- Profit-taking hits SUI after strong April rally: SUI surged 124% last month but has since pulled back ~13% from its $3.87 peak as short-term holders took profits.

- Spot outflows and lower volumes signal cooling momentum: SUI saw $37M in outflows and a drop in trading volume, suggesting fading bullish pressure and possible long liquidations.

- Network fundamentals still strong: Despite the dip, SUI’s total value locked (TVL) and stablecoin liquidity are growing, and open interest just hit a new all-time high—pointing to continued investor interest.

After going on an absolute tear last month, SUI has started May with a bit of a reality check. Some good ol’ profit-taking has kicked in, and now the coin’s price is cooling off. But hey, after a 124% run-up in April, you kinda saw this coming, right?

Just a quick recap—SUI went from rock-bottom levels to a monthly peak of $3.87 on April 28. Since then? It’s shaved off about 13%, now hanging around $3.26. Nothing too dramatic, but definitely worth keeping an eye on.

SUI Outflows Spike, Demand Taps the Brakes

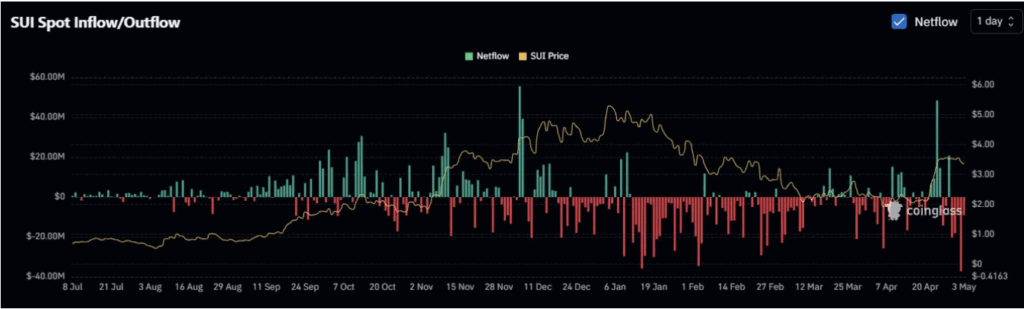

So what’s fueling the cooldown? One major sign: spot outflows. Ever since that late April peak, SUI has seen more cash heading out than coming in. On May 2 alone, outflows hit a massive $37.2 million—the most we’ve seen in over half a year.

And it’s not just spot activity. Derivatives trading is losing steam too. Volumes hit $12.23 billion on April 26 but dropped hard to $4.36 billion in the last 24 hours. That drop in volume usually means fewer bulls and a bit more selling pressure building up.

A chunk of this might be tied to long liquidations. Funding rates had spiked like crazy (biggest jump in over two months), so when the market didn’t deliver that upside… boom—positions got wrecked.

Still, Some Bright Spots in the Shadows

Now, before we get too bearish, let’s pump the brakes. SUI might be pulling back in price, but it’s also hitting new highsin open interest. That means a lot of folks are still very much interested and actively trading it. Not a bad sign for long-term momentum, honestly.

And let’s not forget the Sui network itself—it’s doing just fine. In fact, total value locked (TVL) has been climbing steadily. Back on April 9, it was sitting at $1.16B. As of May 2? It’s at $1.92B and closing in on that all-time high of $2.21B set in January.

Stablecoin liquidity is pumping too, now up to $1.84B. So even if people are selling SUI, the money isn’t leaving the network—it’s just moving around. That’s a big difference.

Final Thought: Pullback or Start of a Slide?

So here’s the deal. SUI’s drop looks more like a typical breather after a strong rally, not a full-on trend reversal. The network’s still got strong liquidity, TVL’s growing, and investor interest is actually rising under the hood.

If the market overall stays somewhat bullish, SUI might not fall too far. Watch that $2.80 support zone—it could be where the dip finds its floor. And if buyers step back in? Well, we could see another leg up.