- Bittensor (TAO) rose 2.34% in the past 24 hours and has gained 48% over the last month, with strong performance continuing to outpace Bitcoin, Ethereum, and other top AI tokens like FET and RENDER.

- Institutional interest and user growth (200,000+ new users) are fueling momentum, while Coinglass data shows $3.11M in net buying and a bullish long-to-short ratio in the derivatives market.

- Based on technicals, TAO could target $697.70 in the coming weeks, though it must first break through key resistance levels at $370.2, $425.2, and $495.3.

Bittensor (TAO) saw a quiet but confident 2.34% push upward in the past 24 hours, a small green candle that’s catching some attention. The move comes on the heels of new research backing the token’s long-term upside — and could be a warm-up for something bigger if the trend holds.

If momentum keeps building, TAO might tack on even more gains to its already solid 48% surge over the past monthand 23% rise in just the last 30 days. Not too shabby, especially in a market still trying to find its legs.

Outpacing the Big Dogs

Fresh data from Funstrat paints a pretty bullish picture for TAO. The token’s been outperforming some heavy hitters, including none other than Bitcoin and Ethereum.

Let’s break it down:

- Since March 2023, Bitcoin is up 195%, while TAO has risen 169%. So sure, BTC is ahead—but only slightly.

- Compared to Ethereum though? TAO is crushing it. ETH only notched a 2% gain in the same time period, while TAO soared.

TAO is also leading the pack when stacked against other AI tokens—beating out names like Render (RENDER), Near Protocol (NEAR), and FET (now under the Artificial Superintelligence Alliance umbrella). Combined, those other projects clocked in a 140% gain, while TAO remains ahead of the curve.

Institutions & Accumulation: The Quiet Frenzy

Part of what’s driving this? Adoption.

There’s been notable institutional interest, including uptake from Grayscale investors. At the same time, the total number of users interacting with TAO has climbed by 200,000 since last year — a surge that seems to be pushing the price up steadily.

And the market? It’s reacting.

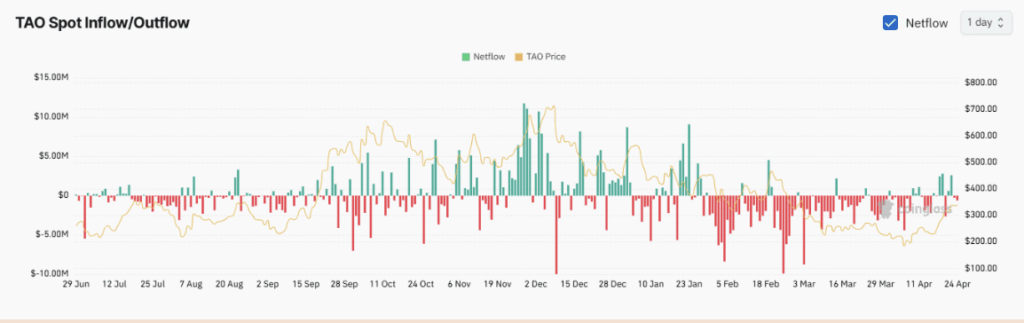

Coinglass data shows traders scooped up about $3.11 million worth of TAO in the past 24 hours alone — net buying pressure, plain and simple.

In the derivatives space, the long-to-short ratio is sitting at 1.0105, meaning there’s more bullish action than bearish bets. Not a blowout number, but it leans green — and that matters.

TAO Price Outlook: Eyes on $697?

So how far can TAO run?

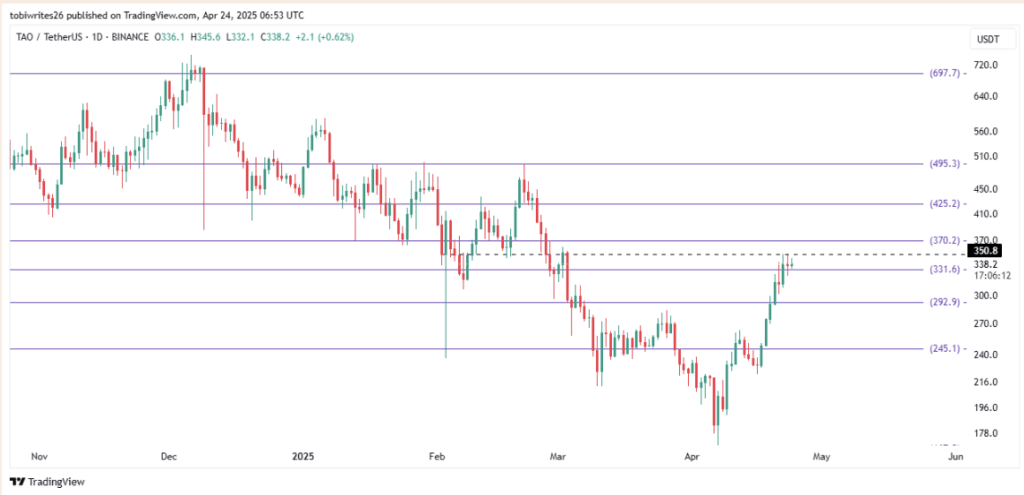

Using Fibonacci retracement levels, the next major ceiling could be up near $697.70. But it’s not a straight line from here to there.

First, TAO needs to clear three key resistance zones:

- $370.20

- $425.20

- $495.30

Any of these could slow things down — think short-term consolidation or a dip before a breakout. But if buyers keep showing up? Those barriers may just be speed bumps.

Final Thought: Still Early?

Bottom line? TAO’s momentum is very much intact, and the combination of institutional accumulation, strong on-chain activity, and decent technical structure suggests there’s room to run.

Sure, resistance levels might stall things short term — but if this pace keeps up, TAO could be setting up for another breakout, possibly even a fresh 2025 high.

Watch those volume spikes. The crowd’s getting louder.