- AAVE hit $330 Monday, backed by an 8% weekend rally and Bitcoin’s surge above $120K.

- Aave reached $50B in deposits, holding 5% of all stablecoins and showing major growth potential.

- Regulatory optimism and the Horizon project could drive future gains, as Aave prepares for institutional adoption.

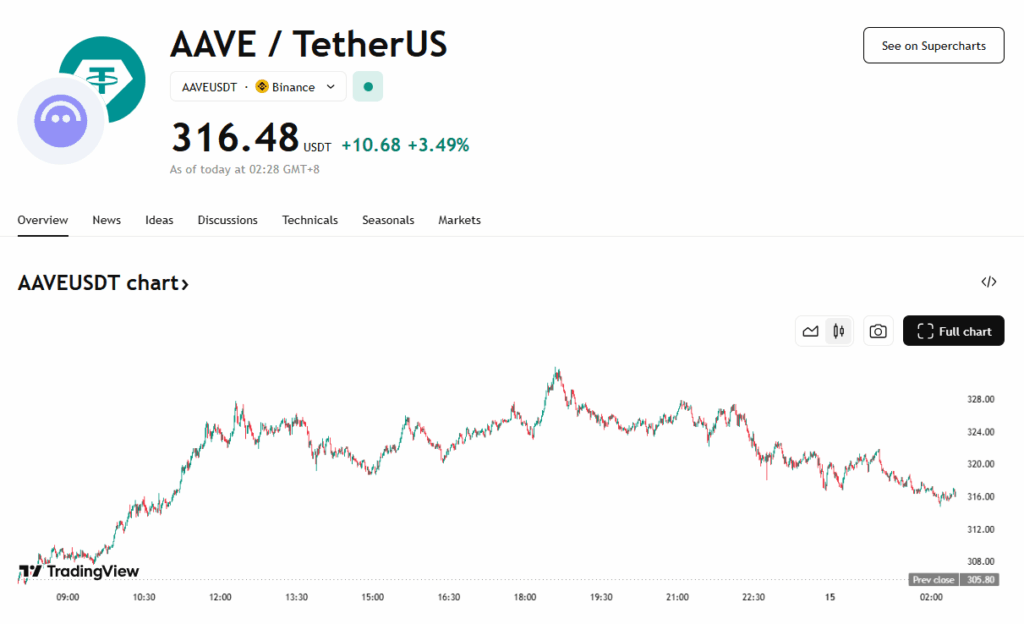

Aave’s native token (AAVE) spiked to $330 on Monday, marking an 8% gain over the weekend as the broader crypto market rallied. The surge comes as Bitcoin (BTC) continues to set new all-time highs above $120,000, lifting the entire decentralized finance (DeFi) sector with it. AAVE cooled slightly to around $316 but remains one of the top performers among major DeFi tokens.

$50B in Deposits Cements Aave’s Leadership

Aave hit a record $50 billion in total deposits, reinforcing its position as the leading DeFi lending platform. This milestone highlights the protocol’s strength in attracting both users and capital. It now holds 5% of the entire stablecoin supply, more than any other DeFi protocol, and its native overcollateralized stablecoin, GHO, has reached a supply of $312 million.

Regulatory Tailwinds and Institutional Demand

According to 21Shares, Aave could be a major beneficiary of favorable U.S. crypto legislation, such as the GENIUS Act. The platform is also gearing up for institutional adoption through its upcoming Horizon project, which will allow tokenized real-world assets like money market funds to be used as collateral for borrowing stablecoins. These developments could position Aave as a critical piece of the future crypto-finance ecosystem.

Bullish Technical Setup for AAVE

AAVE’s technical indicators are flashing bullish. Trading volume surged to over 159,000 units in the morning session, signaling strong institutional interest. A support base around $304 has helped stabilize price action, while the $327 zone has emerged as a key resistance level. Psychological support at $320 continues to attract steady demand, pointing to the potential for further upside if the momentum holds.