- Larry Fink encourages investors to buy the dips—because throwing more cash into chaos always works out, right?

- BlackRock holds a massive Bitcoin stake, and Fink’s optimism feels a little too convenient.

- They suggest a “modest” 2% Bitcoin allocation—so go ahead, risk that whole dollar.

Like any seasoned bag holder, Larry Fink wants you to see the looming dips as golden opportunities. Buy the fear, embrace the chaos, and keep the machine running. Why not? If the market’s gonna nosedive, might as well dive headfirst with your wallet open, right? Someone should tap him on the shoulder and remind him that not everyone has billions to cushion the blow—some of us are still licking wounds from the last “market correction.”

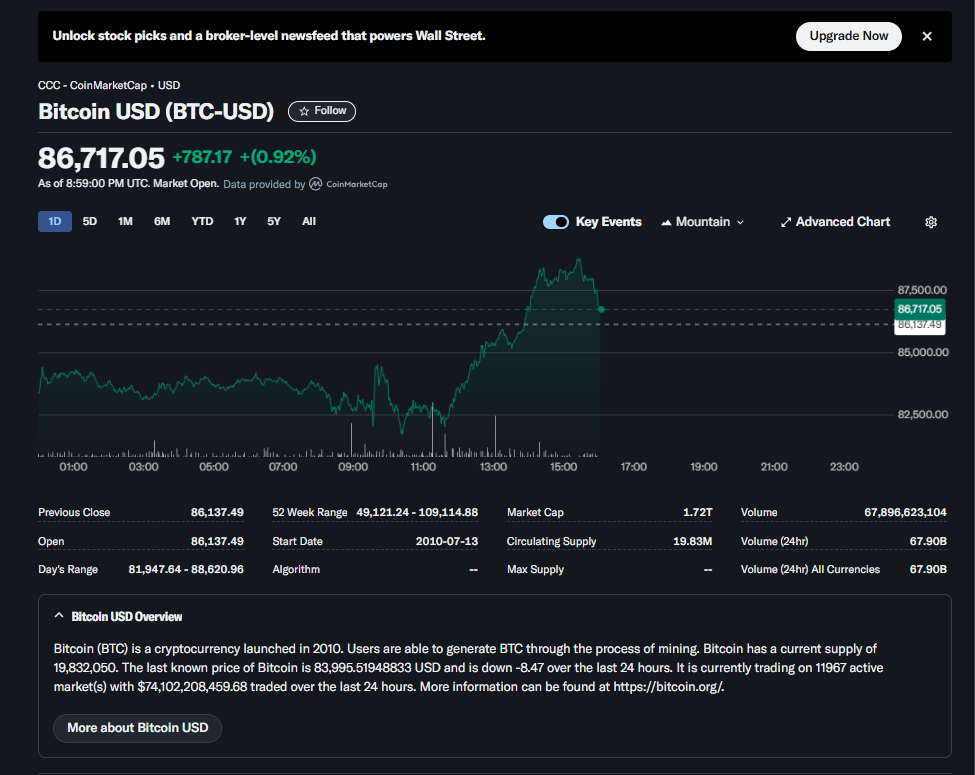

And, of course, the crypto faithful tuned in with laser focus. Why wouldn’t they? BlackRock holds a Titanic-sized stake in Bitcoin, and Fink casually floating optimism feels, well, a little convenient. Almost like a gentle nudge to push retail investors into beefing up the same asset his firm is already deep into. Oh, just a casual 572,226.5 BTC—roughly $50 billion worth—sitting in BlackRock’s iShares Bitcoin Trust (IBIT). That’s about 2.725% of the total Bitcoin supply. Not a small sliver. Real subtle, Larry.

And just how much of your hard-earned cash does BlackRock think you should pour into their ever-expanding Bitcoin empire? Oh, just a “modest” 2% of your portfolio. Which, for those keeping track at home, means if you’ve got fifty bucks to your name, they’re asking you to risk… a whole dollar. Hope that doesn’t break the bank.