- CryptoQuant’s Ki Young Ju warns Bitcoin could face 6-12 months of bearish or sideways movement.

- BTC’s $75K-$78K support is critical as weak demand and ETF selling increase correction risks.

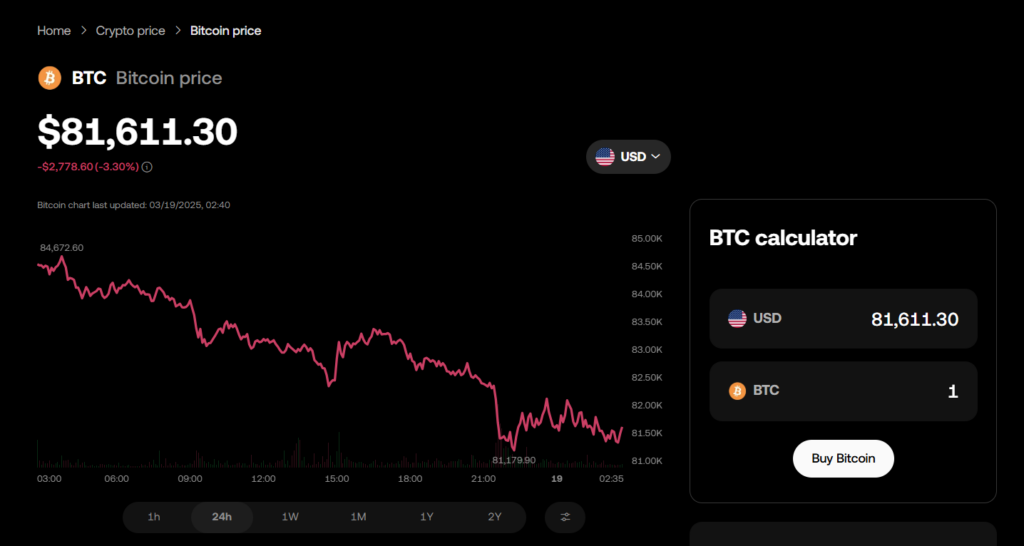

- Bitcoin has dropped 15% in a month, with traders split on whether it rebounds or dips further.

The Bitcoin (BTC) bull market might be running on fumes—at least, that’s the take from CryptoQuant founder Ki Young Ju. He believes BTC is entering a 6-12 month phase of bearish or sideways action, citing a critical lack of fresh liquidity in the market.

Bitcoin’s Momentum Stalls: Bearish Signals Piling Up

Ju took to X to share his outlook, noting that Bitcoin’s on-chain realized cap has stalled, which suggests that no new capital is flowing in. “New liquidity is needed. BlackRock’s IBIT has seen three straight weeks of outflows,” he told CoinDesk via Telegram. “Even with record volume near $100K, Bitcoin’s price barely moved. Without new liquidity to counteract heavy selling, this is a bearish signal.”

CryptoQuant’s latest report backs up Ju’s concerns. Analysts point to Bitcoin’s MVRV Ratio Z-score—a key valuation metric that compares BTC’s market value (MV) to its realized value (RV). Historically, when this score drops below its 365-day moving average, BTC has struggled, often leading to deeper corrections or outright bear markets.

Can BTC Hold $75K–$78K?

CryptoQuant’s analysts highlight the $75K-$78K range as a crucial support level. If BTC demand continues to weaken—evidenced by slowing whale accumulation and net selling by U.S. spot ETFs—the risk of a deeper correction grows.

Similar warnings have been echoed by LMAX Group’s Joel Kruger and Coinbase Institutional’s David Duong. Both have pointed out that continued weakness in U.S. equities, economic uncertainty, and global tensions could create more downward pressure on crypto markets. Stagflation? Not off the table, they say.

Crypto Markets at a Crossroads

With BTC down 15% over the past month, investors are feeling the squeeze. According to CoinDesk Indices data, Bitcoin’s recent slump has erased any post-election gains. Meanwhile, traders on Polymarket are giving a 51% chance that BTC ends the week between $81K and $87K, while 31% are betting it drops to $75K by month’s end.

The big question: Is Bitcoin on the verge of a deeper downturn, or is this just another pause before the next leg up? Either way, the market is bracing for impact.