- XRP has rallied 30% after a recent market crash, but bearish on-chain data and low open interest pose challenges to sustained recovery.

- Whale transactions and realized profits hit historic highs during the crash, with $103 million in futures liquidations recorded over the past 24 hours.

- XRP is eyeing a move past $3.00, with potential upside toward $3.40 and $3.55 if key resistance levels and trendlines are broken.

Ripple’s XRP is making headlines after jumping 30% early Tuesday, with bulls showing signs of a potential recovery from the recent crypto market crash. Despite bearish on-chain data, market watchers believe that if momentum holds, XRP could push past the crucial $3.00 psychological barrier, setting the stage for further gains.

On-Chain Data: Selling Frenzy During Market Crash

XRP’s recent rally follows a period of intense market turbulence triggered by former President Trump’s announcement of new tariffs on Canada, Mexico, and China. Over the last three days, XRP investors realized nearly $2 billion in profits—one of the largest spikes in the network’s history.

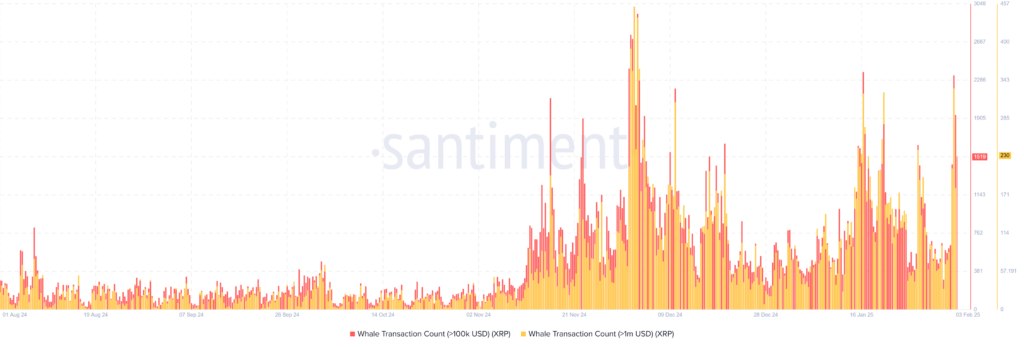

Whale activity has been particularly pronounced. Large transactions, both from long-term and short-term holders, surged during the crash, as seen by the increase in Dormant Circulation and whale transactions exceeding $100K and $1M.

Meanwhile, Weighted Sentiment, a metric that reflects social volume versus positive and negative sentiment, dropped to levels last seen in November. Funding rates for XRP derivatives also hit lows not seen since August, according to Coinglass data. Interestingly, extreme negative sentiment often precedes price reversals, which could explain XRP’s 30% bounce-back.

source: Sentiment

Bulls Face Hurdles Despite Momentum

Despite the sharp rally, XRP’s Open Interest—which tracks the number of outstanding derivative contracts—remains sluggish. It fell from 2.05 billion XRP to 1.50 billion, signaling that many investors are still hesitant to hold large positions.

For XRP to sustain this recovery, bulls will need to re-enter the market in greater force. Without renewed interest and higher open interest levels, the rally could lose steam.

source: Sentiment

Reclaiming $3.00: The Next Major Target

XRP’s price briefly plummeted below the $2.00 level on Monday, triggering over $103 million in futures liquidations—the highest single-day liquidation event in the current market cycle. Of that, $74.67 million came from liquidated long positions, while $28.28 million came from shorts.

Now, XRP is attempting to break back above $3.00. If successful, the next target is the seven-year high resistance level of $3.40. Clearing this barrier would pave the way for XRP to potentially reach a new all-time high above $3.55.

However, XRP faces a descending trendline resistance that has been active since January 16. Bulls will need to overcome this resistance, alongside the $3.40 mark, to continue the rally.

Technical Indicators Point to Building Momentum

On the technical side, indicators are turning bullish. The Relative Strength Index (RSI) is moving upward, indicating increased buying pressure. The Stochastic Oscillator (Stoch) has also crossed above its neutral level, further reinforcing the bullish outlook.

Still, caution is warranted. If XRP fails to maintain support above $1.96, the bullish thesis could be invalidated, putting the token at risk of further declines. Traders will be watching closely for a daily candlestick close to confirm whether the current rally can sustain itself.