- Tron leads USDT activity, processing over $23.4B daily with 2.4M+ transactions, surpassing Ethereum in stablecoin volume.

- Network revenue climbs, hitting $13.1M in a week and reflecting growing dominance in low-fee, fast transactions.

- TRX gains momentum, up 10% in May; a breakout above $0.28 could push it toward multi-month highs.

The stablecoin war is heating up, and guess what? Tron (TRX) is quietly taking the lead. While everyone’s been watching Ethereum and Solana, Tron’s been clocking huge numbers behind the scenes.

Tron Surpasses Ethereum in USDT Activity

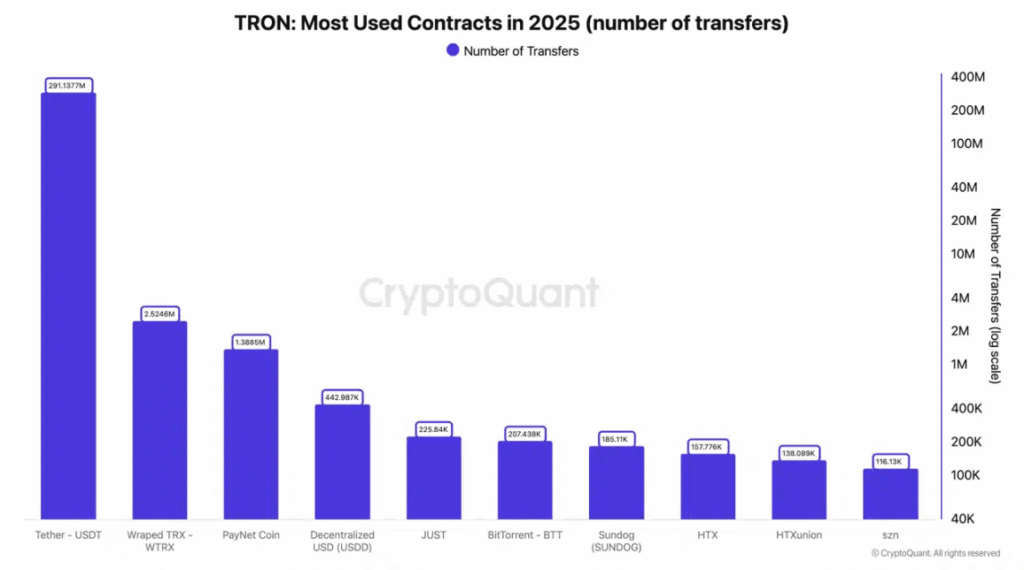

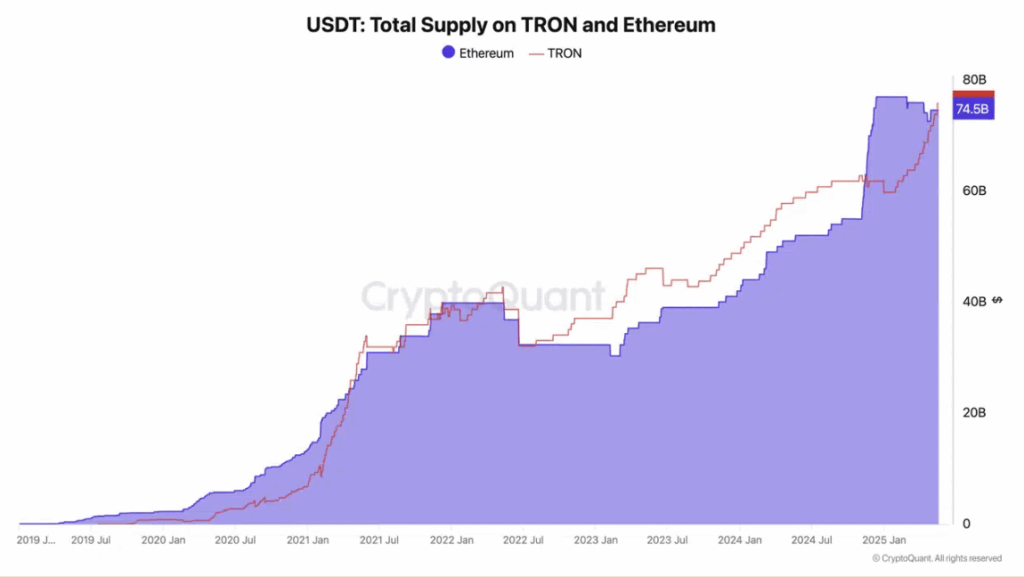

According to CryptoQuant, Tron has become the top dog when it comes to stablecoin payments. With a whopping $23.4 billion in daily USDT transfer volume and over 2.4 million transactions per day, it’s officially leapfrogged Ethereum.

Just this year, Tron’s processed more than 283 million USDT transfers. That’s not small potatoes. It now holds $75.8 billion in USDT — yeah, more than Ethereum — and it’s not slowing down.

The secret sauce? Speed and low fees. It’s proving to be a go-to for stablecoin-based payments, especially in retail and cross-border use cases.

Gaining Ground on All Fronts

Solana still tops the charts in overall network revenue, but Tron’s creeping up. Between May 12–18, Tron pulled in $13.1 million in fees — ahead of Ethereum for that period.

Its steady lead in transaction count and USDT volume is starting to reflect in actual revenue. That’s a pretty big shift.

TRX Price Action Turning Heads

With all this action, TRX has been climbing too. It’s up over 10% in May, trading at $0.272. The RSI is sitting at 66.21 — close to overbought territory — which suggests that momentum’s building.

TRX bounced out of a recent consolidation zone, and buyers seem to be paying attention. If the token breaks above $0.28, it could be on track to revisit multi-month highs.

Bottom line? Tron’s quietly building a solid case for being a serious player in the digital payments space — and TRX might be ready to ride that wave higher.