- Bitcoin hit $118K, but Google searches barely moved—retail interest remains low.

- Institutions are the main drivers, with spot ETFs seeing over $2.7B in inflows last week.

- Analysts suggest retail investors feel priced out, but others say the bull run is far from done.

Bitcoin just smashed through new all-time highs—again. It’s been a wild week, with the price topping $118K. But oddly enough, the usual retail hype? Nowhere to be found.

While institutions are pouring money in like there’s no tomorrow, average folks on the street? Kinda quiet. You’d expect search engines to light up. They didn’t.

Institutions Are Driving This One

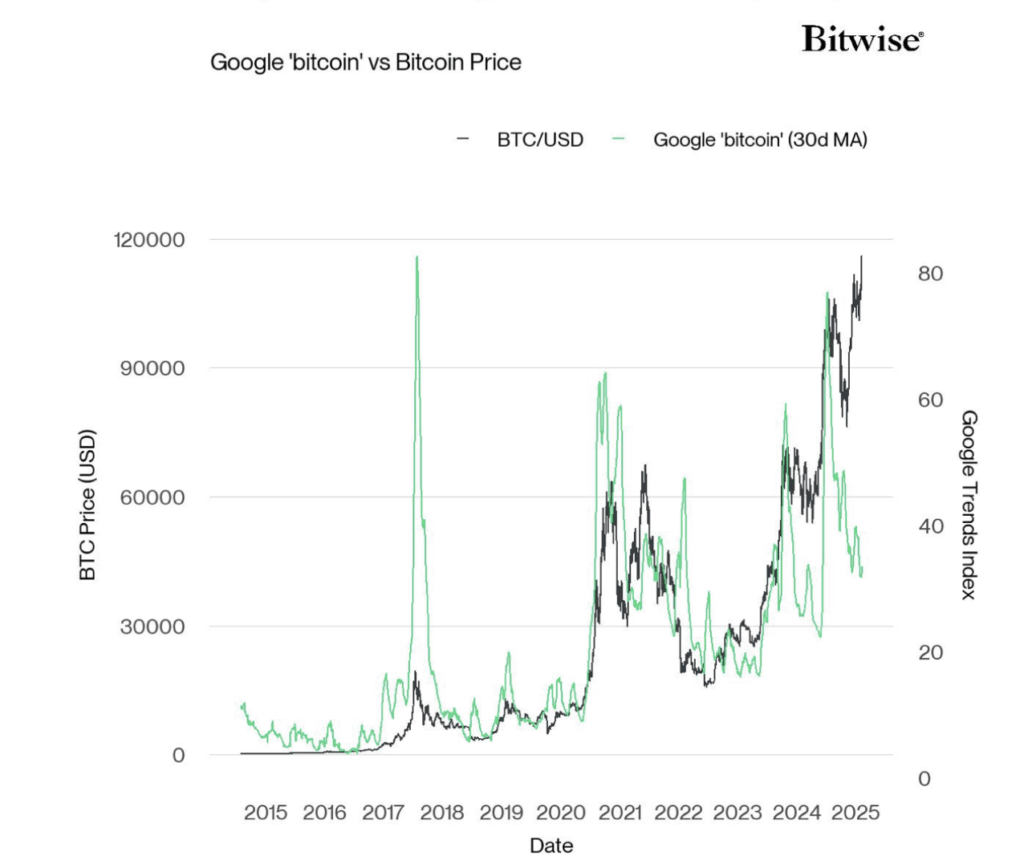

Bitwise’s head of research, André Dragosch, pointed out something weird on X—Bitcoin’s price is on fire, but Google search interest barely budged. “Retail is almost nowhere to be found,” he said. “Latest leg up is mostly driven by institutions.”

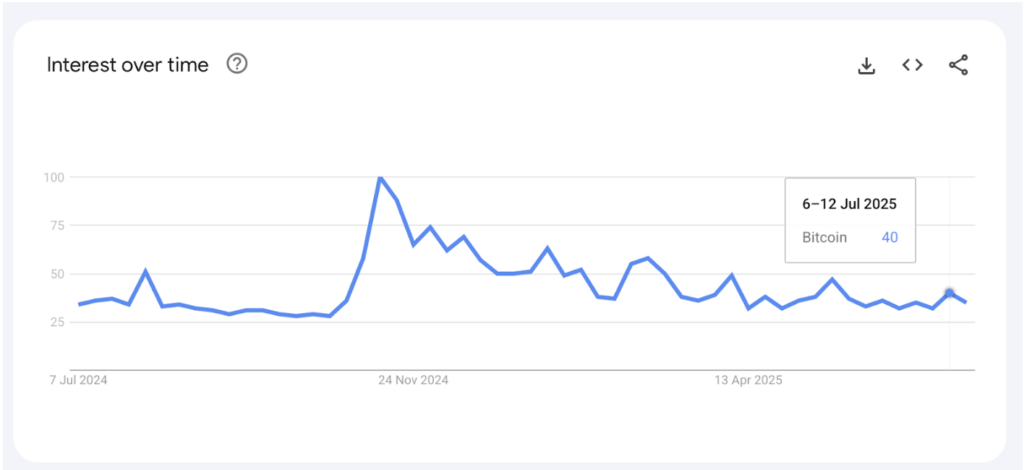

He’s not wrong. Data from Google Trends showed only an 8% bump in global search interest for “Bitcoin” during the week it made those record-breaking moves. Not bad—but not great either, considering the coin jumped from $111K to $118K in just a couple days.

And get this—search interest is still 60% lower than it was back in November, the week after Trump’s win triggered a month-long rally to $100K. Seems like the crowd that helped fuel that run is sitting this one out.

Is Retail Just… Over It?

Some Bitcoiners think regular investors feel like they missed their shot. Lindsay Stamp summed it up on X: “I think a lot of retail folks find out the price of one Bitcoin is 117k and think, nahhh I missed the boat.” Yep, sounds about right.

Cedric Youngelman from the Bitcoin Matrix podcast added, “At what Bitcoin price do you think retail wakes up?” His guess? “I don’t think they’re coming for a long time.”

And hey, maybe that’s true. But not everyone’s convinced the top is in. Analyst Willy Woo chimed in, saying this run “has plenty of legs left.” Translation? We’re not done yet.

ETFs Are Hot, Even If Google Isn’t

Meanwhile, behind the scenes, Bitcoin ETFs are raking it in. Thursday and Friday saw back-to-back $1 billion+ inflow days—first time that’s happened. Over the full week? $2.72 billion in inflows, according to Farside.

Some folks are now wondering: if these ETF shares are ending up with retail holders, maybe we’re underestimating how many regular people are buying Bitcoin… just not directly on-chain.

So yeah, retail might be quieter this time. But with ETFs booming and institutions piling in, the market’s still very much alive.