Dogecoin (DOGE) marked a new local high on Thursday, brushing shoulders with $0.0855 for the first time in 10 weeks. DOGE has emerged as the best performer on daily, weekly, and monthly timeframes following Elon Musk’s acquisition of Twitter.

It has happened for real this time. Elon Musk has closed his $44 billion Twitter acquisition deal following months of legal drama. The Tesla CEO sealed the deal on Thursday night, privatizing the tech company and firing several top executives, including CEO Parag Agrawal, in the process.

This was after the American billionaire updated his Twitter bio to read “Chief Twit,” strolled into Twitter headquarters, and tweeted, “the bird is freed.”

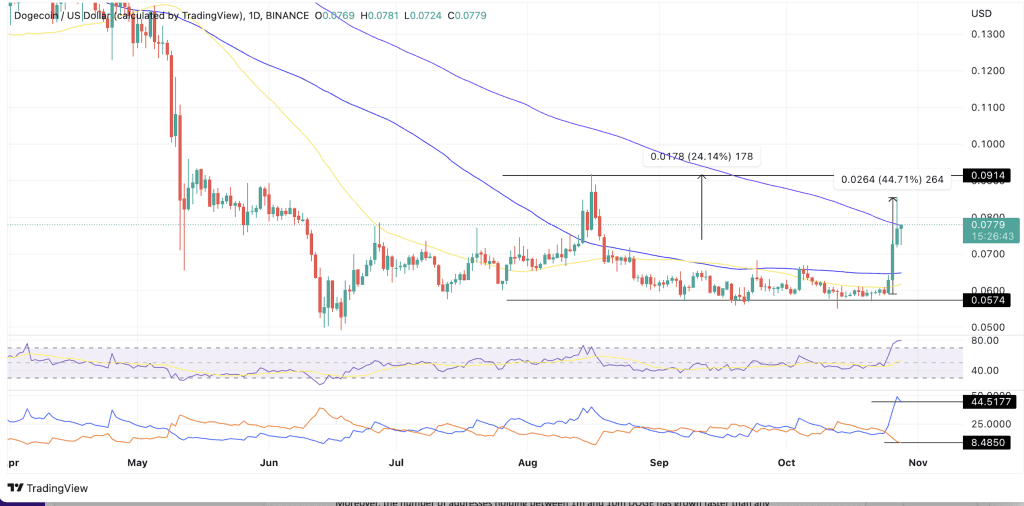

Following these events, DOGE spiked beyond expectations, recording 44.7% gains over the past three days, according to data from TradingView and CoinMarketCap.

To put this into context, the meme coin saw its market cap increase to $10.48 billion over the same period, growing from $7.89 billion between October 24 and 27, a 24.71% increase. This means that $2.59 billion was poured into DOGE over 72 hours.

Can Dogecoin Bulls Sustain The Recovery To $0.09?

Decreasing Thursday’s weekly gains of 32%, Dogecoin’s price is down 2.81% daily and is currently hovering around $0.0779 on Binance. Despite this, this meme token is still the best gainer in 7 days.

The recent rally saw the DOGE price shatter some key resistance levels, including the 50-day simple moving average (SMA), which sat at $0.061, the 100-day SMA at $0.064, and the $0.070 psychological level.

These provide the support the bulls need to push the price above the 200-day SMA, currently at $0.0779. If they succeed, the 10th largest crypto by market value may rise first toward the $0.080 psychological level and later toward the $0.091 range high in the short term. Such a move would represent a 24.14% climb from the current levels.

The up-facing 50-day SMA and the relative strength index (RSI) movement supported DOGE’s optimistic outlook. The position of the RSI at 80 suggested that Dogecoin’s price was in the firm grip of the bulls, who were determined to take it higher.

Also adding credence to the altcoin’s bullish outlook was the Directional Movement Index (DMI), which showed that DOGE had entered an uptrend. The positive directional movement line (+DI) at 44 was well above the negative directional movement line (-DI) at 8, suggesting that more buyers and sellers were in the market.

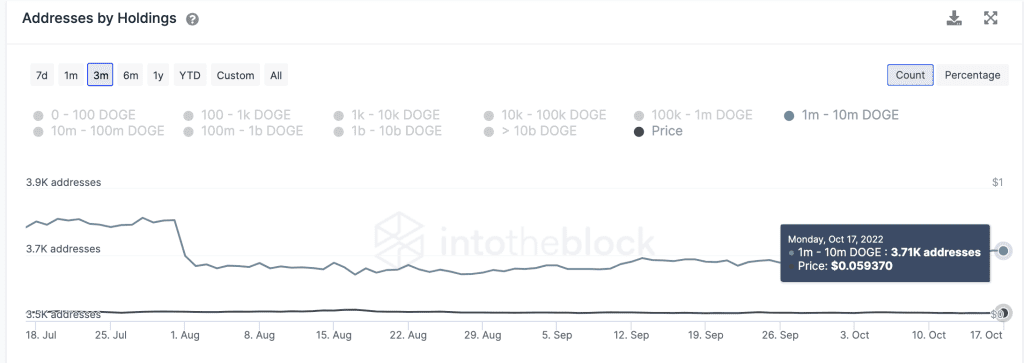

Moreover, the number of addresses holding between 1m and 10m DOGE has grown faster than any other in the past month. This group’s maintenance has been increasing over the last month, reaching a peak of 3,710 addresses on Thursday, October 27. This also points to increased adoption, which leads to increased demand for the pioneer cryptocurrency.

Dogecoin is also recording a surge in the total number of unique addresses holding the coin on the network, adding about 100,000 in 90 days, while whale activity spiked in early October following Musk’s U-turn on the Twitter acquisition.

On the downside, the RSI was placed at 80 in the overbought territory. This means that the current buying pressure may soon run out of steam, pointing to a possible trend reversal shortly. If this happens, DOGE may turn down from the current price and drop toward $0.070.

Further losses could see the price drop to seek solace from the 100-day SMA at $0.064. Market participants could expect Dogecoin’s price to take a breather before staging a comeback.