- DeFi Development Corp. added 17,760 SOL, bringing its total to 640,585 tokens, backed by $112.5M in fresh funding and a $5B credit line.

- The firm is betting on staking-heavy PoS assets, joining a growing wave of crypto treasury firms diversifying beyond Bitcoin.

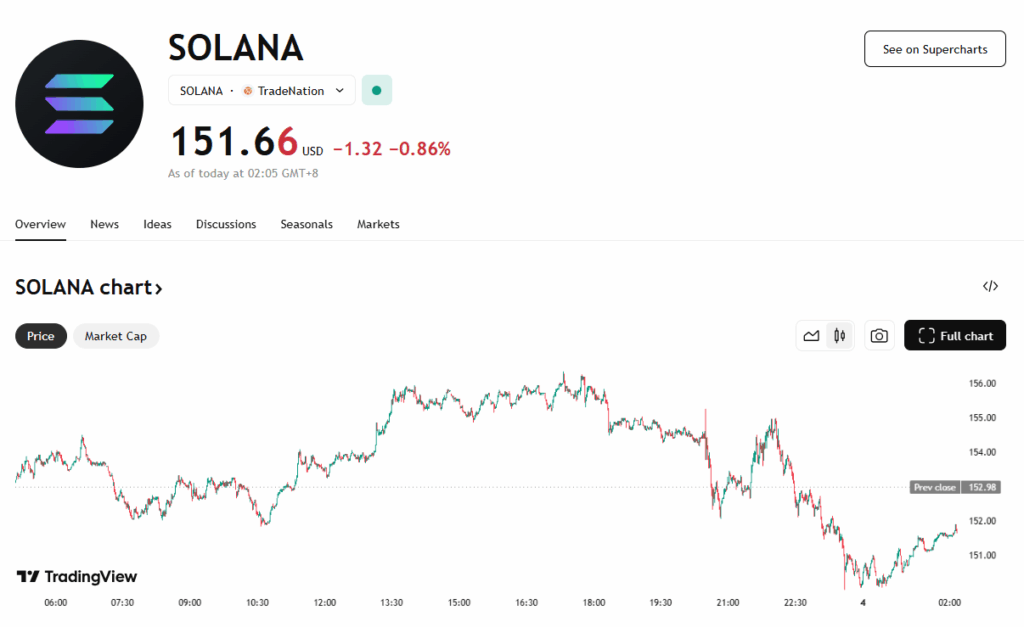

- At an average buy price of $153.10 per SOL, DDC maintains a “SOL per Share” ratio of 0.042 to benchmark its equity’s on-chain value.

DeFi Development Corp. (DFDV), a Solana-focused treasury firm, just expanded its SOL stash by another 17,760 tokens, bumping its total holdings to 640,585 SOL—worth about $96 million at current prices. This latest buy isn’t just another quiet accumulation. It signals a broader strategy the firm has been doubling down on since its April acquisition by ex-Kraken executives. The purchase came shortly after DDC secured a fresh $112.5 million in private funding to boost its war chest.

A New Treasury Playbook Backed by Billions

The $112.5M funding round isn’t DDC’s first rodeo. The company had already raised $42 million in earlier financing and locked in a massive $5 billion line of credit. As part of the latest deal, $75.6 million was allocated for a “prepaid forward” stock transaction—basically a structure meant to shield buyers of DDC’s convertible notes from risk. The remaining funds are going into corporate ops and, unsurprisingly, more SOL.

Staking Is the Strategy, Not Just Speculation

DDC isn’t alone in this game. It joins other treasury-style players like SOL Strategies and Upexi who are betting hard on proof-of-stake tokens. While most firms lean on Bitcoin for balance sheet security, these firms are making a case for PoS assets like SOL, ETH, and BNB—tokens that earn yield through staking. It’s less about HODLing and more about turning token treasuries into productive revenue streams.

$153.10 Average Buy-In and a Unique Metric

The firm’s most recent SOL tranche was bought at an average price of $153.10—roughly $2.72 million worth. DDC tracks its performance with a unique “SOL per Share” ratio, which currently sits at 0.042 as of July 3. This metric is designed to help investors track how much actual SOL backs each share of equity—a clever touch for transparency and valuation anchoring as crypto treasuries go more mainstream.