- Bitcoin sees $32.31M in liquidations within an hour, with longs losing $31.03M.

- Market-wide liquidations hit $483M in 24 hours, led by Bitcoin and Ethereum.

- Bybit records a $7.5M BTC/USD liquidation as forced selling pressures mount.

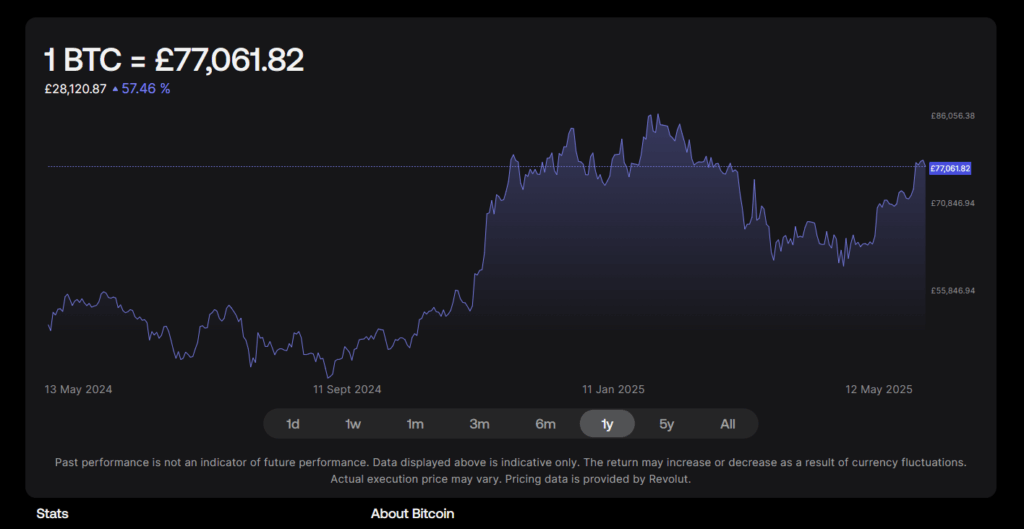

Bitcoin just went through a nasty one-hour liquidation event, wiping out $32.31 million in leveraged positions. But here’s the kicker – $31.03 million of that came from longs, with only $1.29 million from shorts. That’s a 3,100% imbalance, according to CoinGlass.

Market-Wide Wipeout: $483M in Liquidations

It wasn’t just Bitcoin feeling the heat. Across the broader crypto market, $483.01 million in positions got liquidated over 24 hours. Longs made up the majority, losing $255.37 million, while shorts accounted for $227.64 million. Ethereum lost $19.36 million, while XRP, Solana, and Dogecoin added $3.35 million, $2.71 million, and $1.73 million to the tally.

Bybit’s $7.5M Liquidation Takes Center Stage

The biggest single liquidation? A $7.5 million BTC/USD position on Bybit.

Despite the massive long-side wipeout, Bitcoin’s price action stayed relatively calm, briefly pushing above $104,800 before slipping below $103,000. Analysts suggest it was more about forced selling than a full-blown market panic.