- Cardano’s ADA dropped over 10% but bounced back after strong buying support around $0.621, forming a bullish ascending channel.

- New institutional moves, including Cardano node operations by Franklin Templeton and Bitcoin-to-Cardano Ordinals integration, have fueled optimism.

- Despite market volatility from the Trump-Musk clash, ADA is showing technical signs of recovery and may gain further if sentiment stabilizes.

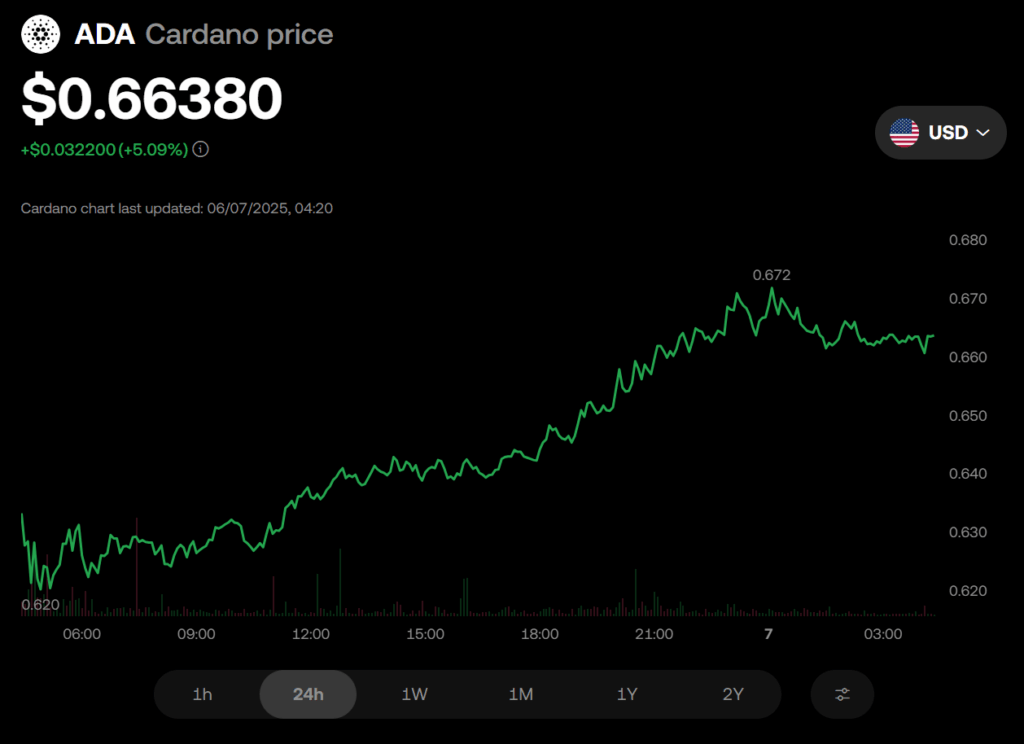

Cardano’s ADA token endured a rollercoaster ride this week, falling sharply amid heightened market chaos linked to the public fallout between President Donald Trump and Elon Musk. The token dropped over 10% from $0.688 to a low of $0.621 before finding support and bouncing back to around $0.66 in early U.S. hours on June 6. The intense dip aligned with a broader wave of crypto market volatility triggered by political uncertainty and economic worries sparked by the feud.

Technical Rebound Shows Signs of Strength

Despite the steep decline, ADA’s recovery has been technically encouraging. Analysts noted the formation of an ascending channel, with resistance forming near $0.644. The price reclaiming the $0.640 range, along with decreasing volatility, has been interpreted as a potential signal of renewed bullish momentum. High-volume buying around the $0.620 zone highlighted a strong support area where traders stepped in to halt the slide.

Bullish Catalysts in the Cardano Ecosystem

Outside the macro noise, Cardano’s blockchain is quietly gaining momentum. Institutional players like Franklin Templeton are now running Cardano nodes, and NBX in Norway is building Bitcoin-based DeFi products on the network. Perhaps most notably, the first-ever Bitcoin-to-Cardano transaction using Ordinals has opened the door to an estimated $1.5 trillion in potential cross-chain trading. These developments are helping bolster ADA’s long-term narrative.

Outlook Amid Uncertainty

At press time, ADA trades at $0.66—down slightly, but holding above critical support. The CoinDesk 20 Index fell 1% over the same period, suggesting broader market tension. Still, ADA’s recovery and technical setup point to possible upward movement, provided volatility continues to ease. With institutional interest rising and cross-chain capabilities expanding, ADA could see renewed strength, especially if external political tensions settle down.