- PEPE’s price has seen a sharp pullback, with volatility shaping its short-term outlook.

- Market cap and trading volume indicate active participation, but uncertainty looms.

- Supply remains high, influencing price stability and investor sentiment.

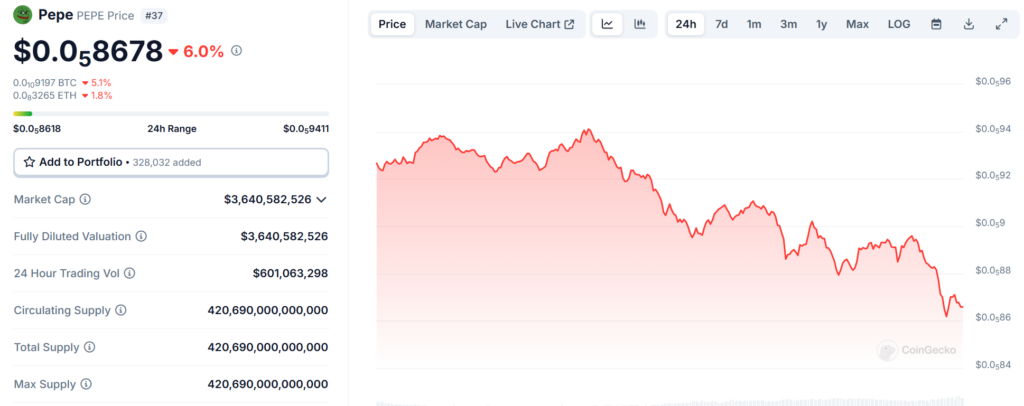

PEPE’s price action has been on a bit of a wild ride lately. Looking at the 24-hour chart, it started off relatively stable before climbing to a short-lived peak. But instead of holding its ground, it reversed course and slid downward, closing in on lower price levels. This kind of movement suggests traders were cashing out after brief gains, causing a wave of sell pressure.

At its highest, PEPE touched around $0.00009411, but as the selling pressure increased, the price dipped to $0.00008618 before stabilizing slightly. The drop isn’t entirely surprising—meme coins tend to be more volatile than traditional cryptocurrencies, often reacting sharply to trader sentiment and short-term speculation.

A Bumpy 24 Hours: What’s Happening?

Even with the price decline, PEPE’s trading volume remains impressive. Over the last 24 hours in the CoinGecko data, a whopping $601 million in trades took place, signaling that market interest is still there. When a coin pulls in high trading volume, it usually means traders see potential, whether for short-term gains or long-term positioning.

But there’s another side to this—when volume is high during a price drop, it often indicates more selling than buying. That’s something to watch out for. If the downward trend continues with sustained high volume, it could mean more traders are exiting, leading to further losses. On the flip side, if buyers step in at these lower levels, we might see a quick rebound.

Circulating Supply and Market Cap: What It Means for Price Stability

PEPE’s total supply sits at 420.69 trillion tokens, and with all of them in circulation, price movements are heavily influenced by market sentiment rather than scarcity. A larger supply can sometimes make it harder for a coin to hold a strong uptrend unless demand significantly outweighs available liquidity.

The current market cap of $3.64 billion is still substantial for a meme coin, proving that PEPE has secured its spot as a significant player in the sector. However, maintaining that valuation will require consistent investor confidence and possibly new catalysts, such as exchange listings, project developments, or broader meme coin hype cycles.

What’s Next for PEPE?

PEPE’s recent downturn raises an important question: Is this just a temporary dip, or the start of a deeper correction? Given the strong trading volume, it’s clear that interest in the coin isn’t fading just yet. A key level to watch will be whether PEPE can hold its support zone around $0.000086—if it stabilizes, we could see a reversal. But if the selling pressure persists, another leg down might be on the table.

Meme coins like PEPE thrive on hype and community-driven momentum, so a resurgence in sentiment could easily turn things around. Keep an eye on social trends, whale activity, and overall market conditions to gauge where it’s headed next.

Where Did PEPE Come From?

PEPE was inspired by the internet-famous Pepe the Frog meme. Unlike some meme coins that try to attach utility, PEPE was created purely as a fun, community-driven digital asset. Despite its lighthearted origins, it quickly gained traction, securing listings on major exchanges and becoming one of the top meme coins in the market.

With its massive supply and a strong following, PEPE continues to be one of the more unpredictable yet intriguing plays in the crypto space. Whether it’s a short-term trader’s dream or a long-term hold remains to be seen—but one thing’s for sure, it’s not boring.