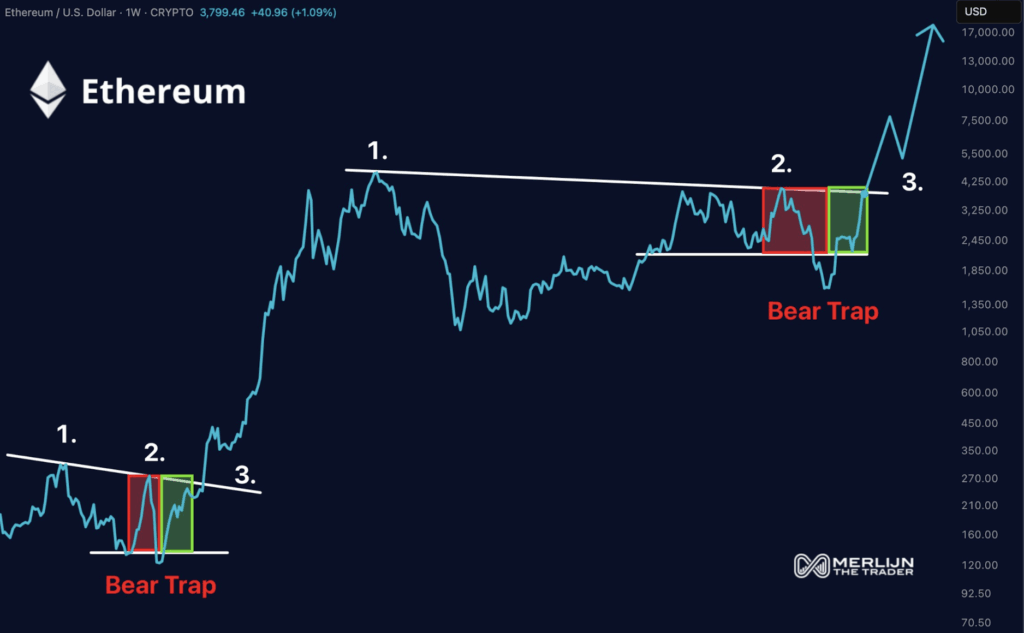

One analyst, ‘Merlijn The Trader,’ says ETH is “replaying its 2020 script,” referencing the descending breakout, final bear trap, and potential explosive move up. Back then, Ethereum ran up 1,800% after a similar setup. Could it happen again? Who knows. But let’s just say, the vibes are getting loud.