- Strategy bought 7,633 BTC for $742 million, pushing its total holdings to 478,740 BTC, worth $46 billion.

- The firm raised $563 million from a public offering to fund further Bitcoin acquisitions under its aggressive treasury strategy.

- Saylor’s company continues its commitment to Bitcoin, following the asset’s surge past $100,000 in late 2024.

Michael Saylor’s firm, now rebranded as Strategy, has resumed its Bitcoin buying spree, purchasing 7,633 BTC for $742 million after a brief pause. The company, formerly MicroStrategy, continues to double down on its belief in Bitcoin as a key asset in its treasury strategy.

Strategy’s Latest Bitcoin Acquisition

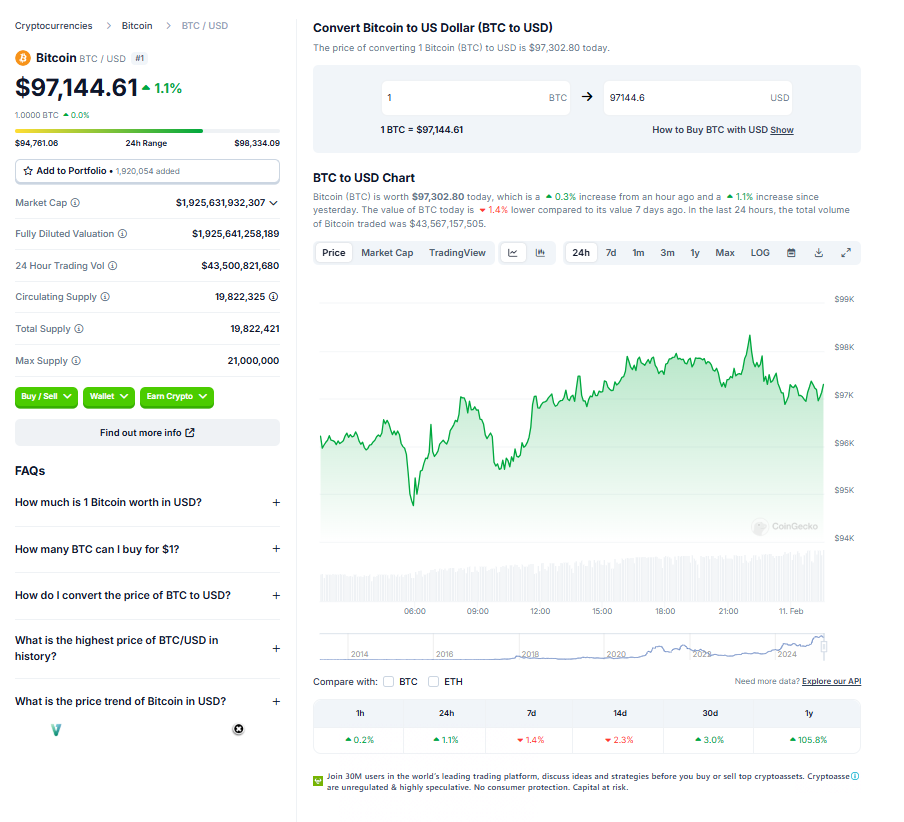

Strategy’s recent purchase of 7,633 BTC at $97,255 per coin has pushed its total holdings to 478,740 BTC, valued at approximately $46 billion.

An Aggressive Treasury Strategy

The company has outlined plans to raise over $42 billion for further Bitcoin accumulation and recently generated $563 million through a public offering of 7.3 million preferred shares.

Saylor’s Vision for Bitcoin Leadership

Michael Saylor’s long-term bullish stance on Bitcoin remains firm as his firm bets big on BTC, which recently surpassed the $100,000 mark during a historic bull run in late 2024.