- Bitcoin hovers around $84,490, with traders eyeing a potential rally to $90K depending on the Fed’s stance.

- The Fed is expected to keep rates steady, but hints at future rate cuts could fuel a crypto surge.

- XRP jumped 13% after the SEC dropped its lawsuit, adding momentum to the already volatile market.

The Federal Open Market Committee (FOMC) meeting is set for 6 PM UTC today, and the crypto market is on edge. Major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and XRP, are expected to react strongly to the Fed’s decision on interest rates and monetary policy.

Bitcoin Eyes $90K as Traders Await Fed Decision

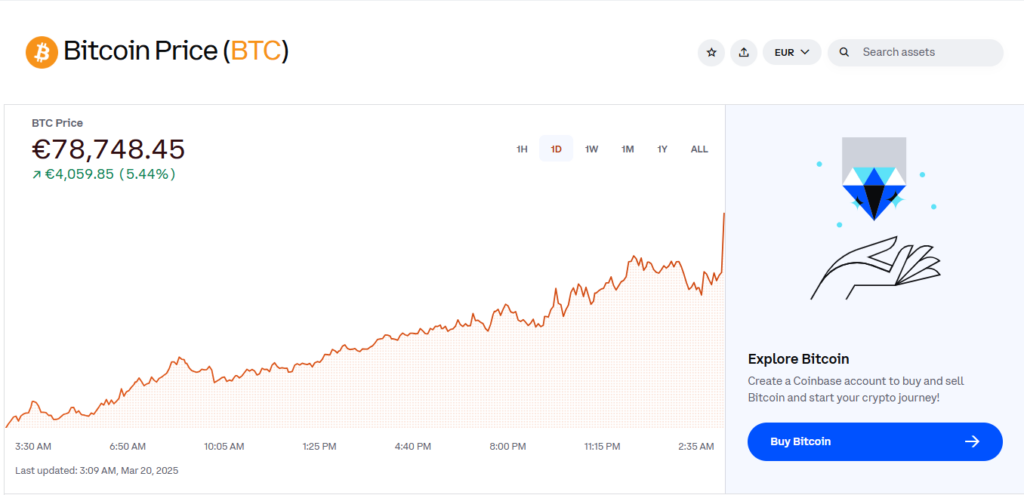

Currently, Bitcoin is hovering around $84,490, with traders bracing for a potential surge toward $90,000—but everything depends on the Fed’s stance. If the Fed leans dovish, signaling future rate cuts or an end to quantitative tightening (QT), markets could turn bullish fast. On the other hand, a strict policy stance could keep BTC stuck or even trigger a decline.

Markus Thielen, CEO of 10x Research, believes a short-term rally is likely, stating: “We can see some counter-trend rally as prices are oversold, and there is a good chance the Fed is mildly dovish.”

Fed’s Stance: What to Expect?

Fed Chair Jerome Powell has already suggested that the Fed will “remain on hold” due to ongoing economic uncertainty. The market is almost certain—99% probability according to the CME Group’s FedWatch tool—that the Fed will keep rates steady. However, investors are watching closely for any hints about future rate cuts or a slowdown in QT.

- If the Fed hints at rate cuts, expect crypto prices to rally.

- If the Fed remains firm on tight policy, Bitcoin and other major cryptos could stay stagnant or drop.

Crypto Market Reaction So Far

The market has already seen some volatility in anticipation of the Fed’s decision:

- Bitcoin dropped to $81K but has bounced back to $84K.

- Ethereum (ETH) is holding above $2,000, gaining 8% in the past 24 hours.

- XRP surged 13% after the SEC dropped its lawsuit against Ripple after four years.

Market Sentiment: Fear vs. Greed

Despite the recent crypto market gains, traders are still uncertain. The Crypto Fear and Greed Index sits at 23, signaling a cautious outlook. Many are waiting to see how the Fed’s announcement plays out before making major moves.

What’s Next?

All eyes are on the Fed’s decision and Powell’s press conference. Whether the Fed signals a pivot or sticks to its strict policy, expect high volatility in the crypto market over the next 24 hours.