- SOL is consolidating around $147 with mixed analyst sentiment and low trading volume.

- Bearish wedge patterns and inflows into exchanges suggest downside risks, possibly to $120.

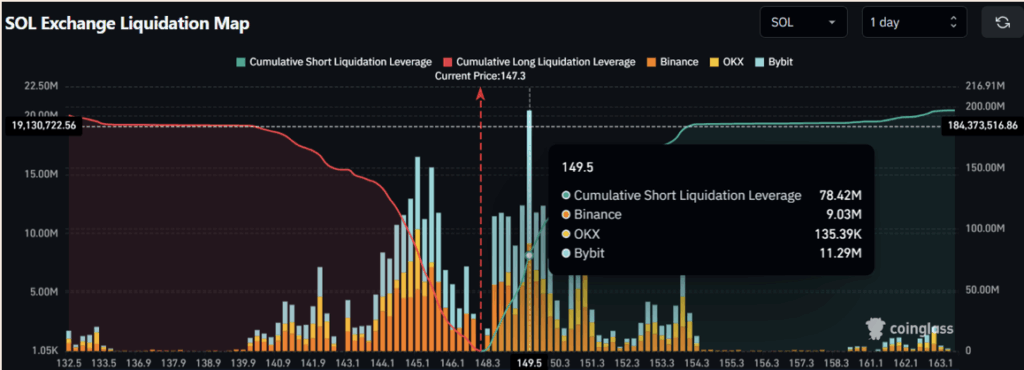

- Over $78M in short positions points to rising bearish sentiment, while bulls eye a breakout above $160.

Solana’s just kinda… hanging out near $147. It crept up a tiny 0.25% in the past 24 hours, which—let’s be honest—barely counts as movement. But even though the price looks chill on the surface, there’s a whole lot of noise underneath, with analysts dropping predictions that range from mildly hopeful to straight-up doom.

Is This Wedge… Bad News?

Over on X, one trader flagged a descending broadening wedge on SOL’s 12-hour chart. They didn’t sugarcoat it either—called it “very scary,” in all caps, no less. Based on that setup, they say a plunge toward $120–$125 is on the table if sellers get trigger-happy.

On the flip side, someone else posted that SOL’s long-term game could be massive. Think $169 to $420 levels. Which is… quite the gap. Basically, it’s anyone’s guess right now, and that mix of optimism and panic is making traders twitchy.

Vanishing Volume and Market Shrugs

According to CoinMarketCap, Solana’s trading volume just fell off a cliff—down more than 47% in 24 hours. That’s a big red flag. When volume dries up like that, it usually means traders are stepping back and waiting for a clearer signal.

AMBCrypto’s chart watchers noted SOL is chilling at a key support line—$145—and hasn’t made a convincing move since breaking out of a descending channel. If it dips below $141, things could slide real fast, maybe even down to $120. But if it pulls off a daily close above $160? That could light a fire under the bulls and push it toward $183.

Big Money Moves and Exchange Alerts

Data shows about $4.26 million worth of SOL just got shuffled into exchanges in the past day. That kind of inflow usually hints at a sell-off brewing—or at least a bit of nervous hedging by holders who don’t wanna get caught flat-footed.

To make things even more spicy, CoinGlass data shows traders are piling up bearish bets. At the time of writing, short positions hit $78.42 million, while longs were sitting at just under $54 million. So yeah, bears are feeling bold right now, especially with resistance hovering around $149.5 and support down at $145.

What Happens Next?

Nobody knows for sure, but the pressure’s building. Whether SOL crumbles under it or breaks out clean depends on what happens around that $141–$160 range. For now, it’s a waiting game—with a whole lot of nerves on the line.