- TRX daily transactions doubled since Sept 2023, while whales and holders keep accumulating below $0.28.

- Price is likely heading toward the $0.295–$0.3 zone, where a high cluster of liquidations sit—expect volatility.

- Traders can aim for profit-taking at $0.3 or wait for a breakout and retest before jumping back in.

TRON’s been quietly picking up steam, and it’s not just hype. Daily transaction numbers have doubled since last September, climbing from under 5 million to 9 million. That kind of traffic’s no small feat—and yeah, the network’s raking in more revenue because of it. Add in whales quietly stacking and some chatter picking up on social media? Feels like something’s brewing under the surface.

Where the Smart Money Bought (and Still Holds)

According to IntoTheBlock, a whopping 98% of TRX holders are “in the money.” That’s not a typo. Most of the heavy buying? Happened in the $0.243–$0.28 range—about 28.39 billion TRX, worth over $7.4 billion, was scooped up there. Meanwhile, only 4.48 billion TRX was bought up between $0.288 and $0.455. That’s a pretty weak zone in comparison.

Translation: that lower zone is a strong demand pocket, and there’s not a mountain of selling pressure up above just yet. Sure, some folks will lock in profits, but buyers still seem to be calling the shots.

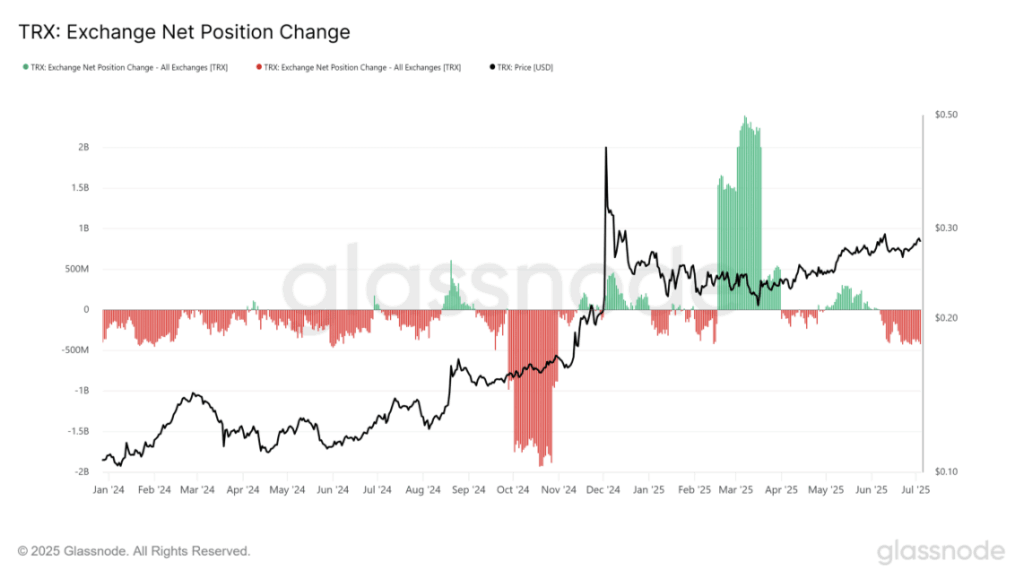

Exchange Outflows = Quiet Accumulation

Over on Glassnode, the Exchange Net Position Change metric is flashing something interesting. When the number’s green, it usually means more TRX is being sent to exchanges—aka, people might be looking to sell. But lately? It’s gone red. TRX is getting pulled off exchanges, hinting that investors are holding tight and accumulating.

That lines up with the recent, slow grind upward in price. And here’s the kicker—this exact same pattern played out last October, just before TRON ripped higher in November and December. That doesn’t guarantee a repeat, but hey, markets love to rhyme.

But That $0.30 Zone? It’s Loaded With Traps

Now, don’t get too comfy. According to CoinGlass’s heatmap, there’s a lot of liquidity sitting just overhead—specifically around $0.29 and especially in the $0.295–$0.3 range. These zones are like magnets, packed with stop-losses and leverage. So, chances are high that TRX will try to reach up there soon, hunting that liquidity.

Once it does, don’t be surprised if things flip quickly. Longs will pile in during the run-up, and then bam—price could reverse hard to squeeze them out. Classic.

That’s why traders might wanna take profits around $0.295–$0.3. If there’s a clean break above $0.3 and a solid retest as support? That’s your green light to long again. Otherwise, a rejection there could set up a sneaky short.