- SOL faces short-term bearish pressure, especially under the $160 mark, with strong support at $145.

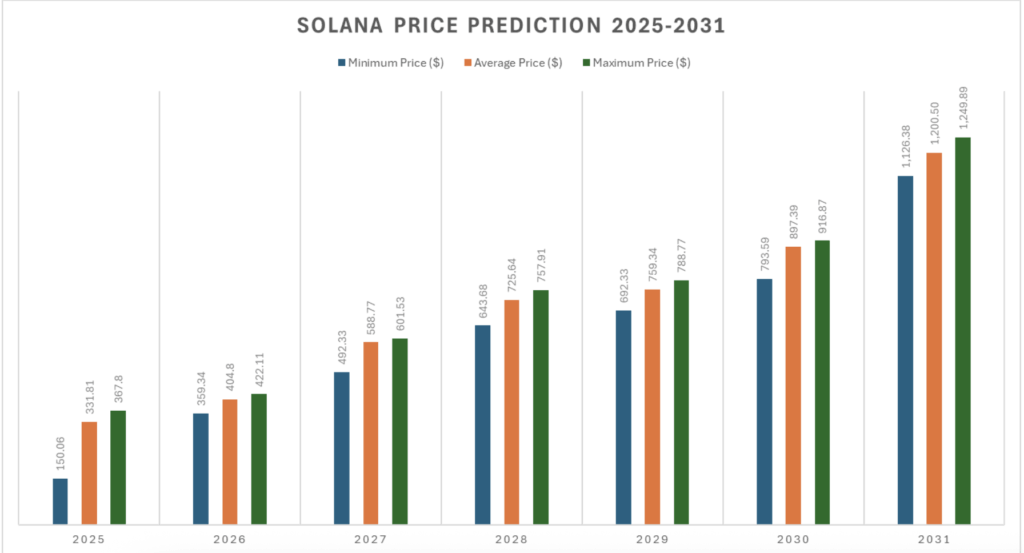

- Long-term price forecasts are optimistic, with targets of $367 in 2025 and up to $1,200+ by 2031.

- Despite recent volatility, Solana’s ecosystem and adoption metrics suggest strong future potential.

Solana’s had its fair share of headaches lately—network congestion, stiff competition, price swings—but it keeps showing up. Despite the current dip, the vibe around Solana feels more resilient than ever. There’s this weird mix of caution and excitement, especially among long-time holders and developers who see the bigger picture.

Right now, SOL’s sitting around $147, after failing to push through that sticky $160 resistance. But even as bearish pressure builds, there’s still strong belief in its long-term play. Technicals show room for more downside—RSI is under 40, MACD’s leaning negative—but support around $145 is still holding. If that cracks, eyes are on $140. It’s a jittery moment, but not panic mode just yet.

Trading Volatility Picks Up as Bulls Try to Regroup

On the 4-hour chart, SOL looks like it’s struggling to find its footing. Every time it creeps toward $160, bears smack it down. Momentum’s fading, and the MACD isn’t doing bulls any favors. RSI’s dipping into oversold territory, suggesting traders are cautious—or just plain exhausted. Still, the trading volume is up, which often signals something’s brewing. Could be a bounce. Could be more bleeding. It’s a wait-and-see kind of stretch.

Daily and hourly EMAs are throwing mixed signals. Some say “buy,” others “not so fast.” Short-term indicators lean bearish, while longer trends show signs of recovery. That tug-of-war has traders on edge, but for many, it’s just another day in the Solana rollercoaster.

Long-Term Forecasts Point to a Strong Future

Zooming out, the long-term outlook still has legs. Analysts predict SOL could hit anywhere from $331 to $367 by late 2025. Some even say $1,000 by the end of the decade isn’t off the table—though let’s be real, that’s a stretch unless crypto adoption really takes off. Even still, with Solana’s growing ecosystem, from NFTs to DeFi to new partnerships like WBTC support, the fundamentals are still strong.

Between 2026 and 2031, projections get even wilder: highs above $1,200 have been tossed around. It’s speculative, no doubt. But with Solana’s scalability, low fees, and increasing institutional interest, the pieces are there. Whether they come together in time is anyone’s guess.

Final Thoughts: Still a Top Contender in the Layer-1 Race

Yeah, Solana’s taken some hits lately. But it’s not fading into the background. With continued development, expanding DeFi tools, and support from heavyweights, SOL remains a top-tier player. For investors with patience—and a strong stomach—it could still deliver some serious upside.