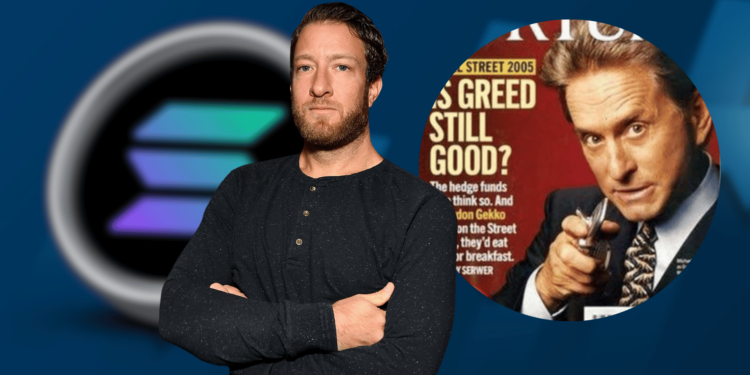

- Portnoy’s GREED token skyrocketed to a $40 million market cap—then crashed when he cashed out.

- After GREED2 met the same fate, the crypto community launched an unofficial GREED3.

- The saga stands as a harsh lesson in meme coin hype and inevitable collapses.

Dave Portnoy’s wild ride with meme coins took an inevitable nosedive when his Solana-based token, GREED, imploded just hours after launch. Supposedly a tongue-in-cheek jab at crypto speculation, the coin briefly ballooned to a $40 million market cap—before Portnoy cashed out entirely, nuking it into oblivion.

Cue the outrage. The whole thing reeked of a textbook pump-and-dump, leaving a trail of bag-holders clutching worthless tokens. But Portnoy? Unfazed. He doubled down with GREED2, swearing up and down he wouldn’t sell this time. Investors took the bait. Another surge, another crash. Rinse, repeat. At this point, skepticism wasn’t just brewing—it was overflowing.

Then came whispers of a possible GREED3. Portnoy toyed with the idea, teasing the chaos, before abruptly backing off, blaming the relentless negativity. But the crypto community, ever the chaotic force, took the wheel. An unofficial GREED3 launched via Solana’s Pump.fun platform—because of course it did.

The result? A brief $2.7 million market cap spike, then the inevitable plummet. Classic meme coin cycle. This time, though, Portnoy stayed radio silent, neither endorsing nor denouncing the rogue launch.

Now, the GREED saga lives on as a cautionary tale—proof that hype can send projects to the moon just as fast as it buries them six feet under. For those still playing the game, well… good luck holding the bag.