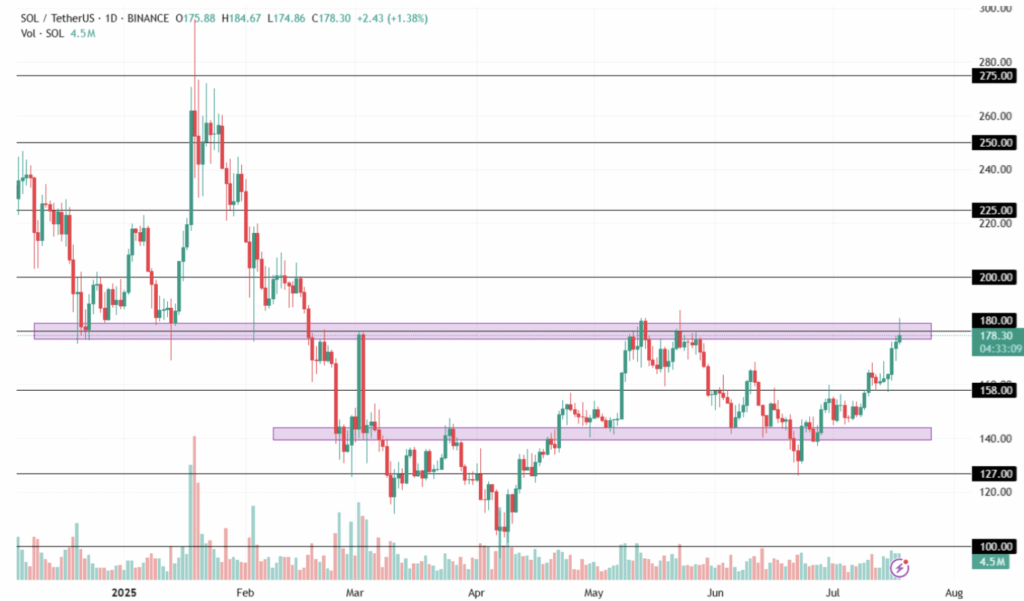

- SOL broke above key resistance at $175 with strong daily closes and rising volume.

- Holding above $180 could trigger a push to $200, then maybe $225 or $250.

- A drop below $158 risks downside toward $145 or lower support zones.

Solana’s back in the spotlight again, and yeah, it’s making some noise. The price just slid past that stubborn $175 level and is now floating around $178.30. Backed by a decent spike in volume (4.5 million, give or take), this move’s got some people wondering—are we gearing up for a full-on run at $200?

Bulls Push Through, Eyes on the Prize

For the past few weeks, SOL’s been kinda stuck—just bouncing between $158 and $175. That range had become a bit of a minefield thanks to heavy selling pressure seen in May and June. But the bulls finally punched through. This wasn’t just some random pump, either. Daily candles have been closing higher one after the other, showing solid upward intent.

And here’s the kicker: institutional players are creeping in again. Funds tied to Solana have seen net inflows three weeks straight, which usually means the “big money” is getting comfy.

What Happens If $180 Holds?

If this momentum keeps cooking and SOL stays above $180, we might be looking at a climb to $200. If that breaks too? Then the next big targets are $225 and $250, zones we last saw during Q1’s rally madness.

But nothing’s guaranteed. If SOL fumbles and slips back under $175, or worse, struggles to stay above $158, things might turn south. And if it really loses steam, we’re talking a potential trip down to the $145–$140 area—ouch, but that’s just how these things go sometimes.