- Brian Armstrong warns that rising U.S. debt could push Bitcoin into a global backup role.

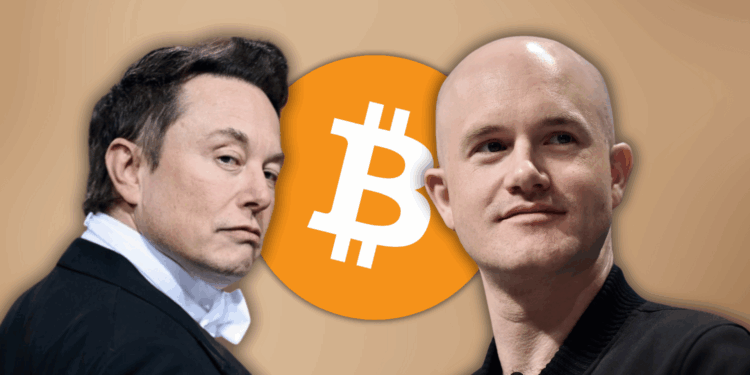

- Public figures like MrBeast and Elon Musk echoed concerns about unsustainable federal spending.

- Economists predict deficits will surge, strengthening the case for decentralized alternatives like crypto.

With the U.S. national debt now over $36.9 trillion, Coinbase CEO Brian Armstrong is sounding the alarm on America’s financial trajectory. His comments reflect rising concern that if government spending continues to outpace earnings, traditional systems may start to lose credibility—pushing Bitcoin into the spotlight as a potential global fallback. Armstrong stressed that Bitcoin isn’t just a speculative asset anymore; it could become a serious alternative if trust in fiat currency keeps fading.

Armstrong’s statement coincides with a projected $2.5 trillion budget deficit for this year—the largest in U.S. history. Rising interest payments are adding pressure to the already strained system. His concerns go beyond crypto fandom; they’re rooted in the growing instability of the dollar itself. As economic credibility erodes, Bitcoin might start looking less like a risk and more like a necessity.

Public Figures Back Bitcoin Amid Fiscal Warnings

Armstrong’s message didn’t land in a vacuum. MrBeast, one of YouTube’s most influential creators, responded by questioning how an economy headed for $100 trillion in debt could still expect investors to stick around. Elon Musk, never shy about voicing strong opinions, dismissed the latest U.S. budget as a disaster, noting that the so-called cuts barely made a dent. The rising chorus of concern suggests this isn’t just a finance nerd problem—it’s starting to resonate with everyday Americans and global observers alike.

Economists now warn that the U.S. could hit a $5 trillion annual deficit within a decade. With higher interest rates baked into the equation, servicing the debt becomes its own massive burden. These numbers aren’t just scary—they’re starting to feel unsustainable, which could fast-track Bitcoin’s evolution from hedge to lifeboat.

Bitcoin’s Role as More Than Just a Speculative Asset

Armstrong’s remarks hint at a future where Bitcoin isn’t just a tech experiment or libertarian fantasy—it’s a real contender for financial security. As global trust in fiat currencies weakens, digital assets may step up as backup currencies, not by design but by necessity. The pivot would mark a turning point in how the world views decentralized finance, especially if more influencers and CEOs continue to question the status quo.

If that happens, the meaning behind Bitcoin’s first-ever transaction—trading digital coins for a pizza—might go from novelty to symbol of resilience. Whether it becomes a hedge, a lifeline, or both, Bitcoin’s next chapter could be written in the fallout of a financial system that’s starting to crack.