- SharpLink just grabbed $463M worth of Ethereum, becoming the largest publicly traded ETH holder and possibly kicking off a wave of corporate adoption.

- Institutional and whale interest in Ethereum is on the rise, with on-chain data showing accumulation and surging depositor activity.

- ETH’s price stability and strong fundamentals could set the stage for a new adoption cycle, mirroring Bitcoin’s institutional breakout.

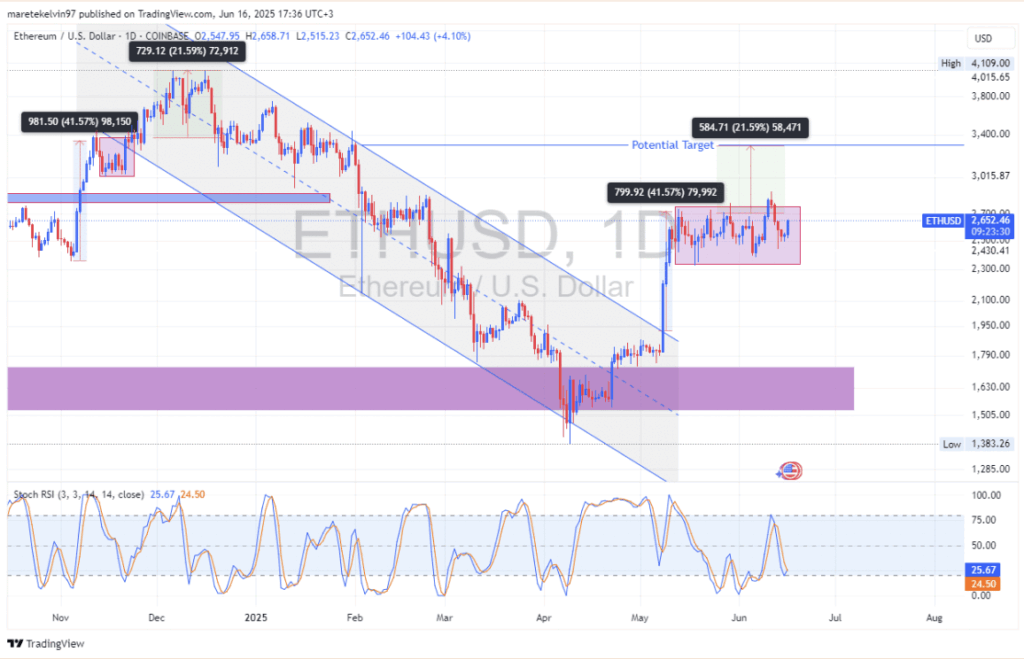

Ethereum’s been holding its ground around the $2,500 mark for weeks now. It hasn’t exactly broken out, but it also hasn’t crumbled under pressure—impressive, given the market’s been all over the place lately.

This quiet resilience hasn’t gone unnoticed. While some coins have been swinging wildly, ETH has kept calm, slowly gaining the interest of retail traders and, more importantly, institutional eyes that usually move a bit more cautiously.

SharpLink’s Massive ETH Buy-In Raises Eyebrows

Here’s where things get interesting: SharpLink, outta nowhere, just bought 176,271 ETH. That’s roughly $463 million worth—making them the biggest publicly traded Ethereum holder. Yeah, seriously. It’s like a MicroStrategy-level play, but for ETH.

This move isn’t just about numbers. It’s about setting the tone. SharpLink’s clearly betting that Ethereum is going to play a much bigger role in global finance, especially cross-border stuff. Kinda like how MicroStrategy’s early Bitcoin grabs kicked off a wave of corporate BTC adoption—this could do the same for ETH.

Institutions Warming Up to Ethereum

SharpLink’s timing might not be random either. More traditional firms are starting to look at Ethereum differently—not as a risky moonshot, but as a serious portfolio piece. With staking rewards, DeFi dominance, and the whole smart contract ecosystem, ETH’s utility is starting to speak for itself.

And now, with regulatory clarity slowly improving, institutions might feel safer getting involved. If that shift keeps picking up steam, Ethereum might become a core asset in a lot more long-term strategies.

Whale Moves & Spike in Network Activity

On-chain data adds to the story. Smaller whales (think wallets holding 1K to 10K ETH) have been quietly scooping up coins. That kind of steady accumulation usually means they believe in a solid price floor—or even a decent rally coming soon.

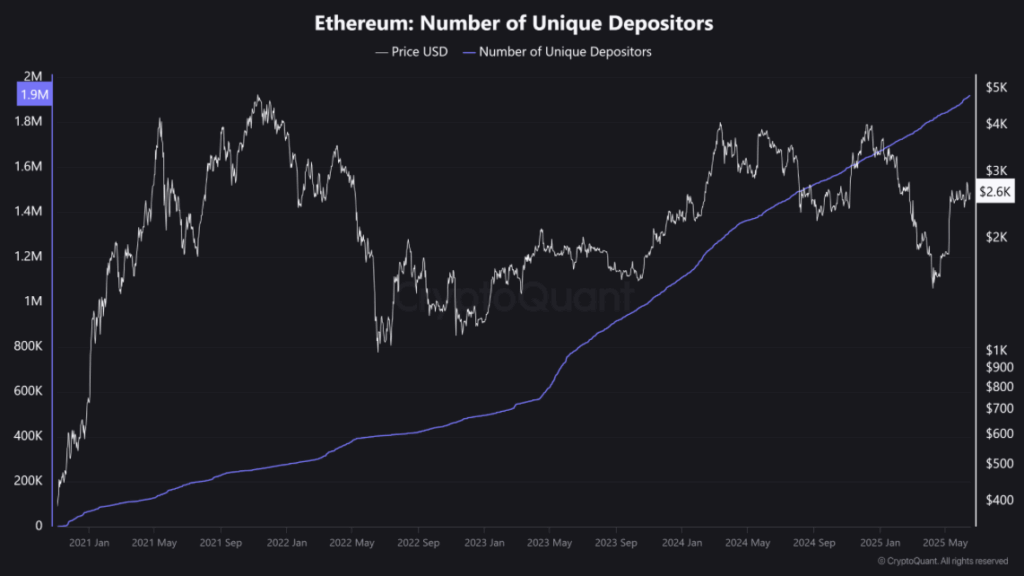

And it’s not just whales. The number of unique depositors on the Ethereum network has been climbing fast, hinting at growing retail interest and general confidence in ETH’s future utility. The network’s buzzing, and that tends to be a good sign.

So… What’s Next?

With institutional players like SharpLink making headlines and on-chain data backing bullish signals, Ethereum might be gearing up for a new chapter. If this echoes Bitcoin’s rise post-MicroStrategy, then SharpLink’s move could be the spark.

Sure, there’s no guarantee, and the market’s never short on surprises. But one thing’s clear: ETH’s foundations are getting stronger by the week—and people are starting to pay attention.