- Over $3.6B in BTC and ETH options expired, creating short-term pressure, but both coins held relatively steady.

- Analysts predict Bitcoin could break out to $137K and Ethereum to $3K, citing bullish technicals and ETF inflows.

- Liquidations caused brief pullbacks, but with expiry behind us, traders may gear up for the next leg upward.

Despite a wave of expiring options and some whale-led sell pressure, Bitcoin and Ethereum prices didn’t exactly tumble. Instead, they just dipped a little—hinting that traders might actually be bracing for a bigger move upward. Yep, even with all the noise.

Analysts remain surprisingly upbeat. Some are even floating price targets as high as $137K for BTC, thanks to a potential breakout from a bullish flag setup. ETH? It’s still fighting to reclaim ground above $3K, riding the momentum from fresh institutional buying and new capital flowing into Ethereum ETFs.

$3B in BTC Options Expiring—Market Braces for Volatility

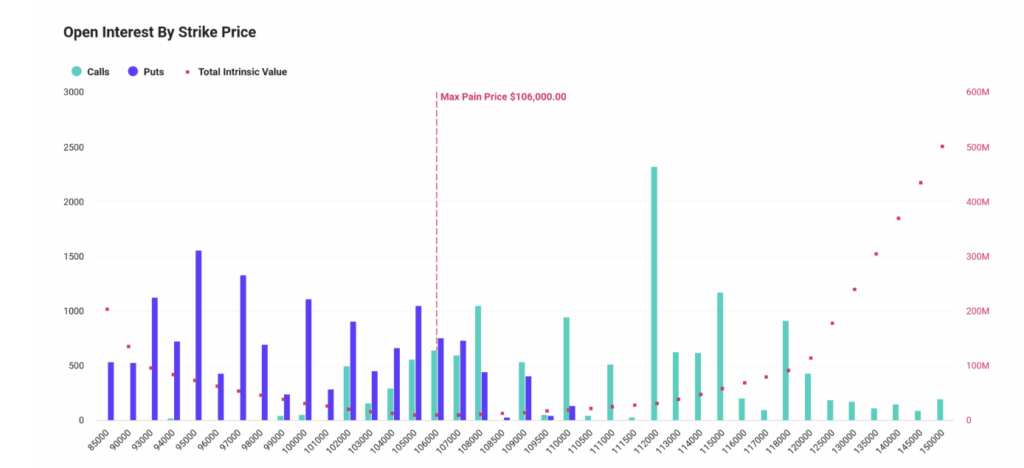

Roughly 27,500 BTC options—worth about $3 billion—were set to expire, with the “max pain” price coming in at $106K. That’s the point where most holders would take a hit, so volatility usually picks up around this time.

Interestingly, the put-call ratio sat at 1.06, leaning bearish. Traders seem to be placing more bets on a downturn. Although, a day earlier, the same ratio was way lower at 0.54, so clearly—sentiment’s all over the place.

BTC hovered near $108,800 at the time, down just 1%. Volume, however, had fallen more than 23%, so we’re not seeing major conviction either way just yet.

ETH Options Worth $600M Also on the Table

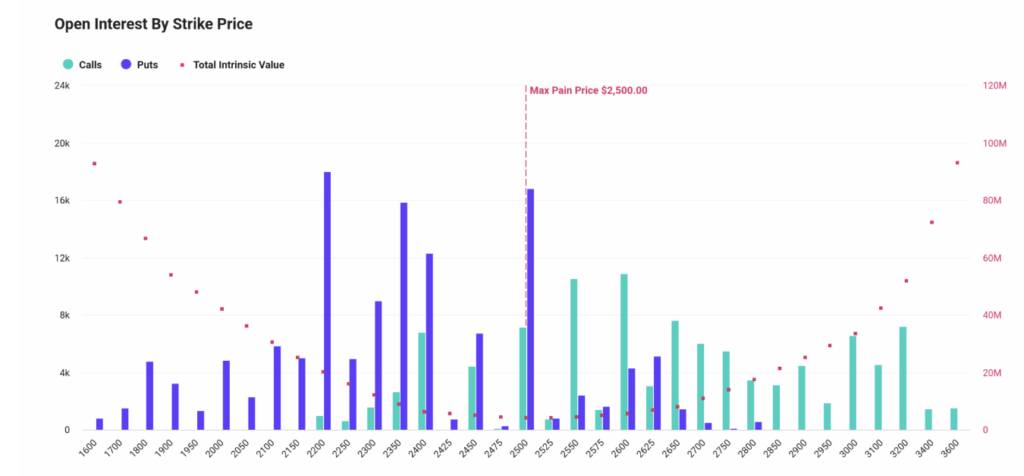

Ethereum had its own expiry event, with 237,000 ETH options—valued at around $600 million—set to close out. Max pain level? $2,500. That lines up with ETH’s recent action, where it was trading at $2,550, down a modest 1%.

Here too, the put-call ratio leaned bearish at 1.26, suggesting some traders are hedging against further downside. Volume dropped over 35% in the last 24 hours. Still, according to Deribit, liquidity is bouncing back now that quarter-end pressures have cooled off. This could give ETH a shot to catch up with the equities rally that’s been leaving crypto in the dust.

Analysts Call for BTC to Hit $137K, ETH to Reach $3K

Several well-known analysts are sounding the bullish alarms. Names like 10x Research, Peter Brandt, and Titan of Crypto are all eyeing a breakout on Bitcoin’s chart. They’re pointing to a clean bull flag breakout and solid Bitcoin ETF inflows. Some say BTC could leap to $135K or more in the months ahead.

Matrixport, meanwhile, is betting on a July rally, targeting $116K first.

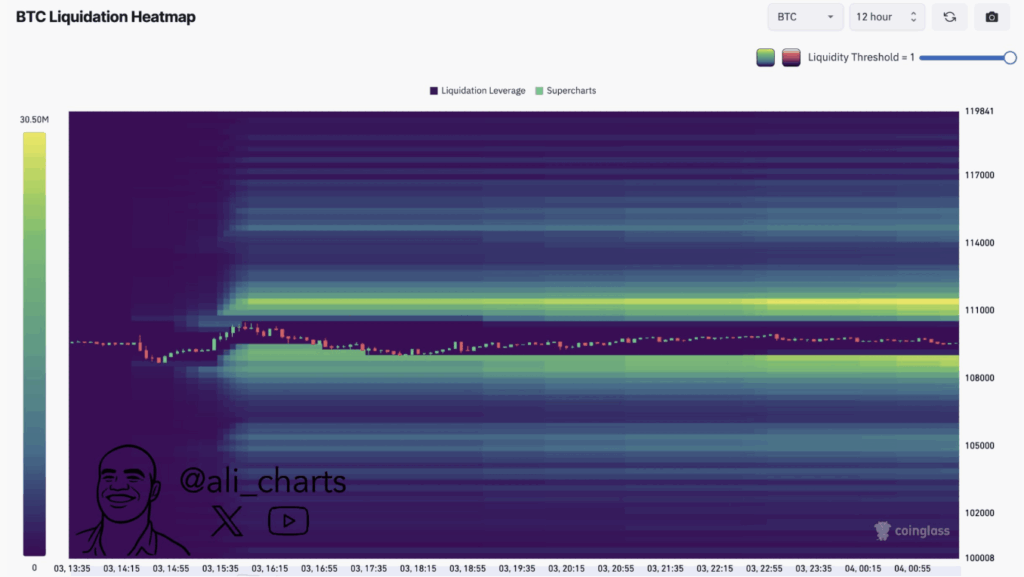

Shorts could get wrecked if BTC climbs past $111K. Analyst Ali Martinez says over $30 million in short positions would get liquidated if BTC hits that mark—possibly triggering a surge to $112K and beyond.

As for ETH, analyst Michael van de Poppe noted ETH broke through resistance. He thinks that if ETH stays above $2,500, it could stretch toward $3,000. Ted Pillows backed that view, highlighting a higher low forming and a possible support/resistance flip in progress.

Wrap-Up: A Breather Before the Next Big Push?

The recent dip in BTC and ETH looks more like a pause than a trend shift. Liquidations from the options expiry may have temporarily pulled prices down, but now that that’s mostly behind us, buying could pick back up fast.

If bullish setups hold and volume returns, the stage may be set for Bitcoin and Ethereum to make another run—this time with even more eyes watching.