- XRP broke out of a bullish pennant pattern, pointing to a potential 40% rally toward $3.20 in the short term.

- Open interest surged to $4.75B, signaling growing institutional demand amid rising confidence in a spot ETF and Ripple’s banking ambitions.

- Technical and fundamental indicators align, with whale accumulation, bullish futures positioning, and positive sentiment boosting XRP’s breakout potential.

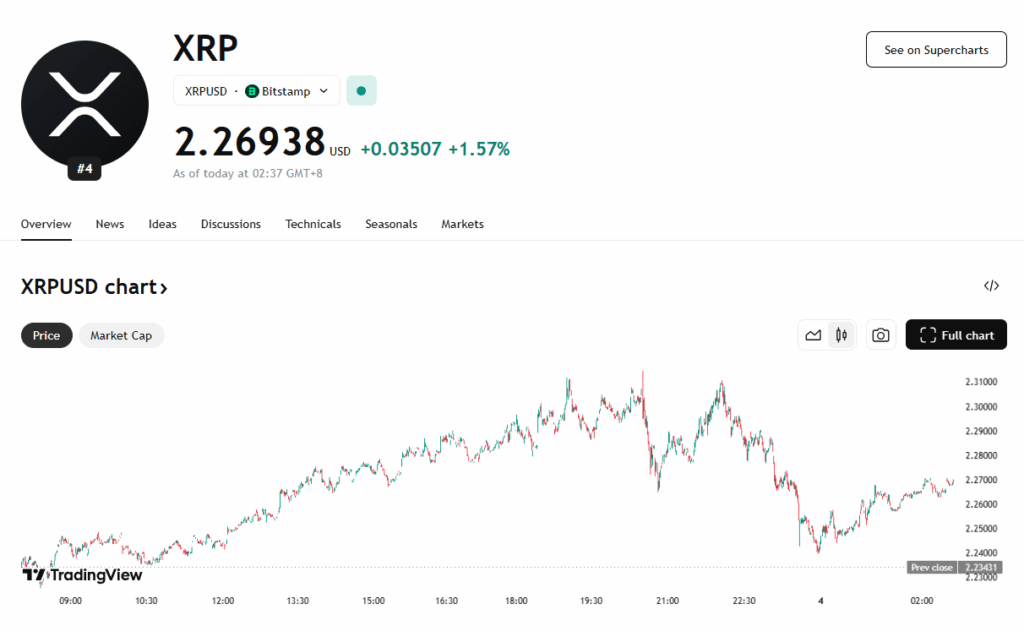

XRP has just broken out of a bullish “pennant” pattern on the weekly chart, suggesting a continuation of its recent upward momentum. This breakout comes as XRP trades around $2.26, with analysts now eyeing a 40% move that could take the token to $3.20 or even higher. The pattern’s confirmation follows Ripple’s aggressive expansion efforts, including a U.S. banking license application and new strategic partnerships.

Futures Activity Signals Institutional Confidence

A sharp uptick in open interest (OI) has backed XRP’s recent surge. OI rose by 11% in just 24 hours and 30% over the past 10 days, hitting $4.75 billion—levels that hint at a wave of institutional money entering the market. Historically, similar spikes in OI have preceded strong rallies in XRP. Traders are drawing comparisons to April 2025, when a surge in OI from $3B to $5.75B accompanied a 65% price rally after a major Trump trade policy announcement.

Key Drivers: Banking Push, ETF Hype, and Whale Action

XRP’s price climb is being supported by several bullish catalysts: Ripple’s push for a U.S. banking license, SEC approval of Grayscale’s GDLC ETF conversion, and its new partnership with OpenPayd. There’s also increasing speculation about a potential XRP spot ETF. All this is happening while whales continue accumulating XRP and traders show a clear bullish bias—evident in the 68% long/short ratio favoring long positions.

Bullish Chart Pattern Points to 40% Upside

The pennant breakout is significant. XRP traded inside a narrowing structure since December 2024, and finally broke above the descending trendline near $2.21 on July 3. This move has technically opened the door to a rally toward $3.20, based on the height of the formation. Some analysts are even more optimistic, predicting a push toward $3.40 as momentum accelerates.