- Dogecoin fell 7% amid a growing feud between Elon Musk and President Trump, sparking fear in the crypto market.

- Musk’s support has historically driven DOGE surges, but that influence appears to be fading during this dispute.

- A confirmed bear flag pattern projects DOGE could dip as low as $0.06, with key support levels nearing breakdown.

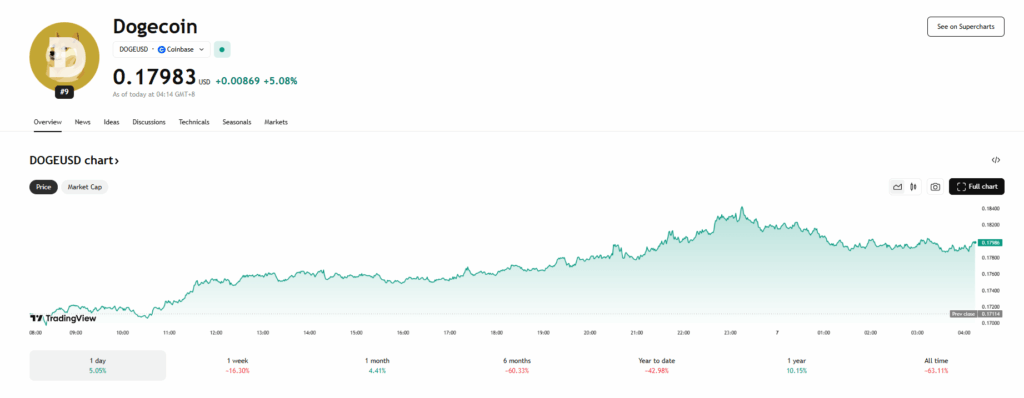

Dogecoin has taken a sharp turn south following an intensifying public feud between two of its biggest influencers — Elon Musk and President Donald Trump. DOGE, which has historically soared off Musk’s tweets and endorsements, plunged 7% in 24 hours to $0.17. The memecoin’s weekly decline now totals 14%, stretching its three-week fall to 28%, as traders absorb the ripple effects of this high-profile breakup.

Political Drama Hits DOGE Hard

The feud escalated after Musk’s exit from the Department of Government Efficiency (DOGE), a Trump-created office. Trump responded by threatening to cancel Musk’s government contracts to save “Billions and Billions of dollars.” Musk didn’t hold back—he slammed Trump’s spending plan as the “Big Ugly Bill” and even supported calls for impeachment. This very public spat is shaking investor confidence, especially given Musk’s long-standing role as a DOGE hype machine.

Historical Musk Effect May Be Losing Its Grip

Musk has historically moved DOGE markets with ease—tweets, Tesla merch payments, and even a simple logo swap once triggered price spikes of 25% to 30%. The November 2024 election also saw Dogecoin rally as Musk and the broader crypto sector backed Trump’s win. But now, with sentiment souring and Musk’s political influence possibly waning, traders are questioning whether DOGE still has the meme magic to hold its value.

Bear Flag Pattern Points to Deep Losses

The charts paint an even grimmer picture. DOGE has now broken down from a bear flag formation and is testing key support at $0.15, right at the 100-week SMA. If that level fails, eyes will turn to the 200-day SMA at $0.14 and April’s low at $0.13. A high-volume move below these could open the gates to a massive plunge down to $0.06—a 66% crash from current levels. The RSI sits at 43, suggesting more downside may be coming before oversold territory is hit.