- The U.S. has launched a Strategic Bitcoin Reserve, fueling speculation about China’s response.

- China’s Bitcoin holdings remain unclear, but past seizures suggest it could rival U.S. reserves.

- Some believe this move could trigger a global race among nations to accumulate Bitcoin.

As the United States pushes ahead with its Strategic Bitcoin Reserve, speculation is heating up over whether China will follow suit with its own national crypto strategy.

U.S. Moves First—Will China Respond?

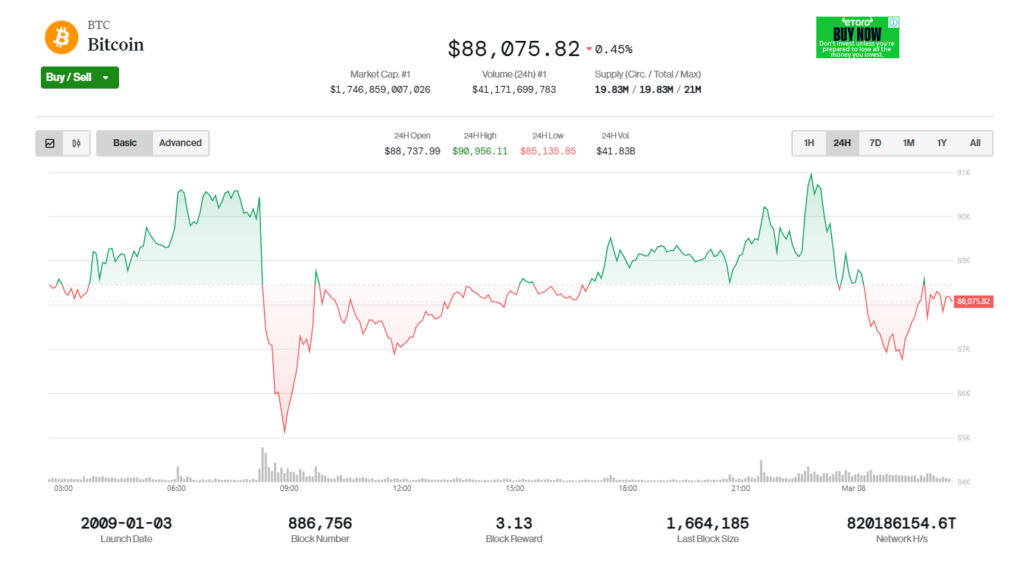

On March 7, President Donald Trump signed an executive order establishing a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile.” The reserves will be initially backed by Bitcoin (BTC) and other digital assets seized from government criminal cases.

With the U.S. shifting its stance on BTC, some believe China won’t want to fall behind. Bitcoin advocate David Bailey, credited with “orange-pilling” Trump, claimed that China has been quietly holding closed-door meetings on Bitcoin since the 2024 U.S. elections—though nothing official has been confirmed.

How Much Bitcoin Does China Actually Have?

If China decides to establish a Bitcoin reserve, it could rival the U.S. in holdings. Currently, the U.S. government holds 198,109 BTC, valued at over $17 billion.

Meanwhile, White House AI and crypto czar David Sacks has stated that the U.S. has no plans to sell its Bitcoin holdings, instead treating them as a long-term store of value. The government is also exploring “budget-neutral strategies” to acquire more BTC without adding to national debt.

China, on the other hand, has never officially disclosed its Bitcoin holdings or whether it plans to buy or sell.

In 2020, Chinese authorities seized nearly 195,000 BTC from the PlusToken Ponzi scheme. A ruling from the Yancheng Intermediate People’s Court indicated that profits from these confiscated assets were transferred to the national treasury, but whether China has sold them remains a mystery.

CryptoQuant CEO Ki Young Ju speculated in January that China may have already offloaded its Bitcoin holdings, arguing that the country would be unlikely to hold “censorship-resistant money.” However, he acknowledged this was only personal speculation, with no official confirmation.

A Nation-State Bitcoin Race Begins?

On March 7, Jan3 CEO Samson Mow noted that some Bitcoin supporters have downplayed the U.S. Strategic Bitcoin Reserve, arguing that it didn’t involve an immediate BTC purchase. But Mow believes this move is more significant than people realize, as it could ignite a nation-state Bitcoin arms race.

According to Mow, there are “budget-neutral” ways for the U.S. to accumulate BTC, including issuing bonds or selling gold. However, he also pointed out that the U.S. might not hold as much Bitcoin as it claims—suggesting that 112,000 BTC or less could remain after repaying assets to Bitfinex. If true, this would put China ahead, potentially holding 194,000 BTC.

Hong Kong as a Testbed for China?

While Beijing’s stance on a Bitcoin reserve remains uncertain, Hong Kong lawmakers are actively exploring Bitcoin’s role within China’s “one country, two systems” framework.

On Dec. 30, Wu Jiexhuang, a member of Hong Kong’s Legislative Council, stated that Hong Kong should study the impact of U.S. spot Bitcoin ETFs on global markets. He suggested that Trump’s decision to make Bitcoin a strategic reserve asset could have far-reaching consequences for traditional finance.

For now, the world is watching closely. If the U.S. begins aggressively accumulating Bitcoin, will China be forced to respond? Or will it continue its cautious approach, staying silent while possibly stockpiling BTC in the background?