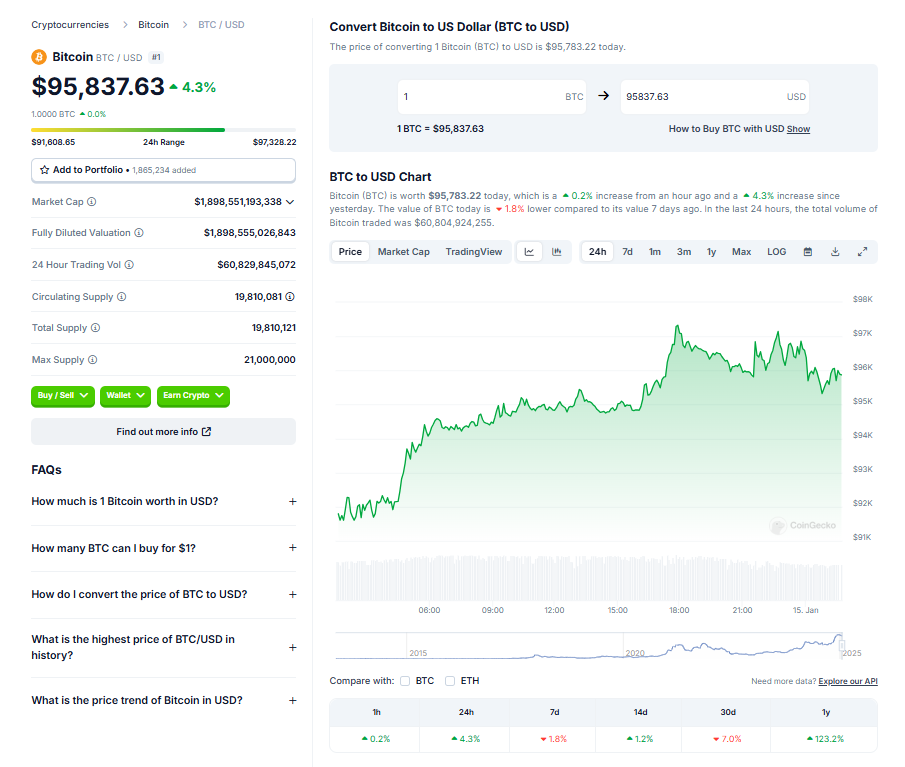

- Bitcoin peaked at $108,000 in December but fell to $89,000 before recovering to $96,793 amid rising macroeconomic pressures.

- K33 analysts are less inclined to favor a “sell-the-news” strategy for Trump’s inauguration due to ongoing market uncertainty.

- Long-term optimism persists, with Trump’s policies expected to rekindle bullish sentiment for Bitcoin and other risk assets.

Bitcoin’s meteoric rise after Donald Trump’s November presidential win has slowed, with macroeconomic headwinds weighing heavily on the market since mid-December. As the inauguration approaches, analysts at K33 are rethinking their earlier prediction of it being a classic “sell-the-news” event.

Market Outlook Shifts as Inauguration Nears

Initially, K33 analysts favored selling Bitcoin around January 20, expecting the market to temper its enthusiasm for Trump’s pro-crypto campaign promises once faced with Washington’s notoriously slow bureaucracy. However, this strategy now seems less appealing.

The market is trying to balance Trump’s tariff-driven inflation concerns with the potential for tax cuts and pro-crypto policies that could bolster risk assets in 2025. The uncertainty has made predicting Bitcoin’s immediate trajectory more complicated.

Bitcoin’s Price Movements Amid Macro Pressures

Bitcoin hit an all-time high of $108,000 on December 17 but has since tumbled nearly 18% to a low of $89,000 on Monday. The decline was fueled by rising 10-year Treasury yields, a stronger U.S. dollar, and reduced expectations for Federal Reserve rate cuts.

As of Tuesday, Bitcoin has rebounded slightly, trading at $96,793, though the broader market remains cautious. K33 analysts Vetle Lunde and David Zimmerman noted, “November’s enthusiasm has faded as Bitcoin hit two-month lows while the S&P 500 erased its post-election gains.”

Trump 1.0 vs. Trump 2.0: A Tale of Market Reactions

K33 analysts compared the market’s reaction to Trump’s first and second election wins. In 2016, the S&P 500 stabilized after mid-December and remained steady until the inauguration, while this time, volatility has surged following the FOMC meeting on December 18.

Back in Trump’s first term, his policies—such as tax cuts and deregulation—were tied to strong stock market performance. Analysts believe this narrative will resurface in his second term, potentially driving optimism for Bitcoin in the long run.

“The market’s early excitement in November has given way to caution, but we maintain a bullish outlook on Trump’s long-term impact on Bitcoin,” the analysts stated.