- Bitcoin bulls are fighting to push past $95K, with $100K in sight but strong resistance ahead.

- Altcoins like Ether, Solana, and Cardano show bullish signs, but key resistance levels still loom.

- Analysts warn of a possible Bitcoin pullback to $87K if momentum fades and sentiment weakens.

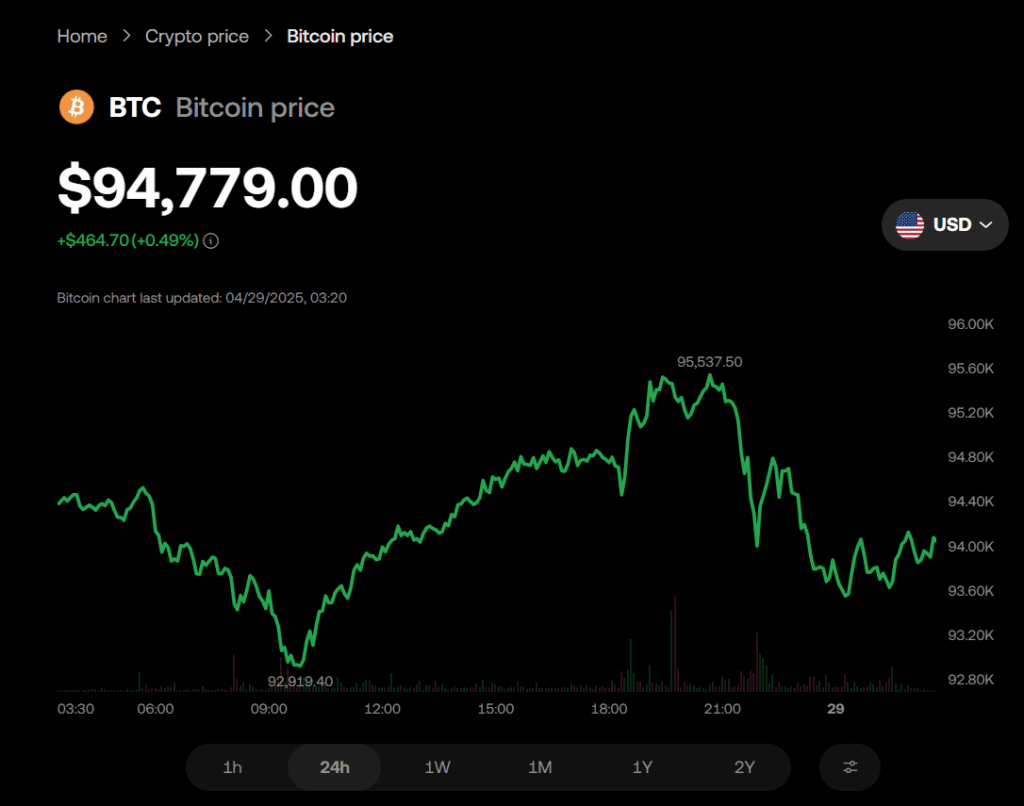

Bitcoin (BTC) is still hovering just under $95,000, with bulls doing everything they can to keep the momentum alive. But let’s be real — bears aren’t backing down either. Traders are wondering: will BTC break through that massive psychological wall at $100K, or are we staring down the barrel of a pullback?

One good sign? Spot Bitcoin ETF inflows in the U.S. have been climbing steadily since April 21, according to Farside Investors. John D’Agostino, Coinbase Institutional’s head of strategy, told CNBC that big institutions jumped into Bitcoin this month, using it as a hedge against inflation and macro risks — basically treating it like digital gold.

But… Sentiment’s Getting Shaky

Not everybody’s convinced this rally can keep running. The Crypto Fear & Greed Index dropped from 72 to 60 between April 23 and 25, even though Bitcoin stayed close to $95K. Some analysts are waving red flags and even tossing out $87K as a possible pullback target.

The big question now: if Bitcoin can stay strong, could it fire up a broader rally in altcoins too?

Bitcoin Price Outlook

Bitcoin’s hanging around $95K, and that’s a good sign for bulls who are still holding tight, betting on a surge higher. The 20-day EMA at $87,437 is trending up, and RSI’s close to the overbought zone — both hinting that buyers are still in charge.

A strong close above $95K could push BTC toward $100K, where sellers will surely dig in. If bulls can defend $95K after the breakout, we could even see a sprint toward $107K. Bears, on the other hand, need a decisive drop below the moving averages to flip things back in their favor.

Ether (ETH) Price Outlook

Ether’s rally is bumping up against resistance at the 50-day SMA ($1,812), but bulls aren’t letting the price fall below the 20-day EMA ($1,696) either. The EMA is flat, yet the RSI has climbed into positive territory.

If ETH punches through $1,812, the next stop could be $2,111 — and if bulls break through that wall, we’re talking a possible run to $2,550. If sellers drag it below the 20-day EMA, though, a tumble to $1,537 might be on deck.

XRP Price Outlook

XRP’s stuck around the 50-day SMA ($2.18) for a couple days now, with bears putting up a serious fight. Good news? Bulls aren’t letting it slip under the 20-day EMA ($2.13) just yet.

If buyers can break the resistance line, XRP might rally all the way to $3. If not, and the price breaks under $2, the party could be over — with a dive toward $1.60 possible.

BNB Price Outlook

BNB pulled back from $620 but found support at the moving averages — a shift from selling on rallies to buying on dips, which is huge. Buyers now need to clear $620 to trigger a rally to $644 or even $680.

A drop below the moving averages would wreck this bullish setup and could sink BNB back to $566.

Solana (SOL) Price Outlook

Solana is struggling to stay above $153. Bulls still have the upper hand, though, with the 20-day EMA ($136) rising and RSI staying positive.

If buyers can hold $153, SOL could jump to $180. But if the price falls below the 50-day SMA ($129), SOL might just get stuck between $153 and $110 for a bit.

Dogecoin (DOGE) Price Outlook

Dogecoin bounced off the 20-day EMA ($0.16) on April 24, showing buyers are still alive. DOGE could soon test resistance at $0.21 — a break above that would complete a double-bottom pattern with a target at $0.28.

If bulls fumble, though, and the price dips below the moving averages, DOGE might trade sideways between $0.21 and $0.14 for a while.

Cardano (ADA) Price Outlook

Cardano broke above its 50-day SMA ($0.68) on April 23, suggesting the bears are losing their grip. The 20-day EMA ($0.65) is creeping up too.

ADA could rally toward $0.83 if momentum holds. Any pullback should find support at the 20-day EMA — if not, we might see a drop to $0.58.

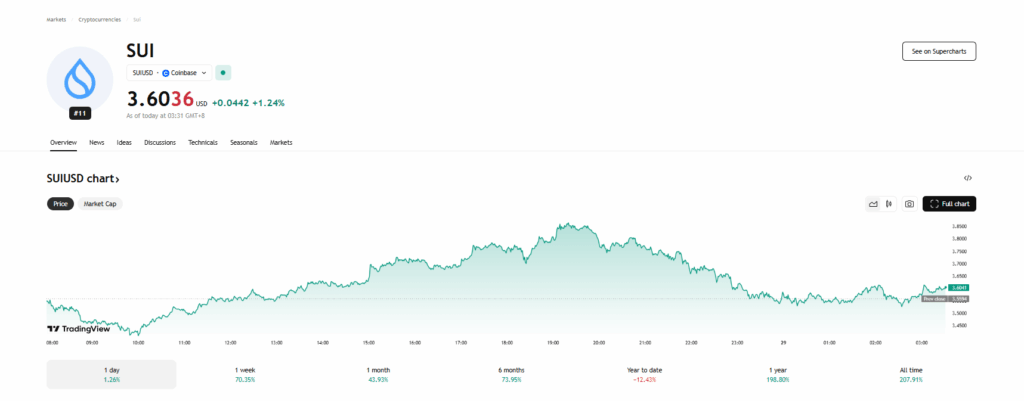

Sui (SUI) Price Outlook

Sui (SUI) shot up after bulls pushed it above the moving averages on April 22. The RSI is now in overbought territory, hinting that a slight pullback could be coming.

If SUI holds steady, though, it could rally toward $4.25 and maybe even $5. A fall below $2.86 would hand control right back to the bears.

Chainlink (LINK) Price Outlook

Chainlink’s recovery has started, but $16 is standing tall as a strong resistance. If it fails there, expect a drop back to the 20-day EMA ($13.53).

A solid bounce from there could give bulls a shot at breaking the descending channel, signaling a trend change. Otherwise, a dip to $11.89 might be in the cards.

Avalanche (AVAX) Price Outlook

Avalanche is struggling to clear the $23.50 ceiling, but bulls aren’t letting the bears take control either.

If AVAX breaks and closes above $23.50, a double-bottom pattern could launch it toward $31.73. If it can’t, though, it might stay trapped between $23.50 and $15.27 for a while.