- Open Interest for Litecoin just hit a record $761M, while price climbed to $103.9, showing growing bullish momentum.

- 66.3% of LTC wallets are currently in profit, with whale holders driving most of the gains and volume jumping 50%.

- Speculation around a potential Litecoin ETF approval could be the spark needed to push LTC toward the $120 mark.

After months of just kinda… hovering, Litecoin (LTC) is starting to stir. Slowly but surely, it’s gathering momentum. In the last 24 hours alone, Open Interest (OI) jumped to $761 million—yep, that’s a fresh all-time high. Not bad for an old-school coin that’s often overlooked when the altcoin hype train rolls through.

LTC’s price also broke through a couple of key resistance zones, bouncing up around 4.5% and settling near $103.9 at the time of writing. With a $7.6 billion market cap, it’s now ranked 21st overall—quiet, but not invisible. Analysts are starting to whisper: Could Litecoin really make a move to $120 this cycle?

OI Is Heating Up, And That’s Usually a Sign

So what’s going on under the hood? According to CoinGlass, Litecoin’s open interest shot up 6.7% in a day. That means traders are placing bets—big ones. Around 7.63 million LTC is currently locked up in futures contracts, which is no small thing.

Rising OI alongside price action usually screams buying pressure. Basically, more people are entering positions, confident the price is headed north. That kinda enthusiasm hasn’t been seen in a while for LTC, so yeah, it’s getting attention.

Now, LTC managed to break past $101 and $102—both important levels technically. Whether it holds above or dips back under those will shape what comes next. If the bulls keep pushing and volume holds, that yearly high might be back on the table.

Over Half of LTC Wallets Are Sitting Pretty

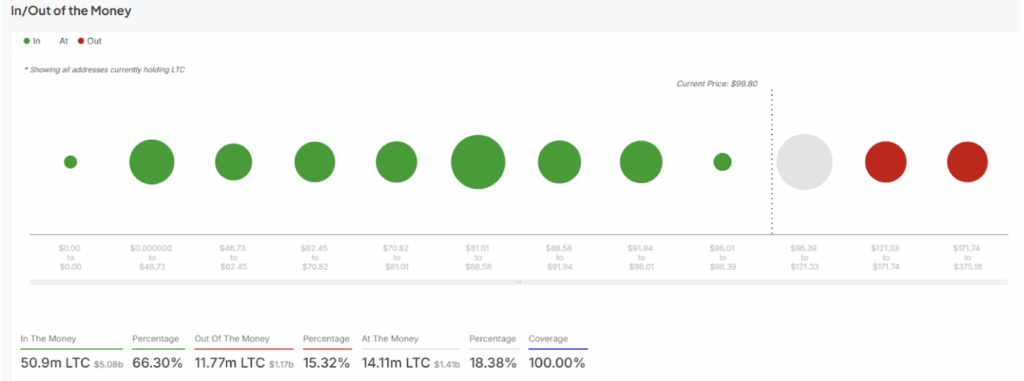

Here’s something else: more than 66% of Litecoin addresses are currently in profit, according to IntoTheBlock. That’s around 50.9 million addresses holding $5.08 billion worth of LTC. Most of that is held by big players too, which adds some weight.

But it’s not all sunshine—about 15.2% of wallets are still underwater, holding roughly $1.17 billion in unrealized losses. And the rest? Just sitting neutral, neither up nor down.

Still, with trading volume up 50% to nearly $967 million, it’s clear interest is building again. Investors don’t just come out of nowhere—they follow signals. And right now, the signals are blinking green.

Is $120 Just a Matter of Time?

So, can Litecoin really hit $120 soon? That depends. Sentiment has improved a lot, but volatility hasn’t disappeared. And while $120 is possible, LTC still needs to prove it can power through the choppy zones ahead.

There’s also that pending ETF news hanging in the background. Canary Capital filed to launch a Litecoin spot ETF with the SEC earlier this year. If it gets the go-ahead, that could unlock a new wave of demand—especially from traditional investors who don’t want to mess with wallets or exchanges.

Even folks at Grayscale are taking notice. Executive John Hoffman recently mentioned Litecoin as a solid low-correlation asset—sorta like Bitcoin in its early ETF days. He didn’t say much more, but it’s clear institutions are keeping tabs.