According to a recent report, cryptocurrency adoption has seen the fastest growth in the Middle East and North Africa (MENA) region over the past year. Although MENA “may be one of the smaller crypto markets in the 2022 Global Crypto Adoption Index”, it notched $566 billion in crypto payments between July 2021 and June 2022, up 48% from the previous year, according to a report by Chainalysis.

Emerging Markets Dominate The Global Crypto Adoption Index

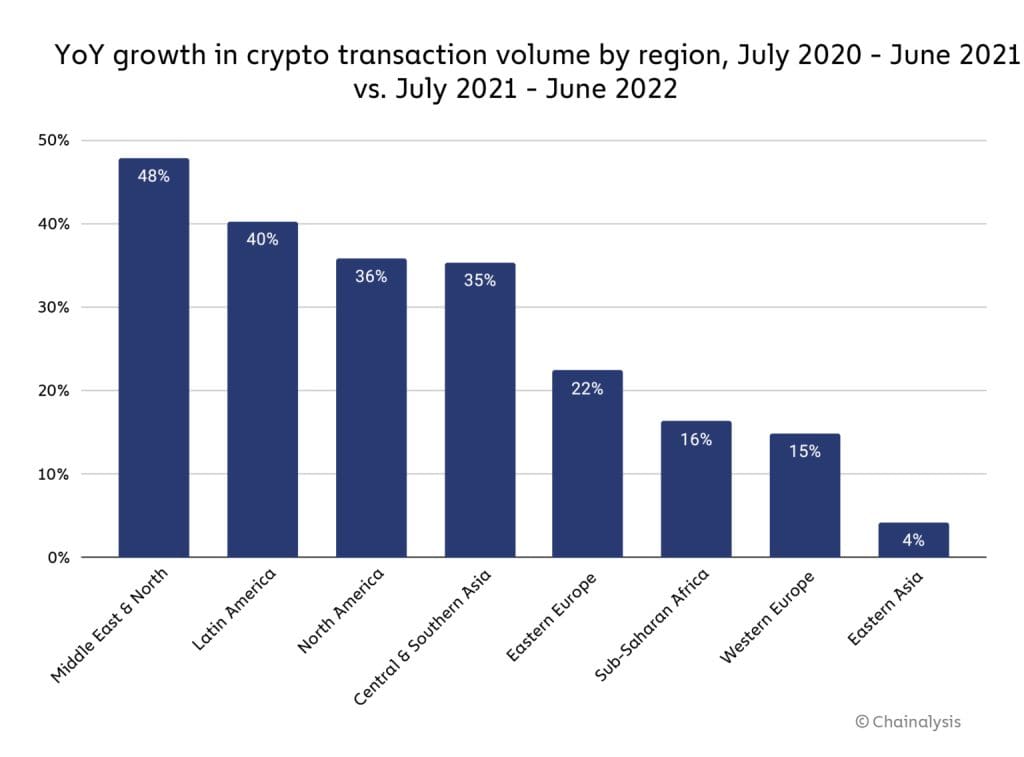

The Wednesday report by the blockchain analytics firm revealed that emerging markets had dominated the Chainalysis 2022 Global Crypto Adoption Index. From the chart, it is clear that the MENA region leads by about 48% growth in crypto transaction volume. Latin America comes in second with a growth of about 40%, with North America third after recording 36% growth, closely following in the fourth and fifth places where the Central and Southern Asian and Eastern Europe regions with 35% and 22% growth, respectively.

The report also highlighted specific markets that displayed increased use of cryptocurrencies within the MENA region as a hedge against debasing fiat currencies and for making remittance payments.

Author’s of the Chainlaysis report list Egypt as the fastest-growing crypto market, recording a 221% growth in crypto transaction volumes over the past year. They attribute the growth to the North African country’s national bank project to build a cryptocurrency remittance corridor with the UAE, where many Egyptian citizens work.

The report reads:

“Egypt’s position at the intersection of growing crypto remittances and increased inflationary pressures help explain why it’s the fastest growing crypto market in all of MENA this year. Between July 2021 and June 2022, transaction volume in Egypt tripled compared to the preceding year. “

Remittance payments account for about 8% of Egypt’s gross domestic product (GDP).

Turkey remains Chainalysis’s most prominent cryptocurrency market as it was the first of the three countries from the region to make the list of the top thirty countries in this year’s index at position 12. The other two were Egypt at 14 and Morocco at 24. Morocco has seen a 120% growth in crypto transaction volumes between July 2021 and June 2022 compared to the prior year.

Even though it has seen a lower growth than the other two, Turkey “remains the largest cryptocurrency market in the region, its citizens having received $192 billion from July 2021 to June 2022, but has seen much slower YoY growth”, reads the Chainalysis report.

Fluctuating Fiat Currencies And Permissive Crypto Regulations Encourage Crypto Adoption

The excerpt from the upcoming 2022 Geography of Cryptocurrency Report by Chainalysis also notes that apart from use cases and the need to make remittance payments, high inflation rates and increasingly permissive regulations also explain the observed crypto adoption growth amongst MENA countries.

In Egypt and Turkey, high inflation rates and rapid fiat currency devaluations have possibly pushed investors to turn to crypto for “savings preservation,” the report said. The Turkish Lira has weakened by over 100% against the U.S. dollar in the last year, while the Egyptian pound has weakened by over 25%, according to data from MarketWatch.

“Egypt’s position at the intersection of growing crypto remittances and increased inflationary pressures help explain why it’s the fastest growing crypto market in all of MENA this year.”

Inflation has been the most severe in Turkey, with the yearly inflation rates reaching over 83% in September, according to a report by the Turkish Statistical Institute. Similarly, estimates from the independent research group ENAGrup showed the annual CPI inflation to be around 83.5% at press time.

Morocco’s inflation rates have been relatively moderate, remaining at a “manageable 5.3%”. The Chainalysis report attributes the country’s high rating on the Global Crypti adoption Index to the “government’s newly permissive crypto stance,” which has bolstered grassroots adoption.

In 2017, the North African country imposed a blanket ban on crypto trading, declaring “penalties and fines” to those involved in cryptocurrency transactions. Earlier this year, the country’s central bank committed to crypto regulations, emphasizing innovation and consumer protection.