- LTC struggles under three major moving averages, with bearish momentum growing and RSI drifting below neutral.

- Volume and liquidations point to seller dominance, with long traders absorbing most of the losses in the past 24 hours.

- $86.85 and $84 are key levels; a breakout or breakdown from this range could set the tone for Litecoin’s next move.

Litecoin’s kinda stuck right now — not crashing, but not flying either. As of Tuesday, LTC is trading around $86.18 after slipping 1.86% over the last four hours. Not a huge move, but it’s keeping everyone on edge, mostly because the price has been hovering below some pretty stubborn moving averages.

Right now, you’ve got the 50-period SMA sitting at $85.51. Then there’s the 100-day right behind it at $86.15, and capping it all off is the 200-day resistance at $86.85. Three straight sessions now and Litecoin still hasn’t managed to close above any of them. Each failed attempt chips away at whatever bullish energy is left — if there’s much left at all.

Bears Still Holding the Steering Wheel

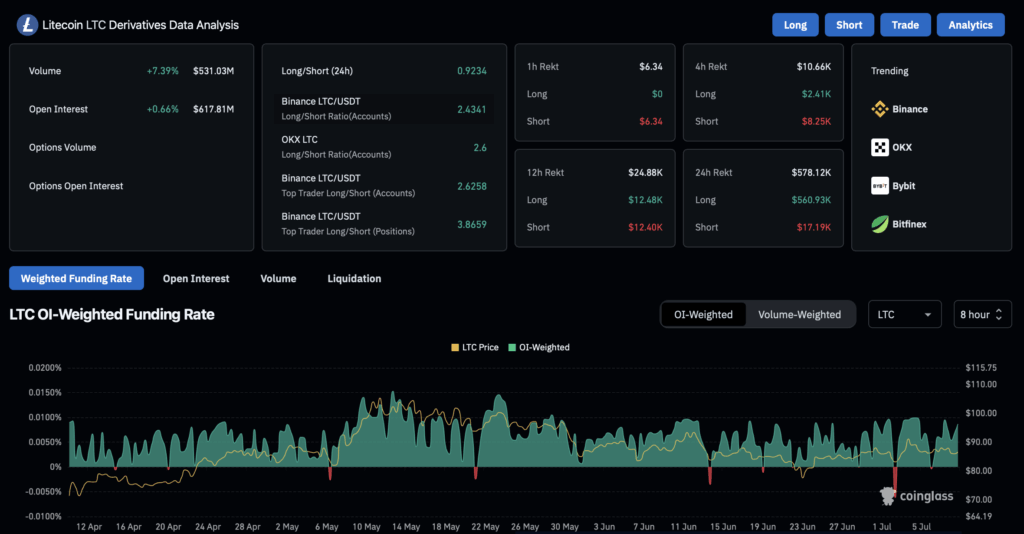

Momentum indicators aren’t giving much comfort either. The RSI is chilling around 44.98, sliding under the signal line at 48.68. That kinda setup leans bearish — like, there’s interest from buyers, but not enough to flip the vibe. According to CoinGlass, trading volume has picked up 9.46% to hit $540.97 million, which could mean people are just taking advantage of short-term price swings.

Open interest crept up 0.11% to hit $609.19 million, with most of that coming from perpetual futures. That’s a subtle long bias, with the funding rate just at 0.008%, so no one’s really going full degen yet. In the past 24 hours, $631,950 worth of LTC positions got liquidated — and nearly all of that ($623,010) came from longs. Shorts only took an $8,940 hit, which… yeah, kinda tells you who’s in charge here.

Technicals Set the Stage — But Which Way?

Right now, traders are laser-focused on some key levels. Resistance is still right up at the 200-period MA at $86.85. If Litecoin can bust through that with some volume, we might be talking a quick sprint to $90 or even last month’s highs around $92. But that’s a big “if.” Nobody wants to get caught in another bull trap with no follow-through.

If the price heads south, immediate support is sitting at $84 — that’s where buyers stepped in late last week. Below that, there’s a downward-sloping trendline that meets the $82 zone. Break below that and, well, we could be heading back to $80 or even May’s low near $77. Not ideal.

Since peaking just above $90 on July 3, LTC’s been making lower highs and lower lows. Classic descending channel stuff on the 4-hour chart. Bears seem to be pressing their advantage for now, and unless something shifts, they’ll probably keep pressing.

Macro Drag and Range Pressure Mounting

There’s a broader story at play too. Bitcoin dominance is rising again, pulling capital out of altcoins like Litecoin. It’s hard for LTC to move independently right now without some kind of major catalyst. Headlines or macro events could change the script — but until then, we’re kinda grinding sideways.

LTC is in a bit of a pressure cooker. A solid break above $86.85 might be the spark bulls need. A dip under $84? That probably hands the reins back to the bears. Volume’s creeping up, and the squeeze is getting tighter, so something’s gotta give. Everyone’s watching for that first real move.