- Strategy (formerly MicroStrategy) bought 3,450 more BTC last week, bringing its total to over 531,600 coins.

- Metaplanet, dubbed “Asia’s MicroStrategy,” picked up 319 BTC and now holds 4,525 coins.

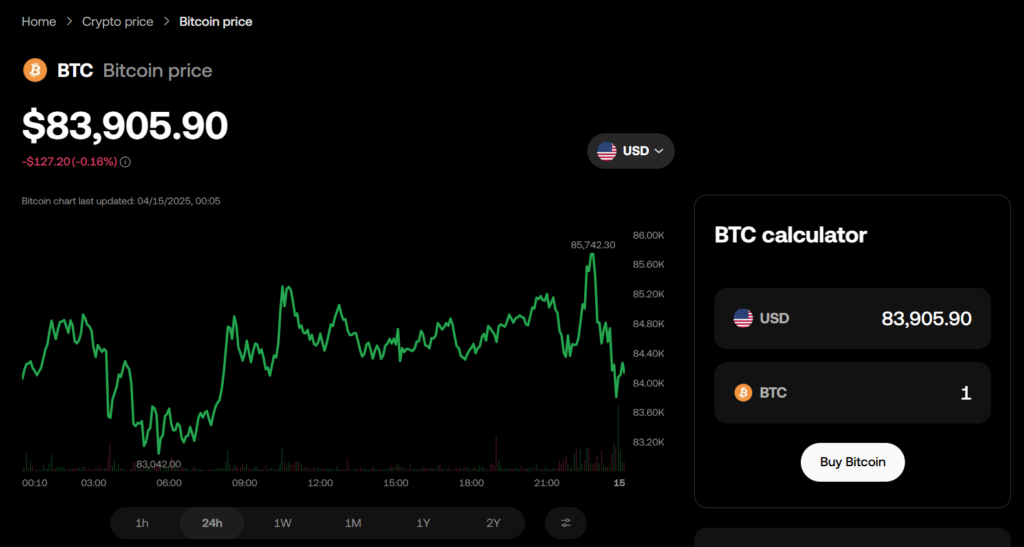

- Despite tariff chaos, Bitcoin climbed 8% this week, with Strategy shares rebounding 4%.

Strategy—the firm that used to go by MicroStrategy—just grabbed another 3,450 Bitcoin last week, spending roughly $286 million, per a fresh SEC filing. That brings their stash to a wild 531,644 BTC, worth about $45.2 billion based on current prices. They paid around $82,600 per coin during the latest haul.

Notably, this is the third straight Monday the company has announced a buy. So it’s looking less like a flex and more like a habit. Strategy’s pivot from a traditional software biz to a full-blown Bitcoin treasury play is continuing full steam. On top of the buy, they also sold 1 million Class A shares, with another $2 billion in equity still ready to go under their ATM (at-the-market) offering program.

Shares of Strategy jumped 4% on Monday to $312, riding the wave of a broader tech recovery. That came as the White House confirmed tariffs wouldn’t hit phones and laptops—good news for the Nasdaq, which rose 1.5%.

Metaplanet Adds More BTC Amid Tariff Woes

Meanwhile, over in Tokyo, Metaplanet—nicknamed “Asia’s MicroStrategy”—also stacked some sats. They dropped 3.78 billion yen (about $26.3 million) on 319 BTC, paying roughly $82,549 per coin. That pushes their holdings to 4,525 BTC, worth around $385 million.

The Japanese firm has big goals. It wants to boost holdings by 470% this year, aiming for 10,000 BTC by December.

Bitcoin Rallies Despite Uncertainty

Bitcoin itself? It’s been bouncing back. Prices were hovering near $85K on Monday—up 8.3% from last week, though still flat for the month. Strategy’s shares had dipped to $236 during last week’s tariff-induced panic but rebounded as fears cooled.

Michael Saylor, still leading the charge, chimed in on X: “No Tariffs on Orange Dots,” poking fun at his trademark orange-circle Bitcoin tracking.

Strategy now owns more than 2.5% of all Bitcoin in circulation. Their closest corporate competitor, Marathon Digital, holds around 47,500 BTC—not even close.

Metaplanet, for its part, ranks #10 among public companies when it comes to BTC holdings, according to Bitcoin Treasuries.