- $53.8M in BTC long and short positions liquidated in a single day, signaling massive trader shakeout

- Bitcoin remains range-bound, with key support near $103.4K and upside resistance around $109K

- Inflation ticks higher, weakening chances of a Fed pivot and keeping pressure on risk assets like BTC

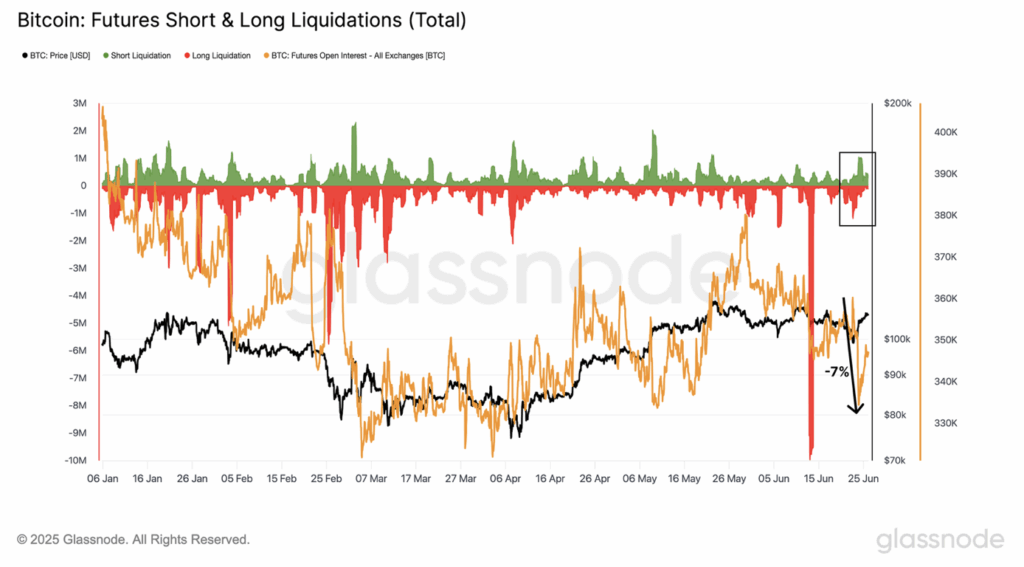

Bitcoin had a wild ride to start the week—price swings were sharp, sudden, and they didn’t play favorites. Both long and short traders took a hit. In just 24 hours, Glassnode reports that $28.6 million in longs and $25.2 million in shorts got liquidated. That’s a pretty rare two-sided flush, and it speaks to just how quickly the market’s mood can turn on a dime.

Open interest in BTC futures dropped around 7%, falling from 360,000 to 334,000 BTC. Translation? Speculative leverage just got washed out, and the market looks like it’s hitting the reset button. Prices are still bouncing between $100K and $110K, but onchain data shows things are cooling off—fewer people participating, and profits are shrinking. So for now, it feels more like the market’s catching its breath.

Range-Bound and Restless: BTC Stuck in a Technical Squeeze

From a chart-watcher’s perspective, Bitcoin’s been stuck in a descending channel lately. It couldn’t quite punch through the $109K mark, and now it’s slowly grinding downwards. The current zone to watch is around $103,400–$104,600. That spot lines up with a daily fair value gap and the 200-day EMA—so, not a bad candidate for a bounce, if buyers step in.

There’s still a shot that BTC breaks out to new highs if it scoops up enough liquidity down here. But honestly, that’s a big “if.” Until onchain data starts showing signs of life and momentum picks up, it’s likely we’re stuck in this sideways churn for a bit longer.

Inflation’s Back in the Picture—and That’s a Problem

To make things trickier, inflation’s starting to act up again. The Fed’s favorite measure, Core PCE, came in at 2.7%, a bit hotter than the expected 2.6%. Not huge, but enough to keep rate-cut hopes on ice for now. That means tighter financial conditions stick around—which isn’t exactly a win for Bitcoin or other risk assets.

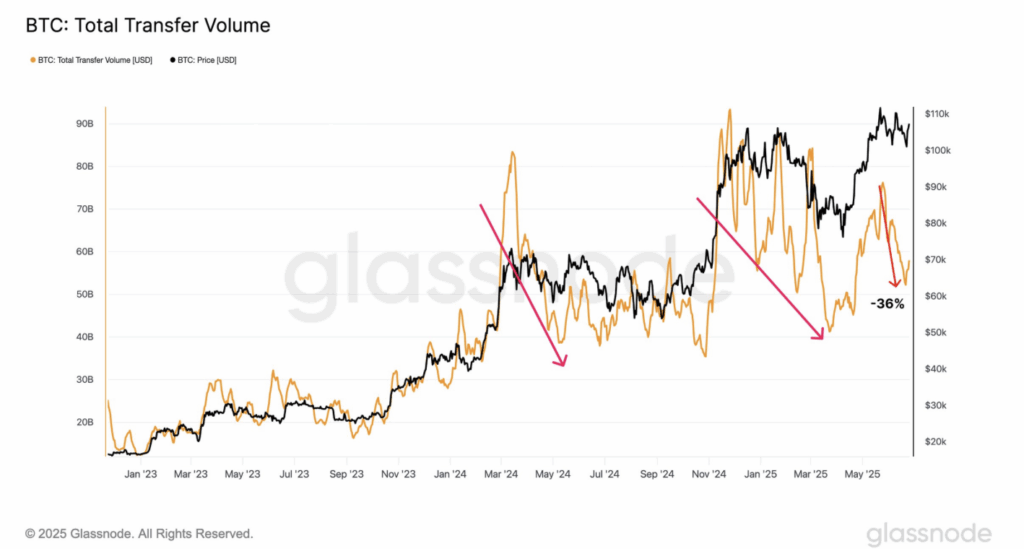

Even on the activity side, things are meh. Spot volume only saw a mild $7.7 billion bump in Q2. Meanwhile, transfer volume actually dropped 36% earlier in the quarter. So, speculative interest is definitely taking a breather.