- Litecoin spiked 10% after MEI Pharma revealed plans to raise $100M and put it all into LTC as a treasury asset.

- Charlie Lee, Litecoin’s creator, will join MEI’s board, with major crypto players like GSR and CoinFund backing the move.

- The rally also rides momentum from the GENIUS Act’s passage and anticipation of the CLARITY Act bringing clearer crypto regulations.

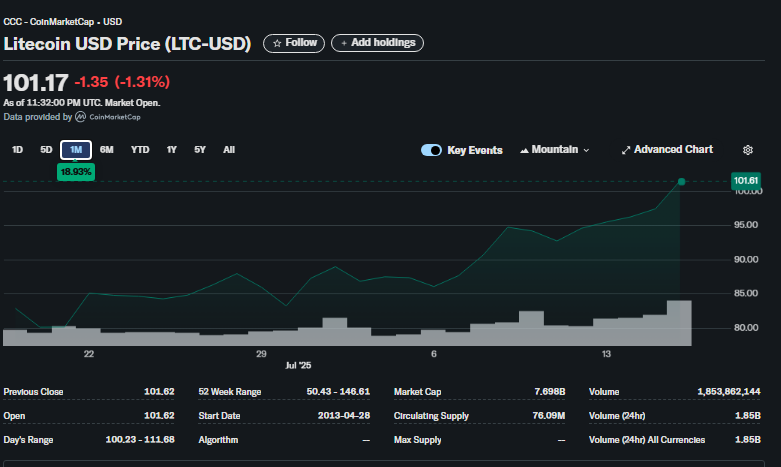

Litecoin’s having a moment. The OG altcoin pumped 10% midweek, riding a July rally that just got even hotter. What’s fueling it? Well, outta nowhere, a Nasdaq-listed biotech firm just announced it’s raising $100 million—and it’s planning to throw all of it into Litecoin. No, seriously. All of it.

That news dropped just as Washington cleared the GENIUS Act, a new piece of legislation aimed at boosting blockchain innovation across the board. It’s expected to get the official Trump-sign-off at a White House event this Friday. And yeah, there’s more coming—the CLARITY Act, which should (finally) offer clear rules on how crypto gets classified in the U.S., might pass in the next few weeks too.

MEIP Goes All-In On Litecoin

MEI Pharma (ticker: MEIP) announced it’s raising that $100 million through a PIPE deal—a private investment in public equity. Basically, they’re skipping the public offering and selling nearly 30 million shares straight to institutional buyers at $3.42 a pop. If the deal goes through (expected by July 22), every dollar of net proceeds is going to Litecoin. No hedging. Just straight-up LTC stacking.

And get this—Charlie Lee, the guy who created Litecoin back in 2011? He’s joining MEI’s board after the deal closes. He even pitched in as a lead investor. Crypto trading firm GSR is hopping in too, and they’ll help manage the reserves once everything’s locked in.

Who Else Is Involved?

Alongside Lee and GSR, there’s a stacked list of crypto players in this raise: the Litecoin Foundation, ParaFi, CoinFund, Hivemind, MOZAYYX, Primitive, RLH Capital—yeah, it’s a bit of a who’s-who in the digital asset world. MEI says this isn’t just a splashy move. They’re serious about long-term diversification, and they chose Litecoin for its uptime, cheap fees, and reliability. Honestly? Not the worst pick if you’re trying to avoid drama.

MEI’s still a biotech company at the end of the day—they’re developing stuff like voruciclib, a CDK9 cancer drug—but they clearly see value in holding crypto as part of their treasury strategy. Titan Partners Group is managing the offering, and everything’s been structured to stay within Nasdaq’s listing rules. Once the deal closes, MEI plans to file with the SEC so those new shares can be resold.

Takeaway

A biotech firm throwing its entire raise into Litecoin? That’s not something we’ve seen before—not at this scale. It’s bold, risky, and probably just the kind of jolt LTC needed to remind everyone it’s still here. Whether this sparks a bigger rally or fizzles out… time’ll tell. But one thing’s clear: Litecoin just made headlines in a big way.