- Michael Saylor calls SBF “the poster child of the crypto world” while breaking down his antics that led to his empire’s downfall.

- The ex-CEO of FTX and other people in the crypto industry were always guilty of the sin of “shitcoinery.”

- According to Saylor’s perception of crypto problems, they are “inherent problems which are greed, arrogance, and foolishness.”

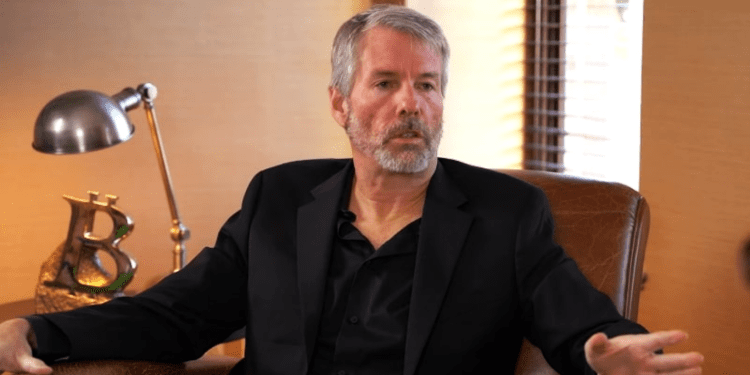

In an interview conducted by Patrick-Bet David and Adam Sosnick, Michael Saylor, the MicroStrategy Executive Chairman and significant Bitcoin bull has shared his comments on the fall of the gigantic FTX exchange which SBF formerly headed.

Saylor stated that for years there has been a low-grade “boiling Guerilla war” between the Bitcoin industry and the larger crypto ecosystem over industry practices that he referred to as “shitcoinery.”

From Saylor’s perspective, the ex-CEO of FTX, Sam Bankman-Fried, was “a poster child” of the crypto community. He further said,

“There is something ethically broken about being able to issue your unregistered security. Sam and most people in the crypto world were always guilty of the sin of shitcoinery.”

The Bitcoin maximalist attributed the behaviors such as promoting shitcoins to his perception of the crypto community’s inherent problems: greed, arrogance, and foolishness.

Saylor further noted that the devilish twist in the FTX collapse was that SBF generated millions of dollars out of tokens he printed out of thin air and issued himself billions of loans from customer funds.

However, a probe is being conducted to determine whether SBF was involved in misusing customer funds and loaning himself vast amounts of money to profit his companies, including the trading firm Alameda Research.

Many users and companies have come out applauding Saylor’s remarks on the situation and his openness. The community on Reddit celebrated Saylor for his clear explanation of the incident and a straightforward comparison with Bitcoin.

Users’ Comments Erupt upon Saylor’s Perception of SBF

Others have flooded the comment section regarding Saylor’s approach to the matter and claimed that his explanation was the best and most rational. Users claimed that SBF knew what was happening and tried to cover up the loans by buying companies and luring unsuspecting traders from other platforms.

FTX’s demise remains the topic of discussion in the crypto space after it filed for bankruptcy roughly a month ago, leaving millions of customers in the lurch. FTX was among the prominent crypto exchanges in the world and was processing approximately $4 billion in daily trading volume.

Nonetheless, in the early days of the FTX scandal, Michael Saylor and the Binance CEO Changpeng Zhao were among the first prominent people in the crypto ecosystem to urge the community to practice self-custody.

In a court hearing dubbed “Investigating the collapse of FTX,” conducted on December 13th by the U.S. House of Financial Services Committee, chaired by Maxine Waters, the current CEO of FTX John Ray III, testified before Congress that SBF’s family received payments by FTX.

In a statement released by Congress, the chairwoman thanked Mr. Ray for his participation. She added that Ray’s task to recover customers’ funds would be long and difficult given the extent of fraud committed by SBF.

She further stipulated that the SEC has a tremendous job ahead and will require additional funding as Congress will also play its role. “We must not only investigate, but we must also legislate.” Noteworthy, SBF was arrested a day before the hearing at the request of federal prosecutors in New York. If he is extradited to the U.S., he can formally receive notice of the criminal charges brought against him.