The flagship cryptocurrency, Bitcoin, struggled to rise above a critical resistance barrier dropping over 3% over the weekend to reach lows of around $16,000 on Monday. Similarly, the most valuable altcoin Ethereum followed the big crypto’s lead, losing as much as 6% to trade just above $1,150.

The total crypto market capitalization fell 4.4% to $765.2 billion over the same period, sending major cryptocurrencies into the red during the early Asian trading hours on November 28. The total crypto market volume has grown by 3.04% over the last 24 hours to $46.86 billion. And as such, the global cryptocurrency market cap has regained some of the recent losses and now stands at $836.07 billion, up 2.27% daily.

The total trading volume for the DeFi sector currently stands at $3.06 billion, 6.53% of the entire crypto market trading volume in the past 24 hours. The importance of all stablecoins is now $45.05B, 96.14% of the total crypto market 24-hour volume.

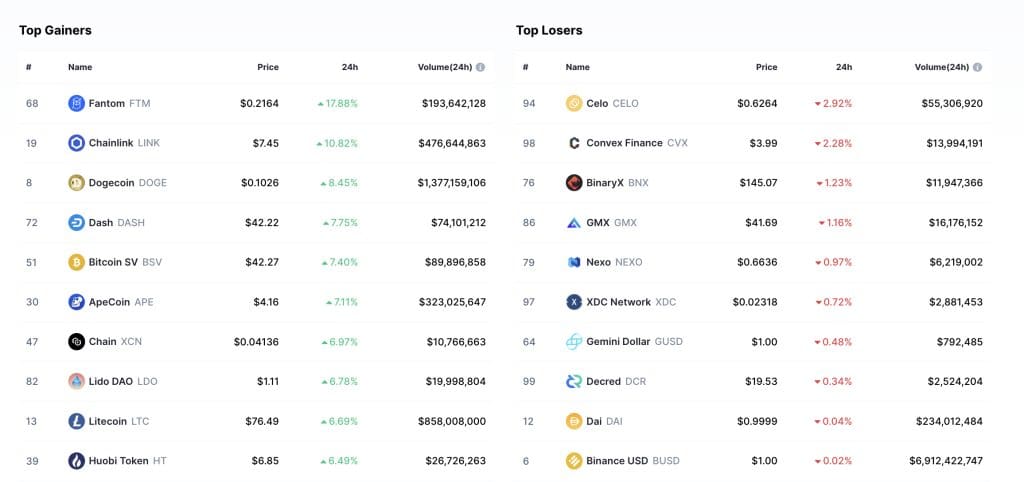

Top 24-hour Altcoin Gainers and Losers

Fantom (FTM), Chainlink (LINK), and Dogecoin (DOGE) are the three top 100 cryptocurrencies that are leading recoveries on Tuesday. The FTM price has spiked 17.88% to $0.2164, the LINK price has soared by more than 10.82% to $7.45, and the DOGE price has increased nearly 8.45% to $0.1026.

Celo (CELO), Convex Finance (CVX), and Binary (BNX) are three of the top 100 assets that have lost value in the last 24 hours, where CELO, which was amongst the top gainers on Monday, has lost over 2.92% to trade at $0.6264. CVX is down 2.23%% to trade at $3.99. At the same time, BNX’s price is down around 1.2% to trade at $145.

China Lockdown Sends Tremors In Global Financial Markets

Global markets dumped over the weekend and going into the start of the week on Monday amid nervousness amongst investors sparked by reports of protests in China against another Covid-19 lockdown. Protesters are reportedly against harsh Covid restrictions and called for China’s strong leader Xi Jinping to quit.

This was a rare occurrence in the world’s most populous nation as officials in at least eight provinces tried to suppress the demonstrations that erupted at the end of last week. The demonstrations are seen as a direct threat to the ruling Communist Party.

The protesters are discontented with the Chinese government’s famous zero-Covid policy that still stands more than three years after the pandemic outbreak. Consequently, there has been a surge in public disobedience in mainland China that has not been seen since President Hu Jintao took office a decade ago.

The largest economy in the world, the U.S., is also feeling the effects of the strict Covid-19 regulations. The demonstrations, which have now extended to other cities, including the capital Beijing and numerous university campuses, are the broadest expression of dissent against the ruling party in years.

Anything that happens in China, the second-largest economy in the world, significantly affects global financial markets as investors move to protect their investments. Stocks and cryptocurrencies are risk-on assets, which is why they displayed a bearish price action as they reacted to the uprising in China.

However, as things subsided on Monday, cryptos turned slightly bullish, with Bitcoin and other currencies flashing green on Tuesday morning.

Bitcoin Price Prediction

Bitcoin (BTC) is trading at the resistance line of a descending triangle pattern at $16,461. For the BTC price to confirm a bullish breakout, it must produce a daily candlestick close above the upper boundary of the prevailing chart pattern. If this happens, it will clear the way for the bellwether cryptocurrency to rise toward the optimistic target of the triangle at $17,826, an 8% ascent from the current levels.

BTC’s positive outlook is supported by the upward movement of the Moving Average Convergence Divergence (MACD) indicator. Note that the buy signal the MACD sent on November 24 when the 12-day exponential moving average (EMA) crossed above the 26-day EMA is still intact. This a suggestion that the price movement still favors the upside.

On the other hand, if the price turns down from the current price, it might drop back into the governing triangle, where it could continue consolidating for some time. However, increasing headwinds may see Bitcoin drop below the triangle’s support line at $15,740, with the bears focused on the bearish target of the technical pattern at $14,450. Such a move would represent a 13% drop from the current price.