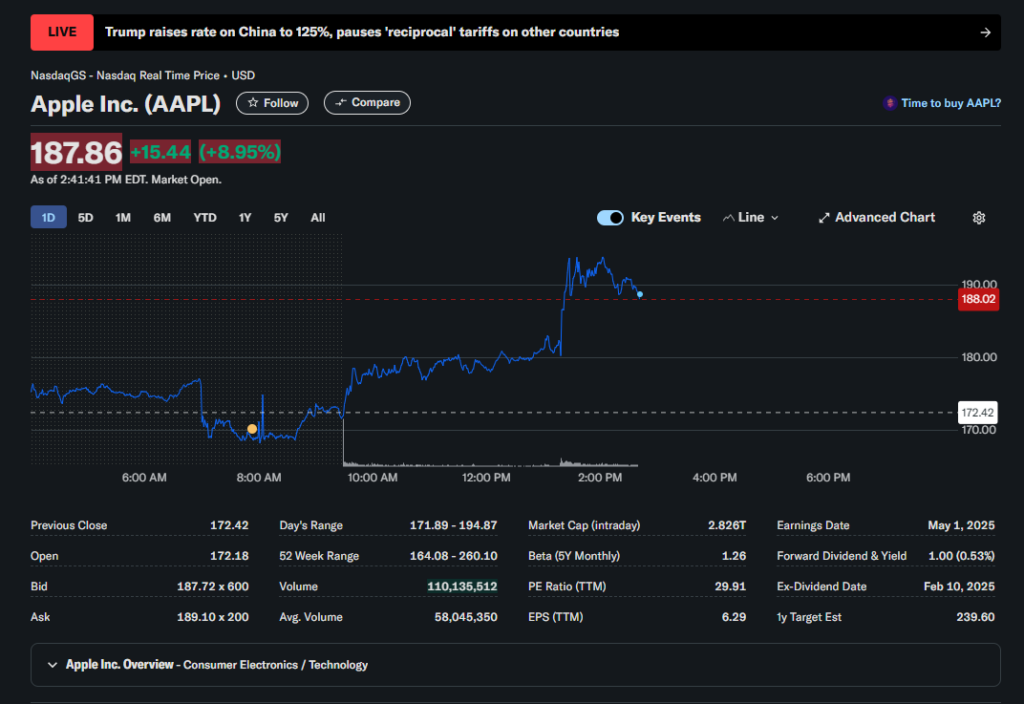

- Stocks soared after Trump announced a 90-day pause on most tariffs, with the S&P 500 jumping 8.5%.

- China was hit harder, as Trump raised tariffs on its goods to 125% despite easing pressure on other nations.

- Investors rallied on hopes of negotiations, but analysts warned the trade war is far from over.

Wall Street finally caught its breath Wednesday after President Trump hit the brakes—at least a little—on his sweeping reciprocal tariff plan. And the markets? They absolutely took off.

The S&P 500 shot up a wild 8.5%, marking what could end up its biggest one-day pop in five years. Over on the Dow, it surged 2,711 points (that’s 7.2%, by the way), while the Nasdaq absolutely ripped higher by nearly 11%.

So, what happened? Trump posted on Truth Social—yeah, that’s still the main news source now—saying, “I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

But not so fast—China still got the hammer. Trump added the tariff on Chinese goods was getting hiked again, this time all the way up to 125%. Yikes.

Relief Rally or Just a Breather?

Treasury Secretary Scott Bessent cleared things up later, confirming that all countries except China would be dialed back to that 10% rate while negotiations were ongoing. However, this pause doesn’t touch sector-specific tariffs—that stuff’s still rolling forward.

Stocks that’ve been absolutely battered by trade war fears were suddenly the darlings of the day. Apple surged over 11%. Nvidia? Up 13%. Walmart rallied 9.7%, and Tesla blasted up 19%—likely thanks to both the tariff news and its usual drama.

“This move feels like a pressure valve release,” said analyst Adam Crisafulli, adding, “but let’s not pretend this is over. China’s tariff rate is now in the triple digits, and who knows what kind of curveball hits in 90 days.”

Not So Fast, Say the Skeptics

Sam Stovall from CFRA Research sounded a bit more cautious. “It’s a relief rally, sure,” he said. “But let’s be honest—this could all flip again. Fool me once, shame on you. Fool me five times… well, shame on me.”

Markets were already bouncing even before Trump’s post. Traders were clinging to any glimmer of hope after four brutal days. Bessent, for what it’s worth, said he’s taking the lead on the tariff talks—maybe a good sign?

Trump, meanwhile, did what he does best: tried to rally the troops. “Now is a GREAT time to buy!” he posted not long after the open.

The Damage So Far

Still, this relief comes after a bruising selloff. In just four days, the Dow lost 4,500 points. The S&P 500 dropped 12%. Nasdaq? Down 13%—levels not seen since the pandemic-era chaos.

And with China, the EU, and who knows who else ready to fire back with their own tariffs, things are still, well… shaky.

Stay tuned. It’s not over—not even close.