- President Trump signed an executive order to create a digital asset stockpile and ban CBDCs, emphasizing U.S. crypto leadership.

- The order establishes the Presidential Working Group on Digital Asset Markets to develop a regulatory framework and explore a strategic Bitcoin reserve.

- Trump revoked Biden-era crypto policies, aiming to boost innovation and global competitiveness in digital finance.

In a significant move, President Donald Trump has signed an executive order to create a digital asset stockpile, delivering on his campaign promises to prioritize cryptocurrency and blockchain innovation. The order positions the United States as a leader in digital finance and takes a firm stance against central bank digital currencies (CBDCs).

A Bold Step Toward Digital Asset Leadership

According to the White House release, Trump emphasized the importance of the digital asset industry for innovation, economic growth, and maintaining U.S. global leadership. The executive order establishes the Presidential Working Group on Digital Asset Markets, tasked with developing a federal regulatory framework for digital assets, including stablecoins, and evaluating the creation of a strategic national digital asset stockpile.

This working group, chaired by the newly appointed AI & Crypto Czar David Sacks, includes high-ranking officials such as the Secretary of the Treasury and the Chairman of the SEC, along with heads of other key agencies. Within the first 180 days, the group will submit a comprehensive report to the president with recommendations for regulatory and legislative proposals to advance these policies.

Banning CBDCs and Overhauling Biden-Era Policies

Trump’s order explicitly prohibits U.S. agencies from establishing, issuing, or promoting CBDCs, which he has vocally opposed. “Any ongoing plans or initiatives related to the creation of a CBDC within the jurisdiction of the United States must be terminated immediately,” the order reads. This sharp turn from Biden-era policies signals a shift toward decentralized innovation, with Trump revoking the prior administration’s Digital Assets Executive Order and its restrictive frameworks.

In the release, Trump framed CBDCs as a threat to economic liberty and innovation, emphasizing that the U.S. must foster blockchain and cryptocurrency development without overreach.

Strategic Crypto Reserve on the Horizon?

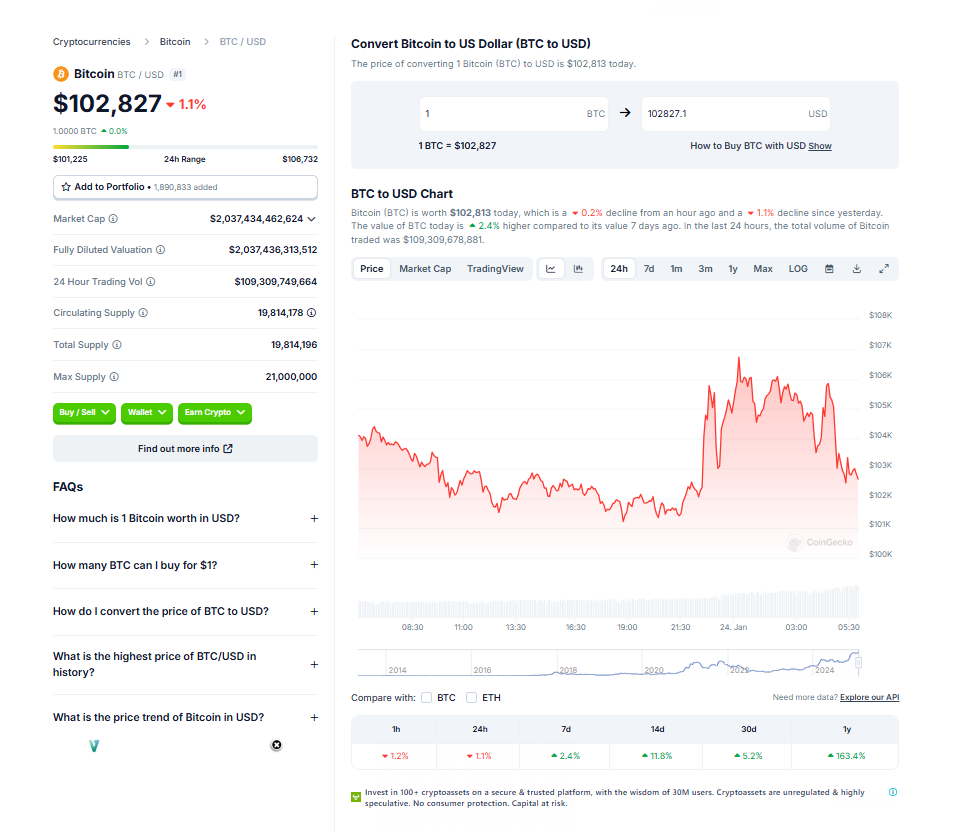

While the stockpile’s exact contents remain unspecified, it is expected to house major cryptocurrencies like Bitcoin and XRP. During his campaign, Trump had championed the idea of a strategic Bitcoin reserve, and although it hasn’t been implemented yet, this order brings it closer to reality.

The crypto industry has responded with optimism, anticipating a surge in institutional and national attention. The move aligns with Trump’s broader agenda to promote a crypto-friendly regulatory environment, reinforced by his appointment of Mark Uyeda as acting SEC Chair and the formation of the SEC’s Crypto Task Force.

A New Chapter for U.S. Crypto Policy

By dismantling previous regulatory barriers and outlining a roadmap for digital asset adoption, Trump’s executive order has set the stage for innovation and growth in the crypto space. With institutions and government agencies now fully engaged, the U.S. is poised to take a leadership role in global digital financeAs Trump puts it, the digital asset industry is not just a sector—it’s a cornerstone of economic progress and international leadership in the 21st century.