- Solana leads with ultra-low fees, blazing speed, and $271M in Q2 revenue, far outperforming Cardano’s declining activity and revenue.

- Cardano’s Hydra scaling is still underutilized, and its tiny $32M stablecoin market cap dampens institutional interest.

- Solana’s active DeFi, stablecoin growth, and adoption across sectors make it the more obvious investment right now.

Solana (SOL) and Cardano (ADA) both claim to be fast, scalable powerhouses in the crypto world—but only one of them is actually moving. The other? Well, it’s… kinda stuck in second gear.

If you’re eyeing a crypto investment right now, it really comes down to momentum, and, honestly, Solana’s kinda leaving Cardano in the dust.

Solana’s Already Gunning It

Solana isn’t just fast—it’s crazy fast. Transactions cost less than a penny (like, way less… we’re talking fractions of a cent), and they zip through in under a second. Meanwhile, over on Cardano, you’re paying around $0.29 per transaction and waiting 15 seconds—or longer—for finality. That might not sound like a big deal, but in crypto? That lag’s enough to lose a trade.

Because of that speed and affordability, Solana’s attracting more builders, users, and dApps. It’s dominating. In Q2 alone, Solana pulled in $271 million in revenue—yeah, more than any other chain for three straight quarters. Oh, and in June? It matched every other L1 and L2 combined in terms of active wallets. Wild.

Its DeFi scene is stacked too, with over $9.3B in total value locked (TVL), trailing only Ethereum. Plus, stablecoins on Solana grew 5.5% last month, hitting $10.4B. That’s the kind of capital flow that keeps ecosystems thriving.

Meanwhile… Cardano’s Struggling

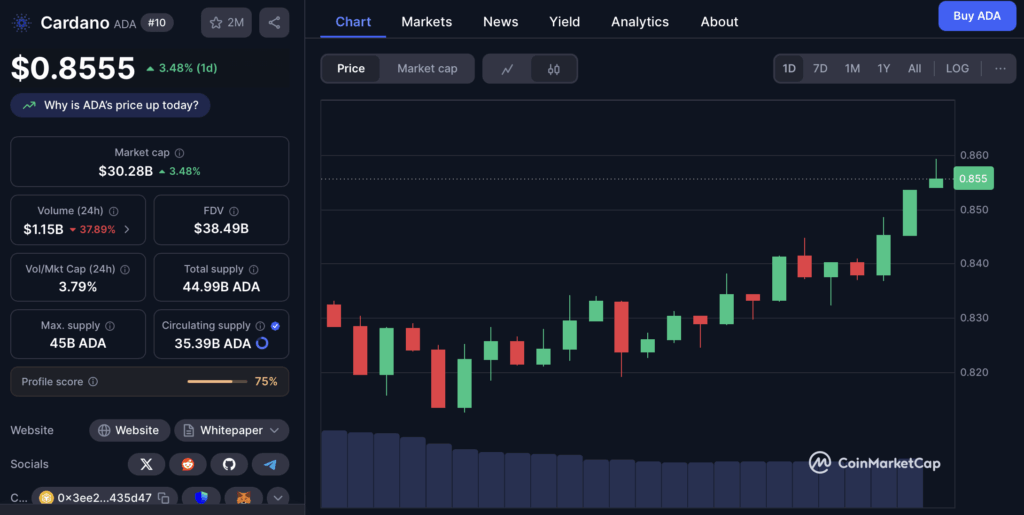

Cardano’s Q1 report reads more like a warning sign. Daily transactions dropped by nearly 30%, DeFi TVL shrank 29% to $319M, and fee revenue fell 32%. Ouch. That’s not just a blip—it’s a trend.

What that means for investors is simple: less usage = less demand = meh price action. With high fees and fewer users, it’s no wonder the chain’s struggling to gain traction.

Speed vs. Theory: The Culture Divide

Solana’s building in just about every booming crypto segment—NFTs, AI networks, real-world asset tokenization, meme coins, you name it. The ecosystem moves fast and iterates faster. Projects launch confidently knowing the chain’s going to evolve alongside them.

Cardano, though? It’s… cautious. Its Hydra scaling solution was first teased back in 2020 and only recently showed signs of life. But even now, it’s mostly theoretical. Sure, it tested well, but no one’s really using it.

Even Cardano’s stablecoin footprint is minuscule—just $32M. Compare that to Solana’s $10B and the difference is almost comical. Without that financial infrastructure, big players just aren’t paying attention.

Bottom Line: Solana’s the One in Drive

Can Cardano catch up someday? Maybe. But that’s a big maybe, and it would take a serious reinvention to do it. Solana’s already racing ahead, winning over retail and institutional users, growing revenue, and dominating the narrative.

So if you’re looking to back a chain that’s already proven, liquid, and scaling up fast, Solana’s the easy pick. It’s not about potential anymore—it’s about execution. And Solana’s doing just that.