- Filecoin (FIL) is struggling, down 14% over the past month and 33% over six months, with bears still in control and key support levels being tested.

- Chainlink (LINK) shows more resilience, up nearly 12% in the past six months despite recent dips, with traders eyeing the $8.57 support and $20.13 resistance.

- FIL offers storage-focused utility, while LINK powers smart contracts, making both interesting — but risk tolerance and timing matter before jumping in.

Both Filecoin (FIL) and Chainlink (LINK) are sitting at pretty critical points right now. Market sentiment’s been shaky, momentum keeps shifting — and honestly, it’s got traders asking the big question: Is this the right moment to jump in? Let’s break it down and see which of these two might actually be worth keeping an eye on.

Filecoin Struggles But Holds Potential — Kind Of

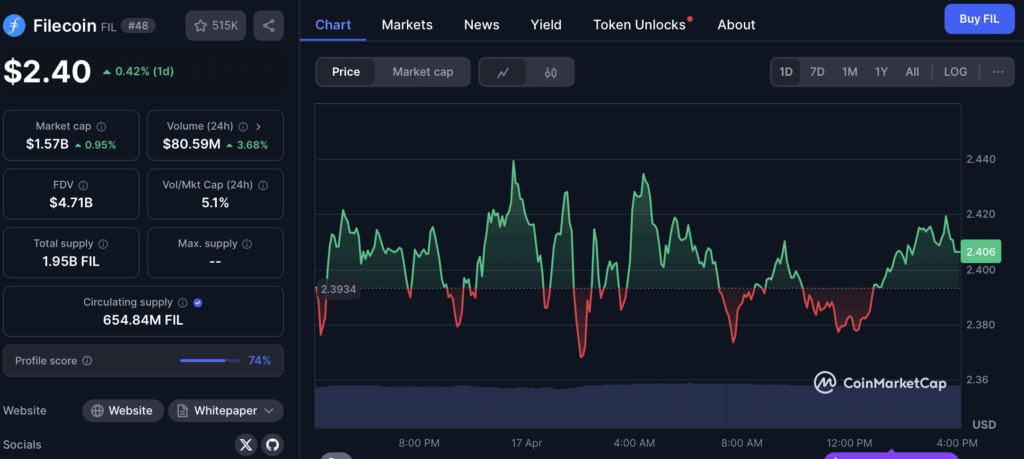

Let’s be real — Filecoin hasn’t exactly been on fire lately. It’s down 14% in the past month, and if you zoom out further? You’ll see a 33% drop over the last six months. Ouch. Sure, there was a little 8% bounce last week, but when the overall trend is down… it’s hard to celebrate too much.

Right now, FIL is bouncing around between $2.29 and $3.44. Resistance is up at $4.10, and there’s an even bigger wall at $5.25. On the flip side, support sits down at $1.79, with a much deeper floor near $0.64 if things really go south.

The vibe? Bears still seem to have control. Indicators aren’t doing FIL any favors, and unless we see a clean breakout above resistance, this one might stay choppy. If you’re playing it, you’re probably watching those support zones closely and hoping to catch a bounce — or maybe just staying patient for now.

Chainlink: Not Perfect, But More Resilient

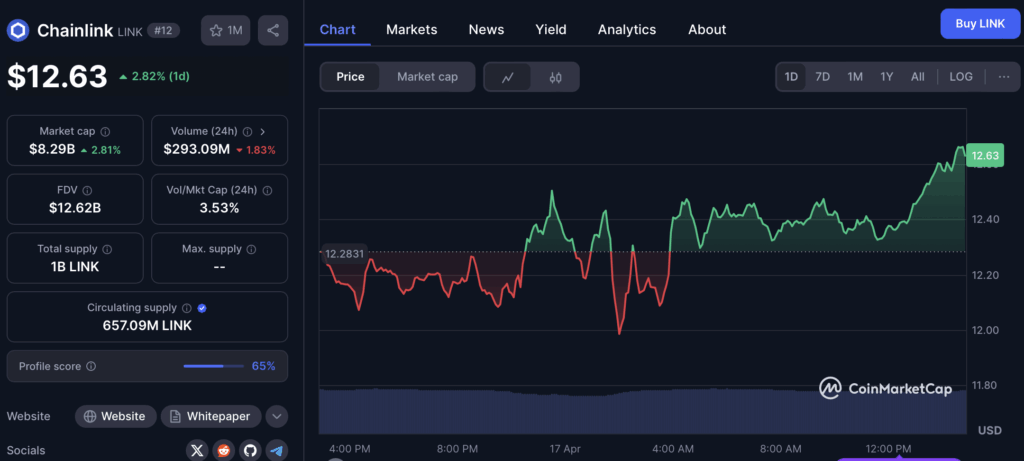

Now, Chainlink’s story is a little more balanced. It’s down about 7.6% over the past month, but if you pull back to the six-month view, it’s actually up nearly 12% — so there’s that.

LINK’s been trading between $11.04 and $16.82, showing more volatility than some might like — but that also means opportunity. Support is sitting around $8.57, and resistance is looming near $20.13. It’s a big range.

Last week’s 13% gain definitely brought a little bullish energy back into the room. That said, the RSI is still around 44, and moving averages aren’t leaning too positive just yet — so, yeah, the momentum is still kind of… meh.

It’s one of those setups where traders are probably thinking: “Buy close to support, sell near resistance, and don’t get caught in the middle.” Not the worst strategy in this kind of environment.

So… Is It Time to Buy?

Hard to say. FIL is interesting thanks to its decentralized storage mission — it’s real infrastructure for Web3. But the price hasn’t been kind, and the bears still look comfy. LINK, on the other hand, is holding its ground a bit better and continues to be a big player in oracle services for smart contracts. It’s got more momentum, even if it’s not exactly flying.

For investors, it’s less about picking a winner and more about knowing your own risk appetite. Want to take a shot at a bounce? FIL might be appealing. Prefer something with a stronger long-term use case and more stable price action? LINK could be your move.

Just remember — none of this is financial advice. DYOR, stay level-headed, and maybe don’t FOMO into anything without a plan. Crypto’s weird like that.