- Strategy and similar firms are amassing huge bitcoin positions via leverage, risking the asset’s appeal as a central bank reserve.

- Sygnum warns that such concentration could destabilize bitcoin’s market structure and discourage organic, institutional adoption.

- While Strategy claims to be crash-proof, other corporate bitcoin accumulators may not survive a sharp downturn—raising broader concerns.

Bitcoin acquisition firms like Strategy (formerly MicroStrategy) are piling up massive BTC reserves using aggressive leverage—raising eyebrows across the financial world. While these strategies have boosted institutional demand and helped dry up liquid supply, Sygnum Bank is waving a red flag: this isn’t great for bitcoin’s image as a potential reserve asset.

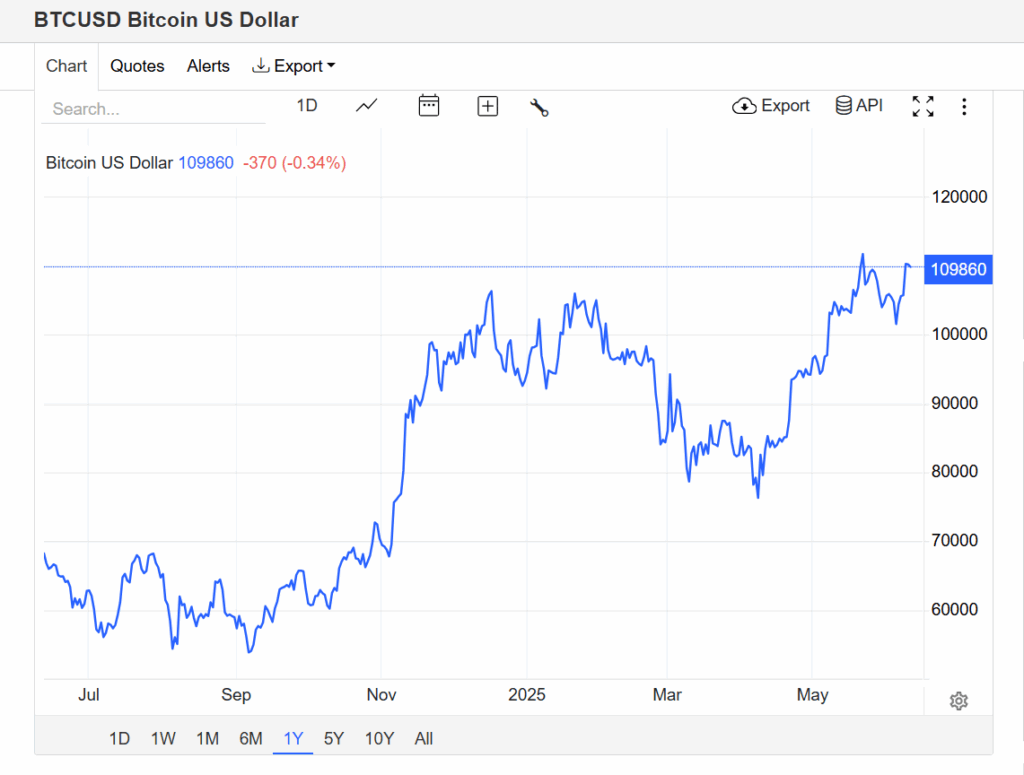

On Monday, Strategy scooped up another 1,045 BTC for $110 million, pushing its total stash to a jaw-dropping 582,000 BTC—nearly 3% of the total supply. That kind of concentration might sound bullish, but Sygnum warns it introduces fragility. The firm argues that such dominance could spook central banks, who need assets with deep liquidity and low volatility, not ones cornered by debt-fueled corporations.

Risk of a Bubble or Foundation for the Future?

What began as a treasury hedge has morphed into something that looks a lot like a speculative investment vehicle. Companies like Strategy, Twenty One, and Nakamoto Holdings are borrowing billions—through bonds and complex financial tools—to buy even more bitcoin. They’re starting to look less like businesses and more like closed-end BTC funds.

Sygnum’s concern? These tactics risk crowding out organic demand and masking true market liquidity. If these firms ever need to sell—say, during a bear market or fundraising squeeze—they could flood the market and spark steep crashes. Worse, it may discourage more cautious institutional players who see bitcoin becoming a leveraged toy rather than a reliable store of value.

Governments Take Notice—With Caution

Interestingly, some governments are inching toward bitcoin. The U.S. is exploring a Strategic Bitcoin Reserve with 200,000 BTC in government possession, and nations like Pakistan, Bhutan, and the Czech Republic are circling the idea. But central banks don’t like risk. Seeing a handful of companies hoard BTC using borrowed cash might push them to wait—or walk away entirely.

Sygnum also noted that small, measured BTC holdings could serve as smart hedges for corporates, but the rise of these aggressive strategies distorts that narrative. It risks turning bitcoin into a symbol of leveraged speculation rather than sound monetary insurance.

Can Strategy Handle a Crash?

Michael Saylor insists Strategy can weather even a 90% price crash. The firm has no major debt due until 2028 and uses a mix of equity and convertible debt to keep things flexible. But other copycat firms might not be so lucky. Those without strong financials or loyal investors may face serious trouble if the market turns south.