- Ethereum faces key resistance at $1,885, with a potential breakout target of $2,596.

- Whales are accumulating ETH, even as retail investors reduce their holdings.

- Institutional sentiment remains cautious, with Ethereum ETFs seeing significant outflows.

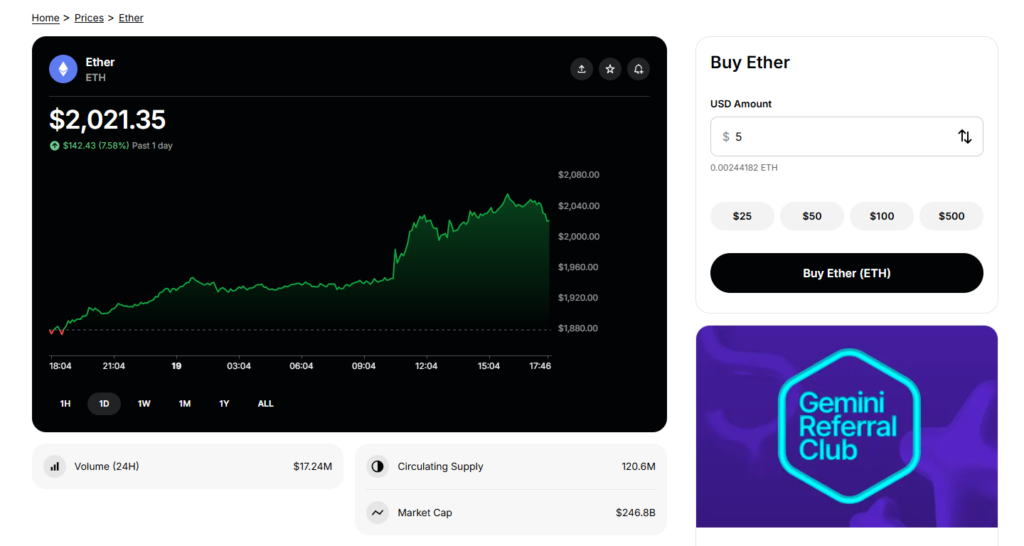

Ethereum (ETH) is currently trading at $1,895, reflecting a 44% decline since the start of the year and a 27.8% drop over the past month. The second-largest cryptocurrency by market cap has faced continuous selling pressure, slipping below the crucial $2,000 mark on March 10.

The decline pushed ETH to a low of $1,750 on March 11, its lowest price since November 2023. However, a slight rebound has brought the token back to $1,900, sparking speculation about a possible trend reversal.

Technical Indicators Point to a Potential Breakout

A TradingView analyst has identified a bullish setup on Ethereum’s 4-hour chart, suggesting that the cryptocurrency is currently testing a downward-sloping resistance trendline. This trendline has repeatedly acted as a barrier during previous downtrends.

According to the analysis:

- A confirmed breakout above $1,885 could serve as an entry point for traders.

- If ETH breaks this level, the next major target is $2,596.

- A stop-loss at $1,700 is recommended to manage risk in this volatile market.

Ethereum recently reached an intra-day high of $1,950 before pulling back, indicating that the resistance level is still in play. Traders are closely watching the next 48 hours for increased volume, which could confirm a strong breakout.

Whale Accumulation and On-Chain Insights

Despite ETH’s price struggles, on-chain data from Nansen shows that whales have been accumulating Ethereum. Addresses holding 10,000 to 100,000 ETH have increased their holdings by over 12% in early 2025. Meanwhile, mid-sized holders (1,000 – 10,000 ETH) have grown their positions by 3% year-to-date.

This accumulation is occurring even as retail investors reduce their ETH balances, signaling that larger players remain confident in Ethereum’s long-term potential.

However, network activity has slowed, with median gas prices dropping nearly 50 times since early 2024. Some transactions are shifting to Solana and layer-2 networks, adding pressure on Ethereum to maintain its dominance.

Bearish Risks and Institutional Concerns

Not all analysts are convinced Ethereum is ready to rally. Some technical traders warn of a potential drop to $1,060 if ETH fails to reclaim $2,500.

Analyst Mags notes that Ethereum has been rejected at the $4,000 resistance level three times in this cycle, each time leading to further declines. The ETH/BTC pair has also weakened, experiencing multiple breakdowns of 13%, 21%, 25%, and 19.5%.

Meanwhile, institutional sentiment remains cautious. Since the beginning of the year, Ethereum-based exchange-traded funds (ETFs) have seen steady outflows. In March 2021, the net assets of spot Ether ETFs shrank by 9.8%, equating to $2.54 billion in withdrawals. In contrast, Bitcoin ETFs experienced only a 2.35% decline, suggesting that Ethereum is losing institutional favor compared to Bitcoin.

What’s Next for Ethereum?

Ethereum’s current market structure presents both opportunities and risks. A breakout above the resistance trendline could push ETH back above $2,000, with potential upside toward $2,596. However, failure to hold above key levels could see Ethereum testing lower supports, with some analysts warning of a potential dip to $1,060.

As Ethereum faces competition from faster blockchains and institutional hesitation, the next few weeks will be crucial in determining whether ETH can reclaim its bullish momentum or face further downside risk.