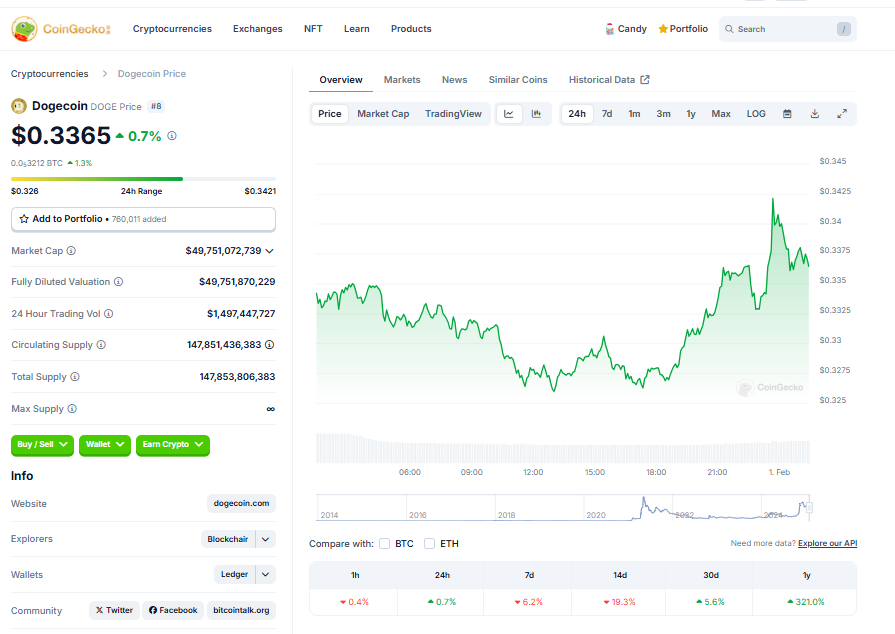

- Grayscale launched a Dogecoin trust, offering exposure to the $50 billion memecoin market.

- Trump’s crypto-friendly policies, including the formation of the D.O.G.E. group, are fueling industry growth.

- Dogecoin’s price tripled last year, driven by rising institutional interest and post-election hype.

Grayscale has unveiled a brand-new trust offering, giving investors direct exposure to Dogecoin (DOGE), the company announced Friday. It’s the latest move in the crypto world that’s got people buzzing.

“Dogecoin is reshaping global financial access,” said Rayhaneh Sharif-Askary, Grayscale’s head of product and research. She explained to CoinDesk that Doge’s low fees and lightning-fast transaction times make it ideal for international money transfers—especially in places where banking services are still catching up.

But that’s not the whole story—far from it.

President Trump’s recent return to office shook things up big time. Within weeks, he formed a quirky yet ambitious new group, the Department of Government Efficiency (or yes, you guessed it—D.O.G.E.), reportedly with input from none other than Elon Musk. Since then, crypto-friendly policies have been rolling in.

Memecoin mania has hit Wall Street too. Several big asset managers are now pushing applications for memecoin ETFs, something that was nearly unthinkable just a few months ago when SEC chief Gary Gensler had a tighter grip on the industry.

Dogecoin, with its market cap nearing $50 billion, still reigns as the king of memecoins. If institutional investors start pouring into trusts like Grayscale’s or ETFs designed around it, the floodgates could open even wider. It’s already been a wild ride—the token’s price has tripled over the past year, with much of the surge happening right after Trump’s election win.

The Dogecoin Trust comes with a 2.5% management fee—steep by some standards—but with excitement running high, it’s got many wondering if DOGE’s story is just getting started.