- Lower inflation and a key Fed meeting this week could set the stage for altcoin rallies.

- SUI, Solana, and Bittensor are showing strong fundamentals and potential setups for the next leg up.

- Despite minor dips, all three coins are sitting at levels that may attract accumulation ahead of a market breakout.

Well, the latest U.S. inflation data just dropped, and hey — it’s actually better than expected. The Consumer Price Index (CPI) came in softer than analysts thought, which gave both stocks and crypto a bit of a bounce. Even interest rates dipped slightly. Not massive moves, but enough to shift the mood.

Now, all eyes are on the big FOMC meeting happening this Tuesday and Wednesday. Investors are itching for clues about when those long-awaited rate cuts might start. And if that happens? Some altcoins are better positioned than others to ride the next wave.

According to AltcoinBuzz, while the broader crypto space is still a little quiet, a few projects are making some noise. Let’s dig into the three altcoins they’re watching.

SUI: A Quiet Climber With Real Traction

Sui isn’t one of those projects that screams for attention, but maybe it should be. It’s quietly up over 200% this past year and continues building fast in areas like DeFi and stablecoins. The project just passed $2 billion in Total Value Locked (TVL), which is nothing to sneeze at.

It’s also branching into decentralized storage and NFTs — making itself more than just a one-trick pony. Right now, SUI’s trading around $3, down a little over 1%, which might actually be a nice entry point for folks looking to buy the dip.

Solana: Still Charging Ahead

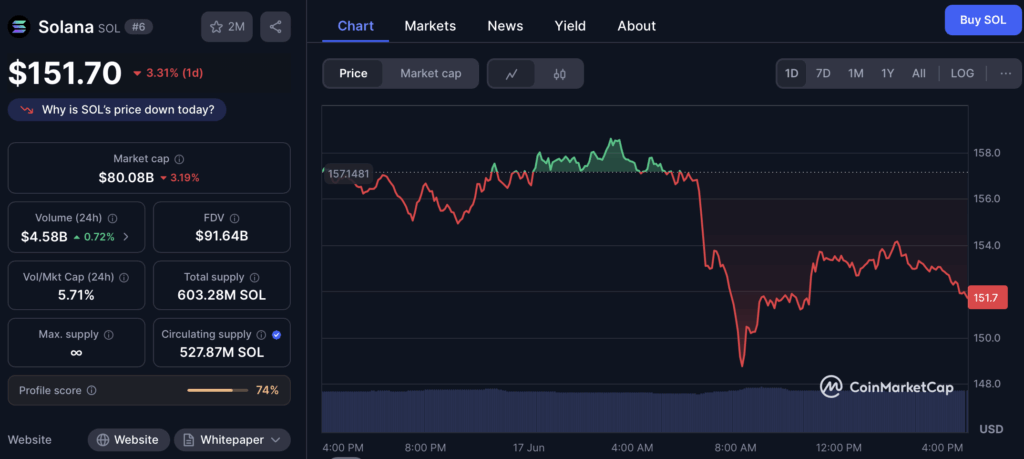

Solana’s been bouncing between $150 and $225 lately — a solid range considering the market chop. And when it comes to real user activity? Solana’s leaving even Ethereum behind in some areas, with more daily users and a thriving stablecoin scene.

It’s fast, cheap, and surprisingly resilient. Right now, SOL’s sitting around $153, down about 2.65%, but it’s not far from that $164 resistance level — a key Fib line to watch. If it breaks through there, things could heat up quickly.

Bittensor (TAO): The AI Sleeper Pick

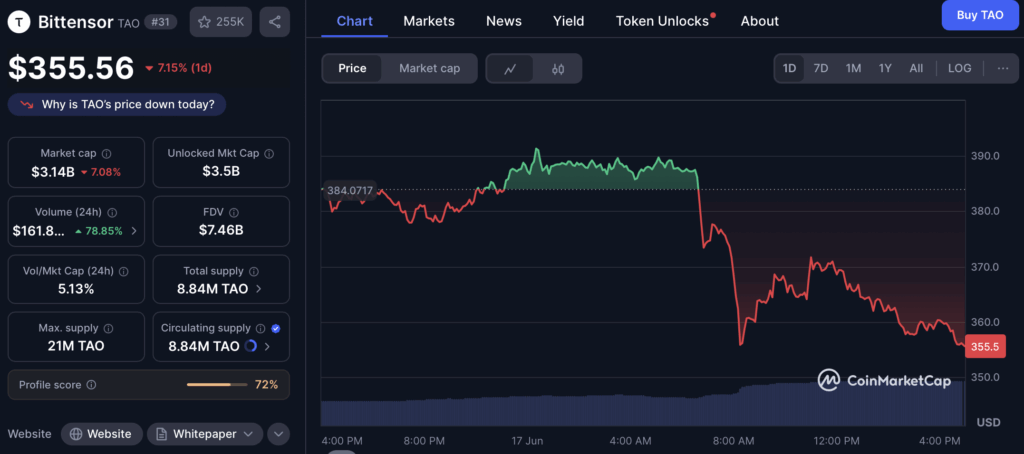

Bittensor’s flying a bit under the radar, but it shouldn’t be. It’s leading the charge in decentralized AI, and just hit a big milestone — its 100th subnet went live. That’s a big deal, creating more ways to use its native token, TAO.

There’s a capped supply of 21 million tokens too, giving it a kind of “digital gold” scarcity vibe. TAO’s down over 3% right now, but the structure looks primed for a breakout if the market turns risk-on again.